Business Credit Scores

Business credit is secured in the name of a specific business, and in turn, it helps a business build and enhance its own credit profile and score. Over time, a well-established credit profile helps a business qualify for additional credit. Importantly, Business credit remains solely in the name of the business (not in the names of the business owners) and is based solely on the ability to pay of the business, not that of the business owners. In fact, since it is the business that qualifies for the credit, in many cases there will be no personal credit check performed on the business owners themselves.

Business credit is associated with a business name and is linked to the employer identification number (EIN) of the business. Significantly, it is credit that a business owner can obtain that is separate from a personal social security number (SSN). When built shrewdly and skillfully, the SSN isn’t even supplied on the business credit application, resulting in no personal credit check performed throughout the process of pursuing and obtaining business credit.

After applying for vendor financing or a small business loan, the vendor or lending institution will retrieve identifying information related to your business name, address, and EIN number. This information is then sent to business credit reporting agencies who furnish the lender a report with all relevant credit information related to your business. An inquiry is placed on your business credit report, a lending decision is made, and any business credit successfully obtained is reported to the business credit reporting agencies – not to the personal consumer credit reporting agencies.

At the risk of being redundant, it is important not to furnish your personal SSN on any application for business credit. Instead, supply only the business EIN, and this will result in the lending decision being made solely on the business’ perceived ability to pay – and not that of any of the individual business owners.

Table Of Contents

Building Business Credit

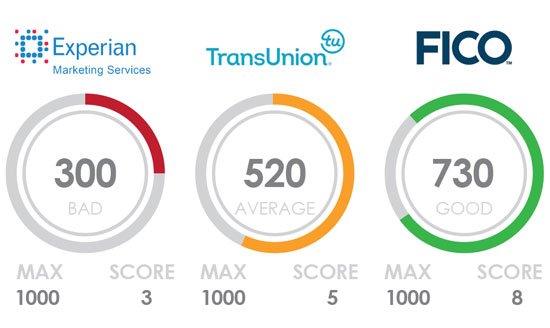

Furthermore, since business credit scores are based primarily on a successful payment history (as opposed to consumer credit scores which are based on payment history, utilization and several other factors) a business can build a strong credit score quickly under an EIN. It can often require as few as three reported accounts to establish an excellent business credit score, with most vendors typically reporting to business reporting agencies in fewer than ninety days.

Vendors will often grant credit on what are known as “net 30” terms, giving the business thirty days to pay off the balance in full. After your business has accumulated a minimum of five payment experiences (when the vendor reports to business credit agencies that your business has paid off a balance) your business will have begun to establish a business credit profile, and it then becomes easier to receive store credit cards from the likes of Walmart, Staples and Office Depot. When your business accumulates over ten payment experiences, VISA, MasterCard and American Express offer grant additional business credit cards that do not require a personal credit check.

ABC

Building business credit is a relatively straightforward process separate and apart from building and maintaining personal credit. By following relatively straightforward steps, your business can build a healthy credit profile by securing Net 30 terms from vendors and paying off balances in a timely manner.

Establishing a successful payment history with vendors leads to the secure of revolving business credit through store credit cards with significant purchasing capacity, followed by earning significant credit lines with VISA, MasterCard and American Express.

Business Credit Scores

Debt Relief Reviews

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs