Square Capital Small Business Loans

Square Inc. is a financial services, merchant services, and mobile payments company. Through its small business lending division, Square Capital, the company offers merchant financing to existing business users of Square’s payment processing services.

Since May 2014, Square Capital has provided over $2.1 billion of funding to over 141,000 merchants through merchant cash advances and small business loans. Today, Square Capital places greater emphasis on the provision of small business loans that range from as low as $500 to as high as $100,000.

Square Capital Loan

Square Capital small business loans are available to eligible existing business users of the Square credit/debit card payment processing platform. Because Square Inc. has access to the transaction and sales histories of its users, Square Capital is positioned to extend pre-qualification loan offers online to business users through the dashboard of the Square platform.

When determining which customers to send loan solicitations, Square Capital (through its lending partner, Celtic Bank) considers processing volume (seeking those businesses with a minimum of $10,000 in annual transactions) and recent transaction history, as well as a business’ overall history with Square in terms of frequency and quantity of payments.

Eligible businesses receive three custom tailored offers of varying loan amounts that must be paid off in full, along with the fixed upfront fee attached to the loan, within eighteen months of origination.

Upfront Loan Fee and Repayment

Instead of utilizing interest rates to compute financing costs, Square Capital business loans come with an upfront fixed fee assessed as a percentage of loan principal that generally ranges between 10% and 16%. Repayment is made each business day and is calculated as a fixed, predetermined percentage of daily Square credit card transactions, typically ranging between 9% and 13% of daily transaction dollar volume.

All Square Capital business loans must be fully repaid within eighteen months from origination, and there is a minimum repayment requirement that 1/18 of the original loan amount be paid every sixty days. There is no prepayment fee in the event of early repayment, although the upfront fee must be paid back in full regardless of any early repayment.

Square Capital Repayment Fee Example

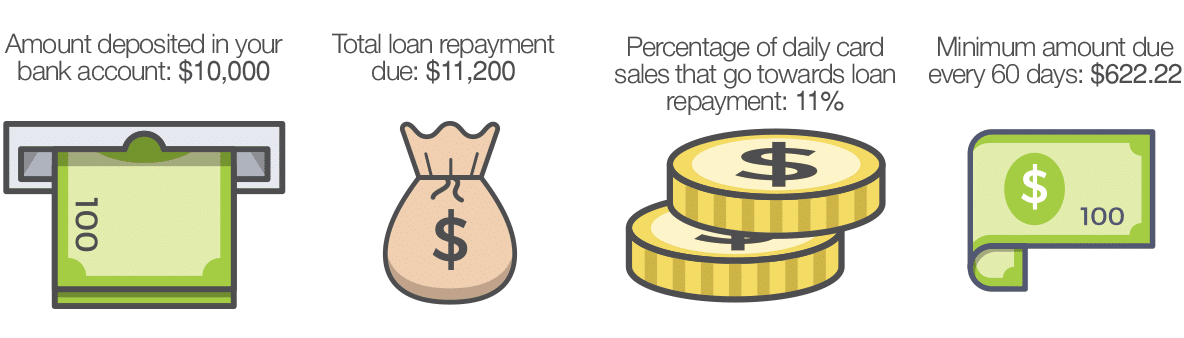

The following example can be viewed in somewhat reduced detail on Square Capital’s website:

Given a $10,000 loan principal and a fixed fee percentage of 11.2%, the total loan repayment due becomes $11,200. With 1/18 of the original balance due every sixty days, this results in a minimum payment due of $622.22 every sixty days. If 11% of daily credit card sales processed through the Square platform are applied toward repayment, a business will be positioned to make its minimum payment when it generates over $5,656 in those sixty days.

However, making only a series of minimum payments will not result in the total balance being paid in full within eighteen months, and Square Capital does reach out to those customers in danger of falling behind on payments. In the above example, at an 11% repayment rate, cumulative Square transactions of $101,818 over an eighteen month period (or less) results in the loan and upfront fee being paid in full.

Are you in debt? we can help

Business Debt Settlement

Square Capital’s easy application process and rapid disbursement of funding (often within one business day of a completed application) can make it a somewhat appealing option to existing customers of the Square platform. However, the process of daily repayment can cause cash flow management problems for some small business owner borrowers.

If you are currently burdened by the process of daily repayment of a Square Capital business loan, debt settlement could represent a viable solution for you. Debt settlement takes place when a debtor successfully negotiates a payoff amount that is less than the total amount of debt owed.

Though creditors are under no legal obligation to accept debt settlement offers, the process of negotiating and paying lower amounts on existing debts is quite common.

United Settlement and Square Capital

At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with banks such as Square Capital.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with Square Capital for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with Square Capital and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.