Business Bankruptcy Alternatives

Business Bankruptcy Alternatives Guide

If you are contemplating bankruptcy for your business think again, there may be better options. Why do you want to consider alternatives? Because the process and effect of bankruptcy is not good. In fact, only 10% of business that operate under Chapter 11 bankruptcy (restructuring) recover.

Chapter 7 bankruptcy (liquidation) is less desirable and should be a last case scenario. Bankruptcy is very stressful either way. If you are considering Chapter 7 (restructuring) the stress usually gets carried to everyone in the company including the employees. The question of “are we staying in business? Often arises. If you are leaning towards Chapter 11 (restructuring) the risk of losing everything will be on your mind.

Disadvantages of Bankruptcy:

- Declaring bankruptcy will make it harder to do business in the future.

- Fees associated with declaring bankruptcy are expensive.

- Loss of control in your business.

- Time consuming and involves a lot of paperwork.

- Very Stressful.

ABC

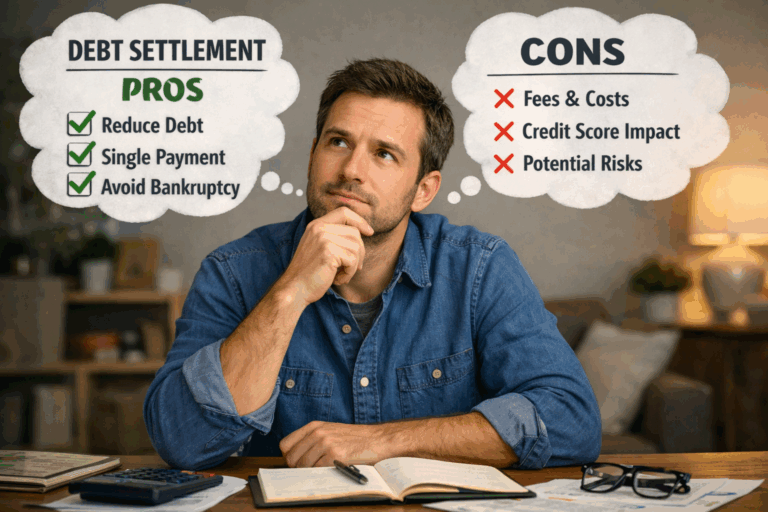

Debt Restructuring / Settlement

Debt restructuring/settlement can be a great alternative to bankruptcy. Debt management firms work on negotiations with the creditors on your behalf. We work out an affordable plan that can help your business survive. Often small businesses have ups and downs, we help you move through your downs to your ups. Once we have an affordable plan you agree too we begin negotiations. Our experience and creditor relations helps us get settlements and debt restructures quickly.

Cash Infusion

At this point you probably tried to get loans everywhere else, even ones that may have got you here in the first place. Another way to get cash is selling equity or assets. Have you considered selling shares in your business? Selling equity in your business may reduce your stake but will be much better than declaring bankruptcy. Do you have assets such as: Inventory? Real Estate? Accounts Receivable? Often there are special finance firms that give loans specifically for those items.

Advisory / Consulting Services

Consultants can be costly but also can be worth it as an alternative to declaring bankruptcy. They will attempt to solve your financial troubles with a workout plan limited to the creativity of the consultants you hire. They will often take some of the stress from you, but will also be on top of you making sure they are provided the correct information regarding the debts and balances.

In Conclusion: Can the Business Survive?

Prior to approaching any alternatives ask yourself, can this business survive? If the answer is yes workout a plan and timeline. If you believe your business can survive fight for it, don’t give up. Speak to debt experts and debt settlement / management firms. Explore all options, because once you declare bankruptcy the odds are against your survival.

Debt Relief Reviews

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs