CAN Capital

Working capital and small business loans

Founded in 1998, CAN Capital is an alternative small business lender that has provided small businesses with access to more than $6.5 billion of working capital through over 185,000 funding transactions since inception.

CAN Capital specializes in small business term loans and merchant cash advances, and through these has helped over 70,000 business owners purchase equipment and inventory, hire seasonal help and open additional locations. CAN makes lending decisions based on its proprietary risk models that integrate small business daily performance data with credit profiles while measuring them with comparable businesses within the same industry.

CAN Capital Recent History and Restructuring

From 2011 to 2016, CAN Capital enjoyed a compound annual transactional growth rate of 29% and compound annual revenue growth rate of 24%. However, following this period of prosperity, in late 2016, CAN halted its lending business after experiencing problems related to how the company recorded delinquencies among its borrowers that resulted in CAN breaching agreements with its major lenders, including Wells Fargo.

CAN then initiated a restructuring that involved replacing its CEO and other members of top management, conducting significant asset sales and slashing over 50% of employee headcount. With a new management team and revamping of its internal processes, CAN secured a capital infusion from Varadero Capital, an alternative asset manager that allocates capital toward specialty finance platforms such as CAN Capital. Once restructured and recapitalized, CAN resumed funding in July 2017, providing term loans and merchant cash advances to small businesses in all fifty states.

ABC

CAN Capital Lending Options

Through its website, CAN Capital allows small businesses to apply (24 hours a day – 7 days a week) for a term loan or merchant cash advance. Using its proprietary technology, CAN customizes loans based on the type of business, industry, sales volume, and business location, determining the size and cost of its funding.

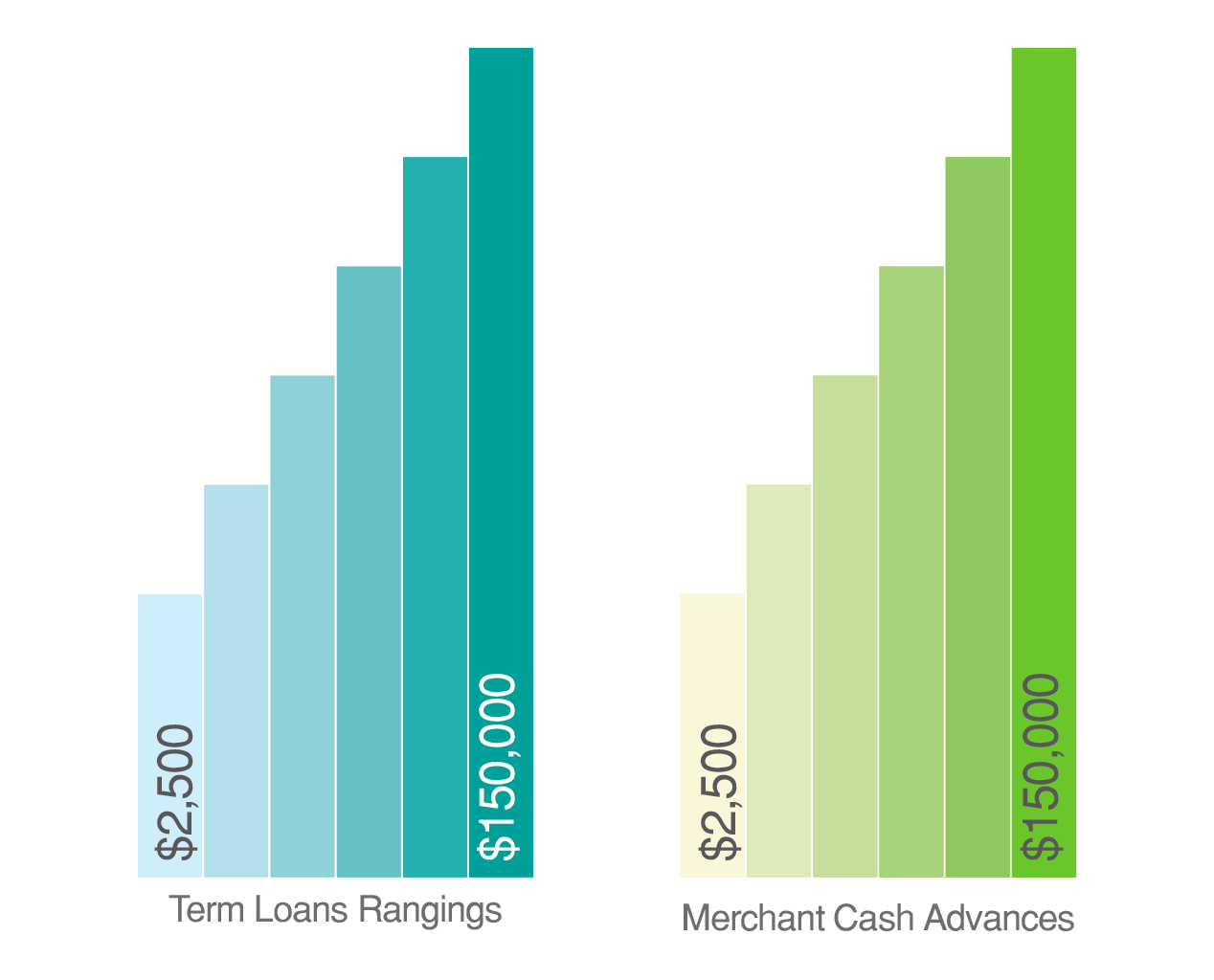

CAN offers term loans ranging from $2,500 to $150,000 with APRs ranging from 12.9% to 29.9%, an origination fee of 3%, and maturities of six to eighteen months, while also offering merchant cash advances ranging from $2,500 to $150,000. Both types of funding are frequently completed within a few days of an application filing. Because CAN collects comprehensive information electronically online and over the phone, it has enhanced the convenience and efficiency of the small business loan application process.

