Everest

Business funding capital partners

Everest Business Funding serves small businesses while specializing in merchant cash advances, which are considered part of the alternative lending industry. A merchant cash advance is a short-term financing option available to small business owners that is easier to qualify for than a traditional small business loan. Merchant cash advances are paid back in small regular payments that are typically paid each business day as a percentage of credit card and/or debit card proceeds.

Everest grants merchant cash advances primarily on a business’ cash flows through a review of a company’s most recent three months of bank statements and is not particularly sensitive to credit scores in evaluating its applicants. In fact, Everest’s website states that 95% of all businesses are approved. Applications are submitted online and frequently approved within 24 hours, with merchant cash advances quickly granted in the range of $5,000 to $500,000.

Merchant Cash Advances

A merchant cash advance is a lump-sum payment made to a small business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. Merchant cash advances are generally of shorter duration (24 months or less) and require the recipient to make small regular payments (typically each business day), in contrast with the lengthier payment terms and larger monthly payments associated with traditional small business loans.

When Everest makes a merchant cash advance to a small business, it is purchasing a percentage of that business’ future credit/debit card sales receivables, which in turn, the small business is bound by the agreement with Everest to pay back.

Is a Merchant Cash Advance a Loan?

Even though a small business is obligated to “pay off” a merchant cash advance that it has agreed to receive, importantly, the merchant cash advance is not legally considered a loan – because it represents a portion of future credit/debit card sales that the merchant cash advance provider has actually purchased from the small business. This legal technicality allows merchant cash advance companies such as Everest to operate in a largely unregulated market not bound by state usury laws that prohibit lenders from charging high interest rates.

Unfortunately, many small businesses learn the hard way that when their cash flow becomes strapped because of the required daily payments taken directly from their credit/debit card processor, the effective cost of a merchant cash advance is often substantially higher than the interest expense associated with a traditional small business loan. Indeed, the relative ease of getting approved for a merchant cash advance often comes with a price.

Everest Merchant Cash Advance Hypothetical Example

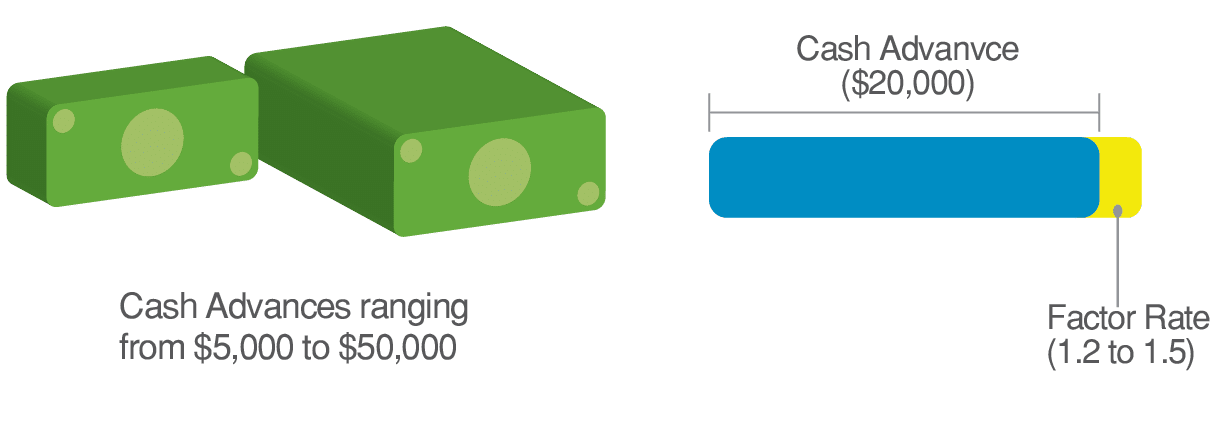

Everest awards Merchant Cash Advances ranging from $5,000 to $50,000, with duration’s of 2-12 months. Instead of interest rates, Everest merchant cash advances use what are known as factor rates, which are multipliers applied to the amount of the advance.

For instance, Everest utilizes multipliers ranging from 1.2 to 1.5, which are determined on a variety of criteria, including credit scores. Now, let’s take the example of a $20,000 merchant cash advance with a 1.4 factor rate attached. This implies that the overall liability to the small business will become $28,000 ($20,000 x 1.4), before adding origination fees ranging from $199-$2,900.

Are you in debt? we can help

In this hypothetical example, even in a “best-case” scenario with daily payments taken directly from the small business owner’s credit/debit card processor resulting in full payoff within a year, it is easy to see that the “effective interest rate” of the merchant cash advance exceeds 40%, substantially higher than the interest rate associated with a traditional small business loan.

Remember – there is no APR, a merchant cash advance is not a loan, there is no true interest rate. But ironically, this “effective APR” of the merchant cash advance will be even higher when it is paid off in less than a year – as the true monetary costs associated with the factor rate (and origination fee) will be the same regardless of the duration of the payoff period.

Business Debt Relief

If you are a small business owner whose cash flow is strained and are currently burdened by the process of paying off a merchant cash advance or other forms of business debt, pursuing debt settlement could make sense for you.

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor and is fully documented in writing. Though creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than many people realize.

United Settlement and Everest Business Funding

Everest capital partners can certainly be a great source for fast business funding. At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with banks such as Everest.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with Everest for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with Everest and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.