Kabbage

Small Business Lenders for the Real World

Kabbage is an alternative business lender that caters to small businesses who generally possess somewhat weaker credit profiles and seek short-term lines of credit. Kabbage offers lines of credit ranging from $2,000 to $250,000 that feature durations of either six or twelve months with annual percentage rates ranging from 24% to 99%.

The average APR for a Kabbage short-term line of credit is 42%. Despite these high interest rates, Kabbage lines of credit can make sense for those small businesses with weaker credit profiles who are in need of a quick short-term infusion of working capital, as many successful applicants are funded the same day of submitting a completed application. Furthermore, the application process itself is quick and easy, lending further appeal to the Kabbage online automated lending platform.

The Kabbage Online Application Process

Unlike traditional small business lenders, Kabbage makes underwriting decisions that are not based primarily on credit score, but on a variety of business data factors including business volume, transaction volume, social media activity and length of time in business.

During the online application process, the small business owner provides electronic access to any number of platforms – including the business’ checking account, PayPal account, and accounting software – as well as less traditional platforms such as eBay, Amazon, Etsy, Square, and others that can provide an overall sense of transactional volume. Kabbage then makes a decision on the amount of credit line to award based on the overall perceived financial strength and stability of the small business.

ABC

Kabbage Requirements and Client Statistics

Though Kabbage is not particularly credit score sensitive, it does require that the small business owner possess a FICO score of 500 or higher, with a typical client FICO score checking in at 640 or higher. Though Kabbage does not depend solely on a FICO score in determining whether to grant access to a line of credit, it will utilize credit scores as a benchmark in determining rates and terms.

Other minimum requirements for the small business seeking a line of credit include it having been in business for a minimum of twelve months, a business checking account balance of $2,500, and an annual revenue figure of at least $50,000, or $4,200 revenue per month for the most recent three months. Typical clients, in fact, show an annual revenue level exceeding $500,000, with many utilizing their lines of credit for purchases of equipment and inventory.

Kabbage Company Profile

Based in Atlanta, Kabbage began lending in May 2011, and has now extended more than $4 billion in credit lines to over 130,000 small business customers. Starting in 2016, Kabbage exceeded $1 billion in annual credit lines awarded. Also in 2016, Kabbage was named to CNBC’s annual Disruptor 50 List of forward-thinking and ambitious companies and named to the Inc.

500 List of the United States’ fastest-growing private companies for a second consecutive year. These accolades were then followed in 2017 by Kabbage ranking 10th on KPMG’s Fintech100 list, 59th on Entrepreneur’s 360 List of the best entrepreneurial companies in America, and #121 on Deloitte’s Fast 500 list.

Kabbage Lines of Credit

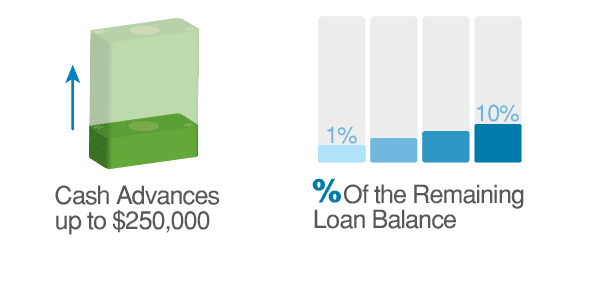

Kabbage awards lines of credit of up to $250,000 to small businesses. Repayment is made automatically on a monthly basis, with each draw made against a line of credit considered a separate loan with either a six or twelve month term. Though Kabbage does not charge origination fees, it does charge monthly fees of 1% to 10% of the remaining loan balance, and these are front-end loaded. For example, for loans with a six month term, fees are assessed at between 1.5% to 10% for the first two months, and 1% thereafter.

For loans with a twelve month term, fees are assessed at 1.5% to 10% for up to the first six months, and 1% thereafter. Since the majority of fees are paid near the beginning of the loan term, even though Kabbage does not charge a prepayment penalty for paying the loan off in full prior to the end of its term, the financial benefit that would ordinarily accrue to the borrower through prepayment is substantially reduced.

Kabbage does not require a personal guarantee. This means that personal assets are not at risk in the event of default. However, Kabbage will file a UCC lien against a small business that has been awarded a credit line, implying that the small business and its underlying assets serve as a form of collateral. Furthermore, Kabbage does not report to business credit bureaus or personal credit bureaus. This means that even when a small business makes timely, regular payments against its Kabbage short-term credit line borrowings, this will not aid in building the business’ credit score and profile.

Business Debt Help

Sometimes, even with the best of intentions, a small business owner can run into trouble after securing a high APR, short-term line of credit, such as those that Kabbage offers. If you are currently burdened by high levels of business debt, the process of pursuing debt settlement may make sense for you and your small business.

Debt settlement takes place when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor and is fully documented in writing. Though creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than you may realize.

United Settlement and Kabbage

Kabbage is in the small business loan marketplace. At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with juggernauts such as Kabbage.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with Kabbage for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with Kabbage and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.

Are you in debt? we can help

Kabbage FAQs

For better or worse, Kabbage does not report repayment behavior to business credit bureaus or personal credit bureaus. Their website does offer insights into general steps that can be taken by business owners to help build business credit, but Kabbage loan repayment behavior will not play a role in building business credit.

Kabbage does not depend solely on FICO scores in determining whether to grant access to a line of credit, although it will utilize credit scores as a benchmark in determining rates and terms. Kabbage requires that a small business owner possess a FICO score of 500 or higher, with a typical client FICO score checking in at 640 or higher.

Kabbage is a legitimate alternative business lender that caters to small businesses who generally possess somewhat weaker credit profiles and seek short-term lines of credit. Kabbage began lending in May 2011, and has now extended more than $6.5 billion in credit lines to over 170,000 small business customers

Kabbage awards lines of credit of up to $250,000 to small businesses. Repayment is made automatically on a monthly basis, with each draw made against a line of credit considered a separate loan with either a six or twelve month term. Kabbage charges monthly fees of 1% to 10% of the remaining loan balance, and these are front-end loaded. For example, for loans with a six month term, fees are assessed at between 1.5% to 10% for the first two months, and 1% thereafter. For loans with a twelve month term, fees are assessed at 1.5% to 10% for up to the first six months, and 1% thereafter. Kabbage does not require a personal guarantee. This means that personal assets are not at risk in the event of default. However, Kabbage will file a UCC lien against a small business that has been awarded a credit line, implying that the small business and its underlying assets serve as a form of collateral.

Kabbage makes underwriting decisions based on factors such as transaction volume, social media activity and length of time in business. During the online application process, the small business owner provides access to the business’ checking account, accounting software, Paypal account, and less traditional platforms such as eBay, Amazon and Square that can provide an overall sense of transactional volume. Kabbage then makes a decision on the amount of credit line to award based on the perceived financial strength and stability of the business.

Kabbage does not report to business credit bureaus or personal credit bureaus. Therefore, when a small business owner makes timely, regular payments against Kabbage short-term credit line borrowings, it does not aid in building the business’ or business owner’s credit score and profile.

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs