American Express Merchant Financing

American Express Merchant Financing loan products are commercial loans secured by the assets of a small business, excluding real estate and motor vehicles. Importantly, merchant financing is not a “merchant cash advance,” which involves the purchase of an agreed-upon percentage of a merchant’s future credit/debit card receivables by a lender.

Through its Merchant Financing division, American Express offers loans ranging from $5,000 to $2,000,000 to businesses that already accept the American Express Card. These are commercial loans that can be utilized for funding significant projects, upgrading equipment, hiring additional staff and for general cash flow purposes.

The Fixed Fee and Terms

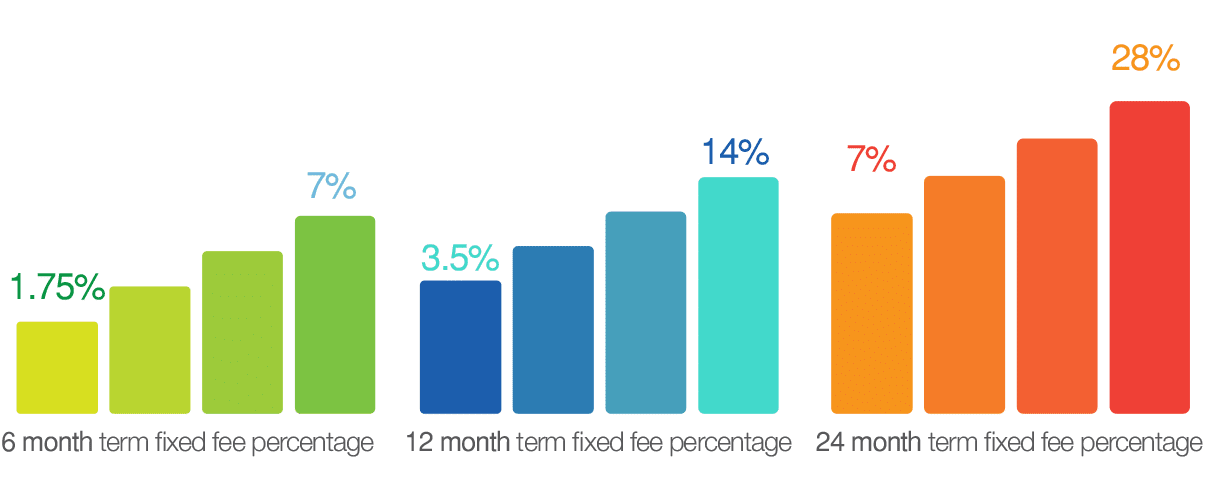

Instead of American Express utilizing interest rates to generate associated expense to the borrower, American Express adds an upfront fixed fee assessed as a percentage of the loan principal while offering terms of six, twelve, and twenty-four months. The fixed fee percentage varies depending upon the creditworthiness of the business and its owner, as well as further considerations such as payment processor arrangements and the term of the loan.

Fixed fee percentages range from 1.75-7% (6-month term), 3.5-14% (12-month term), and 7-28% (24-month term). There are no origination fees. Importantly, there are no prepayment fees – in fact, American Express offers early repayment rebates of either 25% or 10% of the upfront fixed fee, depending on the date of early repayment and the corresponding loan term. small business.

The Application Process

American Express debt relief provides merchant financing to eligible businesses that already accept the American Express Card, generate minimum annual revenue of $50,000 and at least $12,000 in annual debit/credit card receivables, and that have been in business for at least twenty-four months. Applications are submitted online or completed over the phone with a merchant financing division representative.

Depending on the size of loan requested and the method of repayment, applicants may be asked to provide business financials including tax returns, bank statements and payment processor monthly statements. Additionally, for loans $35,000 or less, a personal guaranty may be required, and those businesses seeking a 24-month term loan must have been accepting the American Express Card for at least two years.

If approved, funds are disbursed directly into a business bank account, typically within five business days or less from the date of a completed application.

Repayment Methods

The repayment method is determined by American Express and involves an automatic daily repayment predicated upon creditworthiness, processing arrangements, loan amount, term, and client history with American Express. There are four possible repayment methods to an American Express merchant financing product.

The first involves a repayment rate, or percentage of daily American Express card receivables withheld by Amex, with all remaining amounts sent to the business bank account, per usual. A second payment method involves American Express partnering with a business’ payment processor to automatically send daily payments based on a repayment rate of total credit/debit card receivables from all cards, including those beyond American Express.

A third method, somewhat similar, involves an automatic daily payment based on a repayment rate of total credit/debit card receivables sent by the payment processor to a transfer account at Wells Fargo. Finally, the fourth repayment method involves a fixed amount automatically debited from the business checking account every business day.

Are you in debt? we can help

Business Debt Settlement

If you are a business owner feeling the strain of daily repayment of American Express Merchant Financing or other forms of business debt, pursuing debt settlement could make sense for you.

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor and is fully documented in writing. Though creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than you may realize.

United Settlement and American Express Merchant Financing

American Express recently entered the merchant financing marketplace. At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with juggernauts such as American Express.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with American Express for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with American Express and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.