Business Debt Relief

Business debt relief for businesses facing financial difficulties and in need of help.

Business debt occurs when business owners struggle to meet debt obligations. Every year thousands of American business owners seek debt relief services due to desperate financial trouble. The businesses that do overcome the challenge do so by becoming economical and cautious. Business debt relief reduces expenses and helps businesses survive. Before exploring bankruptcy consider all other options, for beginners see if you can cut any expenses immediately.

Benefits of Business Debt Relief

Reduce Your Debt

Shrink your debt and grow your savings with United Debt Settlement. We’re your partners in chipping away at those towering credit card balances.

Avoid Bankruptcy

Steer clear of bankruptcy’s shadow with proactive debt management. Our experts craft escape routes that protect your credit and your peace of mind.

Financial Freedom

Step into a life free from debt. Our tailored strategies are your blueprint to a future where your finances are yours to enjoy, not owe.

How Does It Work?

How Can your Business Get Debt Relief?

- Your business still needs to pay its bills — even if business is slow.

- This can lead to growing business debt.

- You have options to help your business lower its debt.

- Learn about business debt relief options and which one is best for your business.

We are not attorneys, so if you are considering bankruptcy or need legal advice, please contact an attorney in your state.

What is Business Debt Relief?

- The process of reducing or eliminating debts held by a business.

- There are multiple ways to get business debt relief:

- Business consolidation loans

- Filing for bankruptcy

- Business debt settlement

- The goal of any business debt relief plan is to create an affordable way for you to pay your business debt.

Business Debt Consolidation Loans

Your business may qualify for a debt consolidation loan from a nonprofit organization such as: The small business association. This type of loan is generally low interest which is more affordable. The qualification for this type of loan is difficult and time consuming. If you do not qualify and/or do not have the time to apply using collateral can help you get a loan quicker. This could be a great option although is a major risk because you can lose assets.

Debt consolidation loans pay off original creditors and put all your obligations in one monthly payment. In addition debt consolidation loans save you money on the interest and in many terms roll out the payback to a longer period to significantly increase operating cash flow. The flip side to debt consolidation is it may take up to five years to pay in full. For the duration of the loan the lenders will accrue interests at above prime rates. The compounding interest limits the amount you can save with this form of business debt relief.

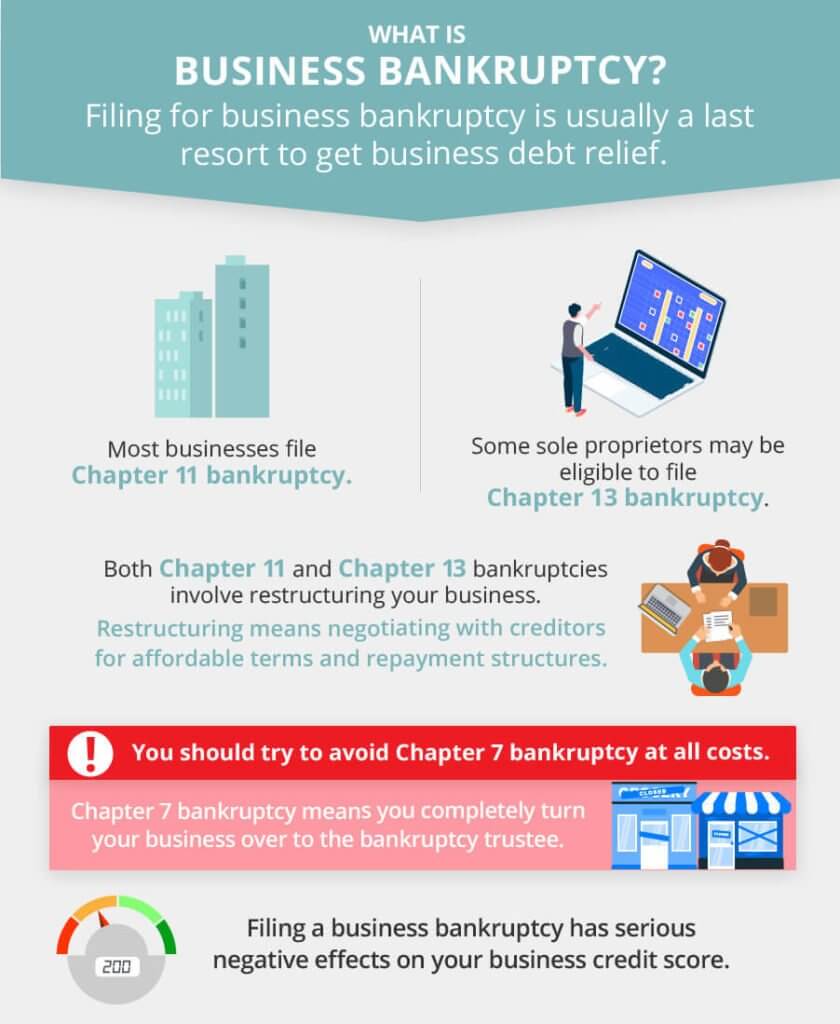

Business Bankruptcy

If you have already explored all alternative options and decided you have to go through with business bankruptcy, you’re not alone. Thousands of businesses are forced to declare bankruptcy annually. There are many reasons to continue the fight especially the cost and time of filing, although there is no shame in pulling the trigger in fact it could be the best decision for your business.

Two types on bankruptcy include “Chapter 11” and “Chapter 13” known as “restructuring”. These types include renegotiating the terms and planning a structured payback. Both filings will have serious effects on business credit scores but help avoid the “Chapter 7” bankruptcy known as “game over”.

In many cases, you’ll need to declare Chapter 11 bankruptcy. Chapter 13 declarations are generally reserved for individual debtors who carry large amounts of unsecured debt. Chapter 13 filings may available to sole proprietors. If you’re the only employee of your business, you have the legal right to declare bankruptcy under Chapter 13 of the U.S. Bankruptcy Code. However, this type of bankruptcy comes with a debt limit: You can’t file for Chapter 13 bankruptcy with more than approximately $1.4 million in total debt. If you have more than $360,000 in unsecured debts or $1.1 million in secured debts, you must file bankruptcy under Chapter 11. Both results conclude similar outcomes which include proposing plan for your payback.

Knowing your numbers helps millions US businesses profit each year. Know where you can restructure and/or save. See where you can add additional streams of revenue. Going over your financials every quarter can help achieve financial success.

The flip side to filing for bankruptcy is the negative impact it has on your business credit score. Even if your restructuring is complete the file stays on your business credit report. This will hurt your business when you apply for new financing in the future.

A Realistic Alternative for Business Debt Relief

Your business debt may qualify for relief through debt settlement. Eligible debts may include personal credit cards used for business expenses, unsecured business loans, merchant cash advances, and more. The debt settlement process has qualities of business restructuring but will likely have a greater impact on the savings amount. Every case is unique, although you may be eligible to reduce a significant portion of your business debt. If you qualify you can get out of debt in as soon as 24-48 months, reduce your payments, and have the least impact on your credit score.

As a business owner you have important decisions to make every day, with business debt relief you have many options such as: business debt consolidation, bankruptcy, debt management, debt settlement and more. Before choosing which is best for you, do your due-diligence as this decision will be present in the long game, think of this as a marathon, not a sprint.

Top Videos Related to Credit Card

Small Business Debt Relief

Business debt occurs when business owners struggle to meet debt obligations. Business debt relief reduces expenses and helps businesses survive.

Too Much Credit Card Debt

Issues start to surface when a borrower becomes overly casual with their credit lines, using credit cards for luxury purchases and other expenses that push them to live beyond their financial means.

Credit Card Interest Rates

Credit card interest rates are classified into three types: variable, fixed, and promotional. Proceed with the following actions to reduce your credit card interest rates effectively.

Education Center

Credit Cards And Your Credit

Business Debt Relief FAQ

Limited Liability Corporations, or LLCs, are designed as separate legal entities from their owners, and as such, the financial doings of the LLC and the individual owner behind it are considered legally separate. This means that owners cannot be held personally liable for business debts, and that the business cannot be held liable for the owner’s personal debts. Therefore, an LLC’s business bank account cannot be garnished for any personal debt, except in rare instances when the LLC structure is abused – when personal funds have been commingled with business funds. In these instances, a court may “pierce the corporate veil” and deny the limited liability corporation protection that would have otherwise been in place, and the business bank account could be garnished for personal debt.

A business with debt can be harder to sell, so the first possibility is for the owner to attempt to pay down the debt prior to facilitating a sale of the business. Absent that possibility, a debt pay-off contingency could be included in the sale of the business, and this requires proceeds from the sale to pay off debts related to the business that is changing hands. A third option is to have the buyer assume the debts, but if the selling business owner is the personal guarantor on these debt, the assignment cannot be transferred to the buyer. In these instances, a creditor may still pursue collection from the selling business owner if the new owner does not pay off the debts as promised and the creditor does not release the previous business owner as guarantor on the debt.

Master Your Finances:

Our Latest Insights & Articles