Navigating Credit Card APRs

What Exactly is Credit Card APR?

APR stands for Annual Percentage Rate, which goes beyond the basic interest rate to include any extra fees charged by credit card companies. This figure is the annualized cost of your credit, giving you a fuller understanding of your yearly expenses.

Annual Percentage Rate, or APR, essentially represents the annual total cost of borrowing. APR is not the exact same thing as interest rate, as APR includes the interest rate, along with any and all additional fees associated with borrowing.

Though they lack mortgage origination fees and other fees including closing costs associated with a home mortgage APR, credit cards will often include annual fees, late fees and other fees that can factor into Credit Card APR. Credit Card APRs are based entirely on a borrower’s creditworthiness, as indicated by the individual’s FICO credit score.

The stronger the FICO score, the lower the APR. When it comes to credit card APRs, there are several varieties including Purchase APR, Balance Transfer APR, Penalty APR and Cash Advance APR. Credit Card APRs vary significantly among these categories, and that’s before taking into account different credit card types and issuers.

APR

Annual Percentage Rate, Represents the annual total cost of borrowing.

The Effects of APR on Your Wallet

Calculating Your Interest Charges

For a given credit card, there may be multiple APRs (as described above) that accumulate varying amounts of interest expense within a specific billing cycle.

Let’s use an example of a credit card with a $10,000 balance that is split as follows.

$10,000

$5,000 is at the Purchase APR of 15%

$3,000 is at the Balance Transfer APR of 6%

$2,000 is at the Cash Advance APR of 22%

Purchase APR interest expense

$5,000 x (.15 / 365) x 30

$61.64

Balance Transfer APR interest expense

$3,000 x (.06 / 365) x 30

$14.79

Cash Advance APR interest expense

$2,000 x (.22 / 365) x 30

$36.16

APRs: Past and Present

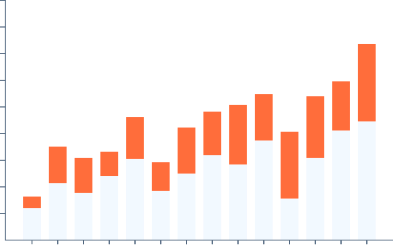

In order to make the comparison between current credit card APRs and credit card APRs from previous years, it’s important to first recognize that there is no such thing as an “average credit card APR,” as they will vary by card type and issuer. There are, however, ranges and averages by type, as this chart from valuepenguin.com illustrates: (Note that these are Purchase APRs)

With credit card interest rates playing such a predominant role in credit card APR, an historical overview of credit card interest rates can serve as a basis for comparing historical credit card APRs.

Changes in credit card interest rates reflect changes in the overall economic environment and can help consumers decide whether they are getting a fair deal based on current values and historical trends.

Historical Credit Card APRs

The chart dates back to mid-2007 and is updated on a weekly basis. (Hover over any point on the chart to reveal data for a given time frame.) This chart includes data on a variety of credit card types – including Airline, Balance Transfer, Business, Cash Back, Instant Approval, Low Interest Rate, Student, and Rewards Cards.

The chart reveals that during the time leading up to and including the financial crisis and its aftermath – ranging from late 2007 until late 2008 – credit card APRs dropped markedly before beginning a steady rise from late 2008 until March 2010. The chart further reveals that for the period between March 2010 through December 2016, most credit card APRs remained relatively stable. However, beginning in January 2017 and stretching to the present time frame of March 2019, Credit Card APRs have risen steadily, with the National Average coming in at 17.6%.

This is significantly higher than the National Average low of 11.11% during April 2008 and the National Average Credit Card APR that remained relatively stable in the mid-14% to low 15% range that persisted from March 2010 through December 2016. Credit Card APRs, therefore, are now more or less at 12-year highs.

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs