Not only has 2021 brought an end to the calendar year 2020, but the new year has brought with it a figurative “turning of the page” on the adversity and civil unrest that 2020 wrought, and the United States has ushered in a new President.

As the smoke clears and vaccinations ramp up and we begin to approach the back half of the COVID-19 pandemic, President Biden’s term is only just beginning. Many changes are likely afoot, and while it isn’t yet clear yet changes to the tax code will ultimately be enacted, a Democratic-controlled House and Senate make it more likely that several of President Biden’s tax initiatives will become implemented. But, what exactly are Biden’s tax policies? Is Biden going to raise taxes? As a new President leads the White House, it is important to learn how Biden’s tax policy may affect your taxes.

Biden’s Tax Policy

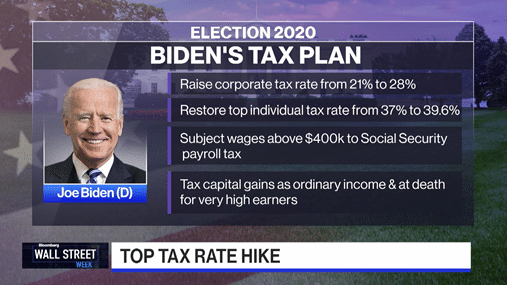

Biden’s tax policies revolve in large part around reducing income inequality within the United States, and the President therefore proposes higher taxes on the wealthy that would include a rise in the highest personal income tax bracket from 37% to 39.6%. Biden has indicated that he does not want to raise income taxes for those individuals making less than $400,000 per year.

Additional measures include placing a cap on itemized deductions for wealthier Americans and phasing out the 20% deduction for qualified business income for upper-income taxpayers. Biden’s tax policy also includes higher inheritance taxes, the likely ending of favorable capital gains tax rates for those earning over one million dollars, and the federal estate tax exemption to be restored to its pre-2017 Trump tax reform level.

Consistent with narrowing the income gap, Biden also wants to initiate tax breaks for low- and middle-income taxpayers. Along these lines, Biden wants to increase the fully refundable child tax credit up to $3,600 for a child under six years old, and increase the credit to $3,000 for children aged 6-17.

Biden also wants to expand the child care credit up to $4,000 for one child and to $8,000 for families with two or more children. The President also seeks to gradually phase out the availability of this credit for families making between $125,000 and $400,000 per year. The discussion of forgiving a portion of student loan debt is also very much on the table, with any forgiven amount to be exempt from Federal taxation.

Additional initiatives include temporarily increasing the maximum earned income tax credit for childless adults to approximately $1,500, raising the eligible income level for this credit closer to $21,000, and allowing older workers to claim the credit through the elimination of an age cap currently in place. Tax breaks related to 401k retirement savings and tax breaks for those businesses that offer retirement plans to their workers are also likely.

Is Biden Going to Raise Taxes?

So, the answer to the question of whether Biden is going to raise taxes is in large part dependent upon how much money an individual earns – with the cutoff being $400,000 per year. These wealthier Americans are likely to pay more in taxes under Biden’s tax policy, but those in the middle and lower brackets are likely to benefit from enhanced credits that can reduce their overall tax burden.

Additionally, Biden is currently calling for $1,400 stimulus checks in the near-term, with the possibility of a third round of “targeted” stimulus checks to those most in need also on the horizon. Biden’s tax policy also calls for increased tax benefits for elderly Americans who pay for long-term care insurance with their retirement savings, and the President wants to allow low-wage workers over the age of 65 to claim the earned income tax credit.

Meantime, the long-term viability of Social Security has long been a hot-button issue in the U.S., and Biden’s tax policies attempt to address the issue by raising the payroll tax for individuals making more than $400,000 a year. Currently, wages above $142,800 are not subject to payroll tax. Finally, President Biden also advocates for a $5,000 tax credit for “informal” caregivers – family members who provide long-term care to an elderly individual.

When it comes to the question of whether Biden is going to raise taxes on corporations, Biden’s tax policy calls for the corporate tax rate to increase from 21% to 28%, following the 2017 Trump tax reform that lowered the corporate tax rate from 35% to 21%. President Biden also wants to double the Global Intangible Low Tax Income (GILTI) rate on foreign profits from 10.5% to 21%. Meantime, Biden wants to restore the electric vehicle tax credit aimed at consumers and is advocating for tax breaks related to energy-efficient buildings and homes.

Biden also wants to create a new, refundable tax credit of up to $15,000 for first-time home buyers and supports a new renter’s tax credit designed to reduce rent and utility costs to no more than 30% of income for low-income individuals. The President also supports an expansion of the low-income housing tax credit in an effort to expand access to affordable housing.

Finally, in an effort to encourage greater hiring of the disabled, Biden aims to increase tax credits for employers who hire individuals with disabilities – with the potential of up to $30,000 in tax credits available to those businesses who do so. Additionally, the President hopes to expand access to ABLE accounts that help pay for qualified disability-related expenses such as housing, transportation and education.

Contact United Debt Settlement to learn more about debt relief or to schedule a free consultation. Give us a call at (888-574-5454) or fill out our online contact form.

About the Author: Steven Brachman

Steven Brachman is the lead content provider for UnitedSettlement.com. A graduate of the University of Michigan with a B.A. in Economics, Steven spent several years as a registered representative in the securities industry before moving on to equity research and trading. He is also an experienced test-prep professional and admissions consultant to aspiring graduate business school students. In his spare time, Steven enjoys writing, reading, travel, music and fantasy sports.

Gabriel Gorelik paves the way for customer service and operations at United Settlement. He is passionate about numbers and holds a strong belief in helping anyone with their debt. Before United Settlement, Gabriel received his BS in Finance & Economics from Brooklyn College. After graduation, Gabriel went on to build his first financial services company where he managed thousands of accounts for business and consumer clients. He understands the importance of client satisfaction, professionalism, and exceeding expectations.