Credit Card Debt Relief Services

Credit card debt can become difficult to manage when high interest rates cause balances to grow faster than payments reduce them. United Settlement provides structured credit card debt relief services for individuals with unsecured credit card debt who are seeking alternatives to ongoing high-interest repayment. Services are designed to help eligible clients work toward resolving debt through established relief options.

Table Of Contents

Benefits of Credit Card Debt Relief

Reduce Your Debt

Shrink your debt and grow your savings with United Debt Settlement. We’re your partners in chipping away at those towering credit card balances.

Avoid Bankruptcy

Steer clear of bankruptcy’s shadow with proactive debt management. Our experts craft escape routes that protect your credit and your peace of mind.

Financial Freedom

Step into a life free from debt. Our tailored strategies are your blueprint to a future where your finances are yours to enjoy, not owe.

How Does It Work?

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Debt Relief Reviews

How to Get Relief From Credit Card Debt

The credit card debt relief process typically includes the following steps:

- Gather documentation for your credit card accounts, including balances, minimum payments, and creditor details.

- Complete an initial consultation with United Settlement to review unsecured debts, assess eligibility, and outline available relief options.

- Develop a customized debt relief plan based on reviewed accounts and financial capacity.

- Once enrolled in a credit debt relief program, make scheduled deposits into a dedicated account used for potential settlements. During this time, negotiations with creditors may take place.

- Receive ongoing updates while progress is monitored through program completion.

Credit Card Debt can seem daunting. Learn how to avoid high interest rates that make paying off your credit card difficult. Discover more credit card debt relief options from certified professionals.

Who Is Credit Card Debt Relief For?

Credit card debt relief programs are intended for individuals with unsecured credit card debt across one or more accounts who are unable to make meaningful progress by paying minimum balances alone. This may include consumers experiencing financial strain related to income changes, reliance on revolving credit or unexpected expenses. Eligibility varies, and programs are not suitable for all situations.

Credit Card Debt Relief Options

Several credit card debt relief program options exist, each using a different method to address unsecured debt. Understanding these options helps individuals evaluate what aligns with their financial situation.

Credit Card Debt Consolidation: Credit card debt consolidation combines multiple high-interest balances into a single, predictable payment, often through a debt consolidation loan. This can simplify repayment and offer savings on interest.

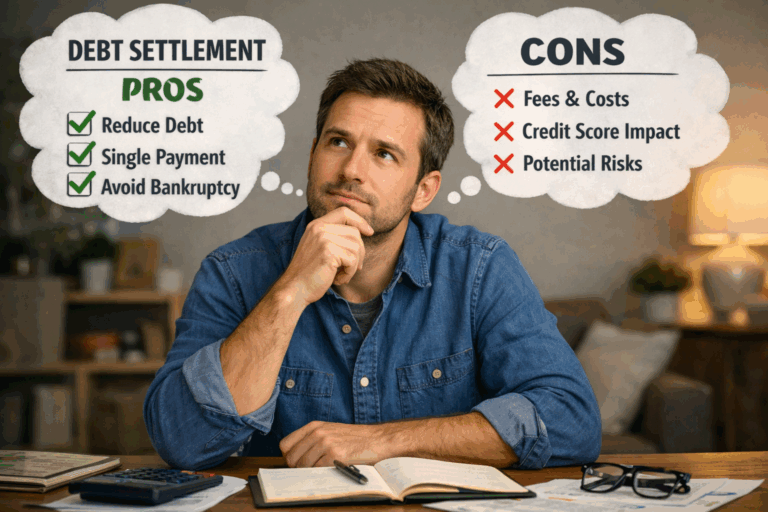

Credit Card Debt Settlement: Credit card debt settlement involves negotiating with creditors to lower the amount you owe. This is usually considered when accounts are delinquent, and consolidation isn’t an option. Settlement isn’t guaranteed, and timelines vary, but it can reduce your overall debt obligations.

When to Consider Your Options

You might decide to consider credit debt relief options if:

- Balances continue to increase despite consistent minimum payments.

- Late or missed payments result in increased collection activity.

- Interest charges become unmanageable.

- Credit cards are used to cover basic living expenses.

Taking action earlier can help prevent further financial strain, so many benefit from reviewing their debt relief options as soon as they identify any of these indicators that support is needed to get unsecured debt under control.

Choosing a Professional Debt Relief Company

For the best experience navigating debt relief, choose a debt relief company that is reputable with licensed professionals that provide transparency, clarity around program details, realistic expectations and performance-based fee structures. Be wary of those who guarantee outcomes or who provide vague information.

Why United Settlement for Debt Settlement Services?

United Settlement works with IAPDA-licensed professionals who negotiate with creditors based on established policies and account conditions. Fees are charged only after a settlement is reached. With experience supporting more than 20,000 clients, United Settlement provides personalized debt relief services grounded in compliance, transparency and client advocacy.

Education Center

Credit Cards And Your Credit

Credit Card Debt FAQ

Credit card debt relief is a legitimate option when eligible candidates work with a licensed and compliant debt relief company. However, outcomes vary based on individual circumstances and creditor participation.

Credit card debt relief services can be a good idea for those struggling to manage high-interest balances through standard repayment options. Schedule a consultation for personalized support.

If you and your former spouse opened any joint credit card accounts or other credit lines – including mortgages and auto loans – then you’ve got to stay on top of these situations. Contact each creditor to determine whether you can convert joint accounts into individual accounts, and make every effort possible to remove your former spouse as an authorized user from any credit card accounts that bear your name.

There isn’t a number to assign to the answer of this question – but rather it is a matter of how you are managing your debt level, the amounts you are paying off each month, and whether you have been using credit cards for extravagances and unnecessary experiences that are truly beyond your means. If you’re paying only the minimum monthly payments, that’s a sign that you’ve got too much credit card debt and insufficient amounts of disposable cash to pay off what is often high interest rate (12-20% or higher) credit card debt. If you’re using one card to pay off another card (exclusive of low-interest rate balance transfer promotions), that’s another sign that you’ve got too much credit card debt. If you’re buying things on credit that you cannot afford to purchase for cash, that’s another sign that you’ve got a bad credit card spending habit in place and have too much credit card debt. Other signs that you have too much credit card debt include when you are denied additional credit when you apply, and when your card(s) “don’t work” at the point of purchase – because the credit lines associated with them are already close to “maxed out.”

Consolidating credit card debt without hurting a credit score is a relatively straightforward process. A debt consolidation loan, such as a personal installment loan – or even a promotional low-interest rate credit card balance transfer – consolidates multiple debts into one single loan, typically resulting in a lower interest rate and monthly payment. Debt consolidation loans streamline the repayment process while simultaneously lowering interest expense and the total amount repaid over time.

Negative consequences result almost immediately following a missed credit card payment. Late fees, an increase in the required minimum monthly payment, followed by penalty APR after 60 days of missed payments – your interest rate can quickly go as high as 29.9%! Interest expense mounts, things get expensive in a hurry, and your credit card billing department will contact you with increasing frequency via phone, text and email. Your credit score gets impacted negatively as the three major credit bureaus (Experian, Equifax and TransUnion) are notified of your delinquency at the 30, 60, 90, 120 and 180-day hallmarks. After 180 days, your credit card issuer will charge-off your account (write it off as a loss) and sell it to a collections agency, who will begin their own steady pursuit of you and the debt. Meantime, since your debt is now over 180 days delinquent, your credit report will bear the stain for seven years, holding back your credit score further.

Structured debt settlement, debt relief and debt consolidation programs can help shorten repayment periods for those who qualify. Taking action sooner can help prevent further credit card debt accumulation.

Yes, credit card debt can sometimes be negotiated with creditors. Professional debt relief companies handle negotiations based on creditor policies and account conditions.

Top Videos Related to Credit Card

Credit Card Debt

Credit Card Debt can seem daunting. Learn how to avoid high interest rates that make paying off your credit card difficult. Discover more credit card debt relief options from certified professionals.

Too Much Credit Card Debt

Issues start to surface when a borrower becomes overly casual with their credit lines, using credit cards for luxury purchases and other expenses that push them to live beyond their financial means.

Credit Card Interest Rates

Credit card interest rates are classified into three types: variable, fixed, and promotional. Proceed with the following actions to reduce your credit card interest rates effectively.

Master Your Finances:

Our Latest Insights & Articles