Growing Auto Debt

Auto debt can spiral out of control, don’t let that happen to you.

Auto loans are nothing short of huge business in the United States. As of March 31, 2018, the aggregate amount of auto loans in the U.S. stood at $1.229 trillion, with the average new car loan exceeding $30,000. Given that auto sales make up for approximately 20% of all U.S. consumer spending, auto loans have become a significant driver of a record U.S. household debt level that now exceeds $13.21 trillion. In fact, following total U.S. mortgage balances – which at $8.94 trillion represent by far the largest contributor to total U.S. household debt – and total student loan debt ($1.41 trillion), next up comes total auto debt, at $1.229 trillion, and growing.

Federal Reserve Bank of New York Auto Debt Statistics

According to the Federal Reserve Bank of New York and its Quarterly Report on Household Debt and Credit, for the first quarter 2018 ending March 31st, total U.S. consumer auto debt grew $8 billion sequentially to check in at $1.229 trillion. This total represents a 0.7% sequential increase, identical to the previous sequential quarterly percentage increase.

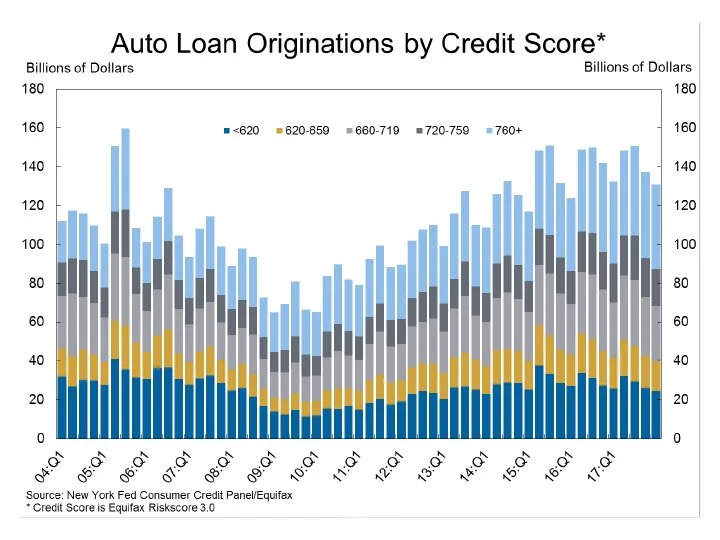

Year-over-year, compared to the aggregate auto debt figure of 1.167 trillion dollars from the first quarter of 2017, the Q1 2018 figure includes a $62 billion increase and 5.3% annual growth. Additionally, Q1 2018 included $131 billion of auto loan origination’s, which have been on a mostly steady uptrend for almost ten years running.

Implications for the Broader Economy

Compared to the sub-prime mortgage debt crisis of a decade ago, the level of sub-prime auto debt, though significant, is considerably smaller, at just over $280 billion. In early 2007, the level of sub-prime mortgage debt stood at $1.3 trillion, and asset backed securitization of these sub-prime loans at exaggerated ratings ran rampant. Today, there is far less securitization of sub-prime auto loans, and because vehicles can be repossessed relatively quickly, a liquid market exists for the seized collateral, making it easier for smaller lenders to recover and make good on their own debts to the larger banks and financial institutions that provided them with funds to lend in the first place.

Contrary to sub-prime mortgage lenders who were often forced to keep liquid properties that required many months or longer to pass through the process of foreclosure, sub-prime auto lenders are not forced to keep repossessed vehicles and bad loans on their balance sheets for years. The likelihood for the sub-prime auto lending space is that many specialized sub-prime auto lenders will disappear, with those surviving forced to tighten lending standards, thereby resulting in fewer sub-prime borrowers receiving loans for new cars.

However, the broader economy is not likely to collapse and bailouts won’t be necessary. Automakers will, however, lose a segment of their customer base, as those with lower credit scores who would have previously pursued sub-prime auto debt will be nudged toward the used-car market instead.

Auto Loan Borrower Profiles

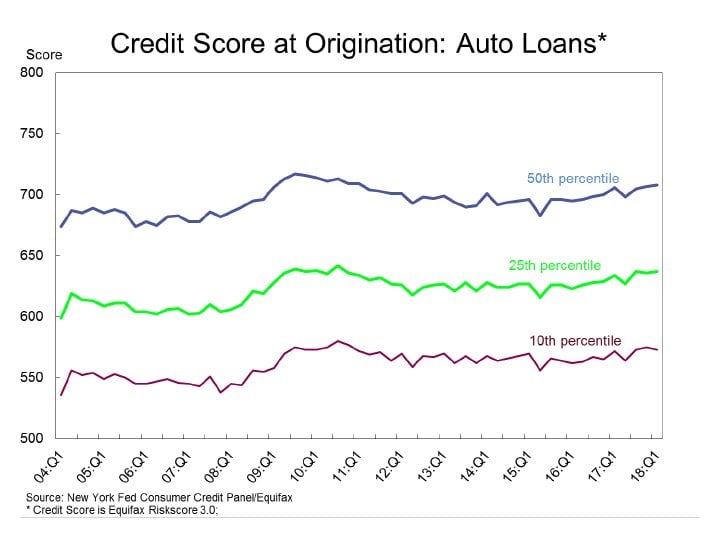

The Q1 2018 median credit score for an auto loan origination increased slightly to 708, the highest figure since 2011, and one that should allow for a borrower to receive financing at a 4% APR. Those with strong credit scores above 750 can expect to do better, in fact often qualifying for zero percent APR financing through an auto dealership.

Borrowers with credit scores in the low-to-mid 600’s should expect to achieve financing at an APR approximating 7%, while borrowers with weaker credit scores in the 500’s and below should anticipate an APR of 11% or higher. These higher interest rate auto loans granted to higher-risk borrowers – or sub-prime auto loans – are beginning to raise eyebrows within the investment community as delinquency rates are on the rise.

The flow into 90+ days of delinquency for auto loan balances has been slowly trending upward since 2012, and stood at 4.3% as of March 31st, markedly higher than the 2.3% level of the previous quarter. This is significant, because when auto debt becomes 90-120 days delinquent, lenders frequently consider the account as approaching default status and begin pursuing the process of vehicle repossession. Because auto loans are a form of secured debt, a defaulted auto loan is collaterally backed by the vehicle itself.

The Specter of a Sub-Prime Auto Debt Crisis?

Owing to a higher auto delinquency rate, a growing number of small non-bank sub-prime auto lenders have been forced to close. The 90+ day delinquency rate on auto loans granted to those with credit scores below 620 now approaches 10%, the highest level since 2010.

The current struggles of smaller auto loan lenders displays similarities to the struggles of small subprime mortgage lenders of a decade ago, and could foreshadow larger losses for the financial system, particularly in an environment of rising interest rates that can trigger further losses in the sector.

Many smaller subprime auto lenders have been overly generous in recent years, displaying a critical lack of selectivity toward potential borrowers that has left many of these lenders vulnerable in an environment of increasing delinquencies and defaults. Meantime, these smaller lenders often packaged their subprime auto loans into asset-backed securities that were sold to outside investors at ratings as high as AA and AAA! Sound familiar?

Get Debt Relief

Connect with licensed debt specialists dedicated to supporting your long-term financial well-being.

Ready To Get Started?

See if you qualify for debt relief. Get A Free Savings Estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Explore other blogs