However, unfortunately, the company does not report to business credit bureaus or personal credit bureaus, so timely repayment in full of a CAN term loan or merchant cash advance, though always advisable, will not assist in the process of enhancing a small business’ credit score and profile. Once awarded, CAN term loans and merchant cash advances are paid back daily.

In the case of a term loan, a fixed daily amount is automatically deducted from the small business’ bank account; in the case of a merchant cash advance, a variable daily amount is forwarded automatically by the small business’ credit/debit card processor as a pre-set percentage of credit/debit card receipts generated on a given day.

Merchant Cash Advances

A merchant cash advance is a lump-sum payment made to a small business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. Even though a small business is obligated to “pay off” a merchant cash advance that it has agreed to receive, importantly, the merchant cash advance is not legally considered a loan – because it represents a portion of future credit/debit card sales that the merchant cash advance provider has actually purchased from the small business.

This legal technicality allows companies such as CAN Capital to operate in a largely unregulated market not bound by state usury laws that prohibit lenders from charging high interest rates. Unfortunately, many small businesses learn the hard way that when their cash flow becomes strapped because of the required daily payments taken directly from their credit/debit card processor, the effective cost of a merchant cash advance is often substantially higher than the interest expense associated with a traditional small business loan.

CAN Capital Merchant Cash Advance Hypothetical Example

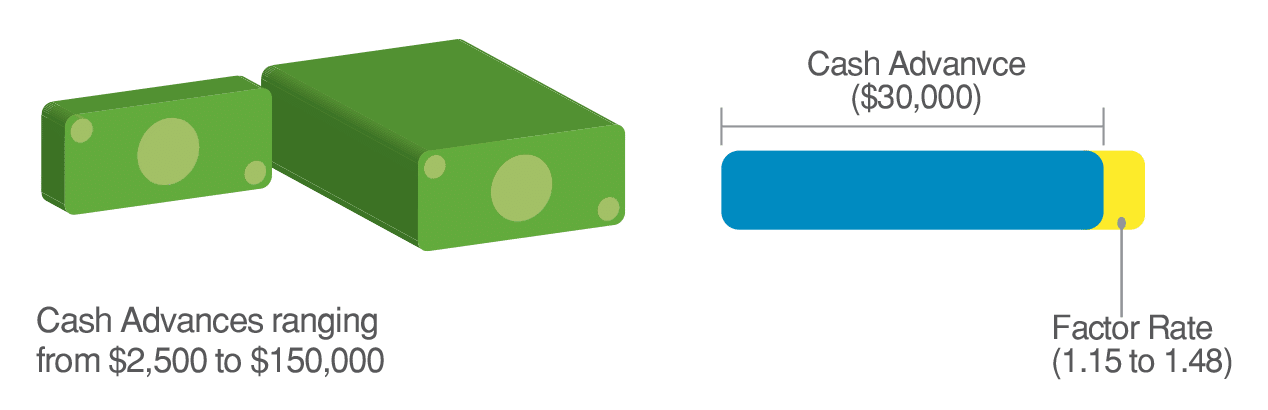

CAN Capital awards Merchant Cash Advances ranging from $2,500 to $150,000, with durations of 3-24 months. Instead of interest rates, CAN merchant cash advances use what are known as factor rates, which are multipliers applied to the amount of the advance. For instance, CAN utilizes factor rates ranging from 1.15 to 1.48, which are determined on a variety of criteria, including credit scores.

Now, let’s take the example of a $30,000 merchant cash advance with a 1.33 factor rate attached. This implies that the overall liability to the small business will become $40,000 ($30,000 x 1.33), before also adding the origination fee of $395.

In this hypothetical example, even in a “best-case” scenario with daily payments taken directly from the small business owner’s credit/debit card processor resulting in full payoff within a year, it is easy to see that the “effective interest rate” of the merchant cash advance exceeds 33%, substantially higher than the interest rate associated with a traditional small business loan.

Remember – there is no APR, a merchant cash advance is not a loan, there is no true interest rate. But ironically, this “effective APR” of the merchant cash advance will be even higher when it is paid off in less than a year – as the true monetary costs associated with the factor rate (and origination fee) will be the same regardless of the duration of the payoff period.

Business Debt Settlement

United Settlement and CAN Capital

At United Settlement, we are proud to enjoy a strong working relationship with the team at CAN Capital. Our experienced debt settlement professionals have successfully negotiated term loan and merchant cash advance settlements with CAN Capital that have resulted in clients saving 50% or more than the remaining balance owed. At United Settlement, our experienced business debt settlement specialists possess relationships with CAN Capital and many of the other leading small business lenders – along with a broad understanding of the overall business debt landscape – and can help you achieve a successful business debt settlement.

CAN Capital is a big player in the small business loan marketplace. At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with juggernauts such as CAN Capital.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with CAN Capital for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with CAN Capital and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.

Are you in debt? we can help

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs