LoanMe

Personal and Small Business Loans

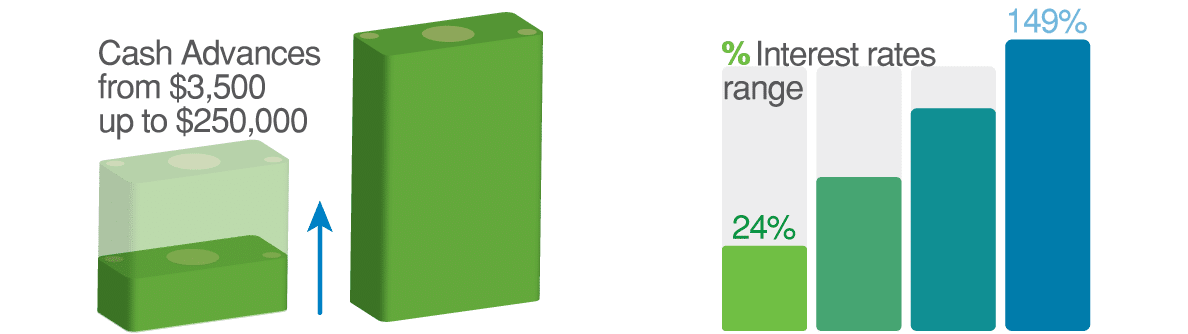

Founded in 2013, LoanMe is an online lender that offers personal loans, auto loans, and small business loans. For the purposes of this article, we will focus on LoanMe’s small business loans division, which offers loans to small businesses in twenty-four states in amounts ranging from $3,500 to $250,000 with terms of up to ten years.

LoanMe typically serves small businesses with an urgent need for funding who don’t qualify for traditional small business loans. Applications are submitted online, 24 hours a day, seven days a week, and funds are granted rapidly – often as soon as the same day of application. However, as we’ll soon see, the relative ease, convenience and availability of LoanMe funding does not come without a price – as interest rates on LoanMe small business loans range from 24% to 149%.

LoanMe Pros and Cons

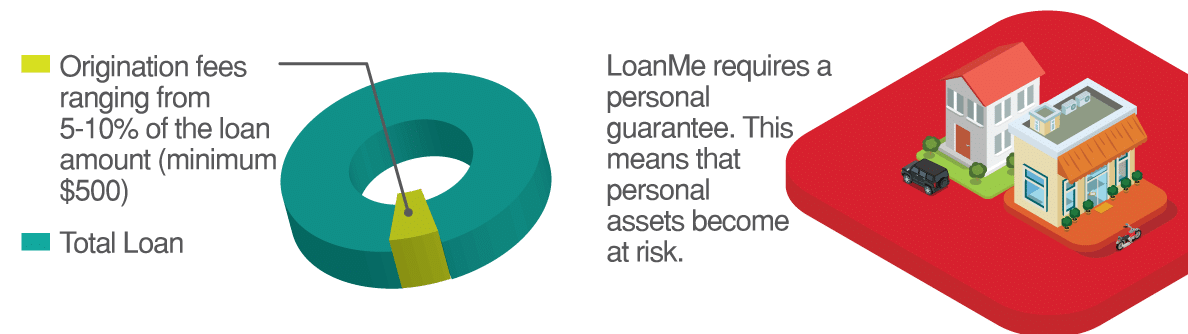

One of the advantages of LoanMe is that it will grant loans to small business owners with weak credit scores, and generally in a fairly rapid manner – often before 5pm on the same business day. However, the availability and convenience of funding doesn’t come without expense, as LoanMe charges origination fees ranging from 5-10% of the loan amount (minimum $500) that are deducted from the amount of funding prior to the small business receiving it.

As mentioned earlier, interest rates for LoanMe loans are inordinately high, ranging from 24% to 149%. However, in spite of the high interest expense and significant origination fees associated with a LoanMe short-term small business loan, borrowers can benefit from the lack of a prepayment penalty.

This implies that if a business owner is able to secure a loan at better terms through the Small Business Administration or elsewhere, it may refinance accordingly and simply pay off LoanMe early, thereby saving substantial interest expense. Additionally, LoanMe does report to several personal credit bureaus and business credit bureaus, a process that helps small businesses build and enhance their business credit scores and profiles.

Payments on LoanMe loans follow a fixed monthly remittance schedule and are automatically deducted from the checking account of the small business. Because of the high interest rates associated with many LoanMe small business loans, it behooves the borrower to pay back as quickly as possible. In fact, LoanMe’s own website numerically illustrates a scenario resulting in total financing costs exceeding 330% of the original loan principal!

Finally, even though the loan is for a small business, LoanMe requires a personal guarantee. This means that personal assets become at risk in the event of default. Furthermore, in the event of default, LoanMe can file a UCC lien against the small business, implying that the business and its underlying assets also serve as a form of collateral.

LoanMe Requirements

LoanMe does not place particularly stringent requirements upon its prospective small business borrowers. LoanMe requires that a small business be a “for-profit” with a business checking account, having been in business for a minimum of two months, and that the business’ owner possesses a FICO credit score of at least 500.

Beyond that, documents such as a valid ID showing proof of age 21 or higher, a business tax ID number, and a voided check put a small business in position to receive LoanMe funding. Maybe that’s the good news. The bad news is that with such onerous interest rates and origination fees, it may be that a small business owner might just as well not want to qualify for LoanMe funding anyway.

Business Debt Settlement

Sometimes, even with the best of intentions, a small business owner can run into trouble after taking out a high interest rate, short-term loan, such as those that LoanMe provides. If you are currently burdened by high levels of business debt, the process of pursuing debt settlement may make sense for you and your small business.

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor and is fully documented in writing. Though creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than you may realize.

United Settlement and LoanMe

LoanMe is in the small business and personal lender. At United Settlement, we are proud to help those people and small businesses truly in hardship. We do not deal with people or businesses that are not already behind on payments. Our core values, integrity, and ethical approach helps us maintain strong working relationship with banks such as LoanMe.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with LoanMe for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with LoanMe and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.

Are you in debt? we can help

Get Debt Relief

Connect with licensed debt specialists dedicated to supporting your long-term financial well-being.

Ready To Get Started?

See if you qualify for debt relief. Get A Free Savings Estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Explore other blogs