On Deck

The leading online small business loan platform

On Deck small business loans is a leading platform for online small business lending, having originated more than $8 billion of loans across 700 industries in the United States, Canada and Australia since 2007. Through its use of proprietary technology and analytics, On Deck assesses the credit-worthiness of small businesses based on actual business performance while taking into account bank statement activity, business and personal credit reports, and government filings.

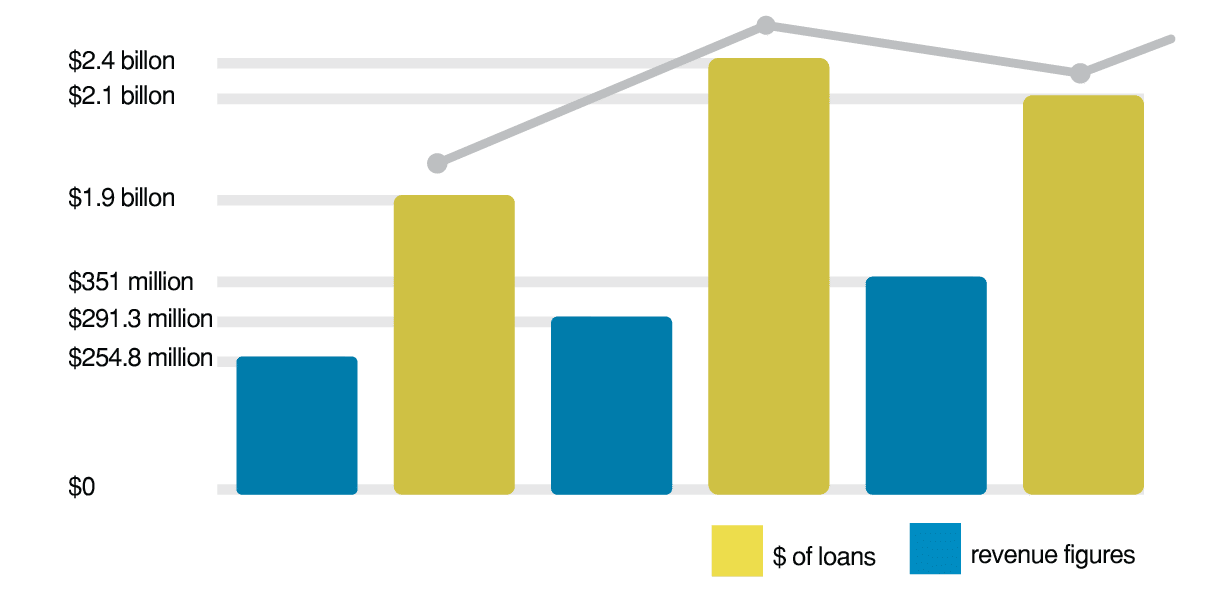

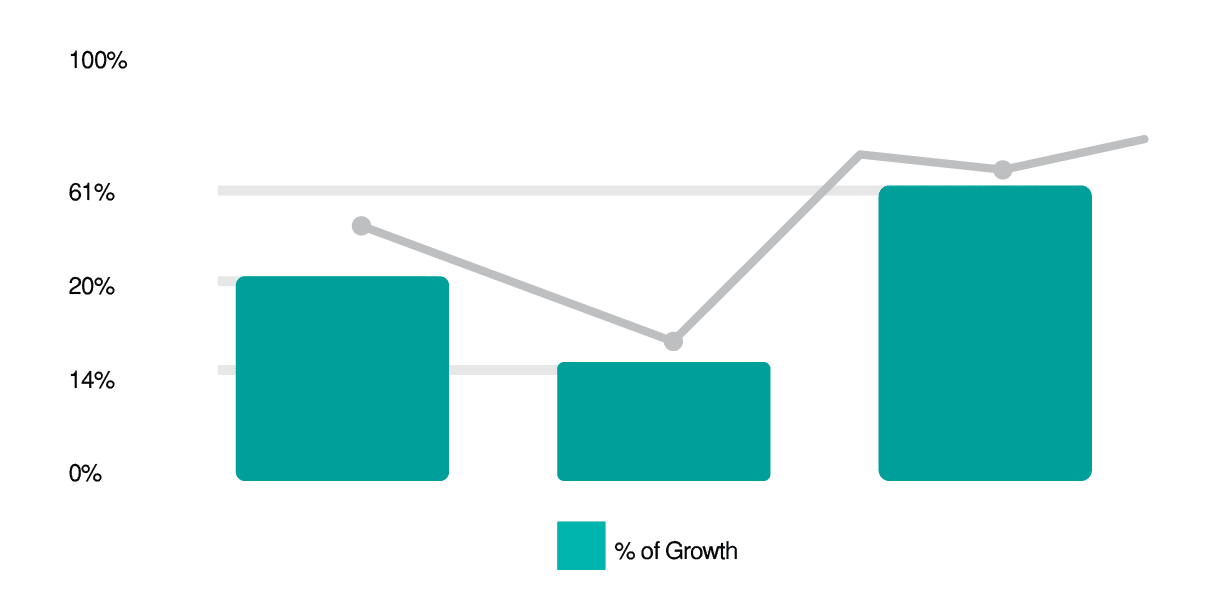

On Deck also considers tax and census data, along with additional factors such as social and reputational data. In 2017, 2016 and 2015, On Deck originated $2.1 billion, $2.4 billion and 1.9 billion of loans, respectively. On Deck’s 2017, 2016, and 2015 revenue figures of $351 million, $291.3 million and $254.8 million, represented year-over-year growth of 20%, 14% and 61%, respectively.

Can I Get a Small Business Loan?

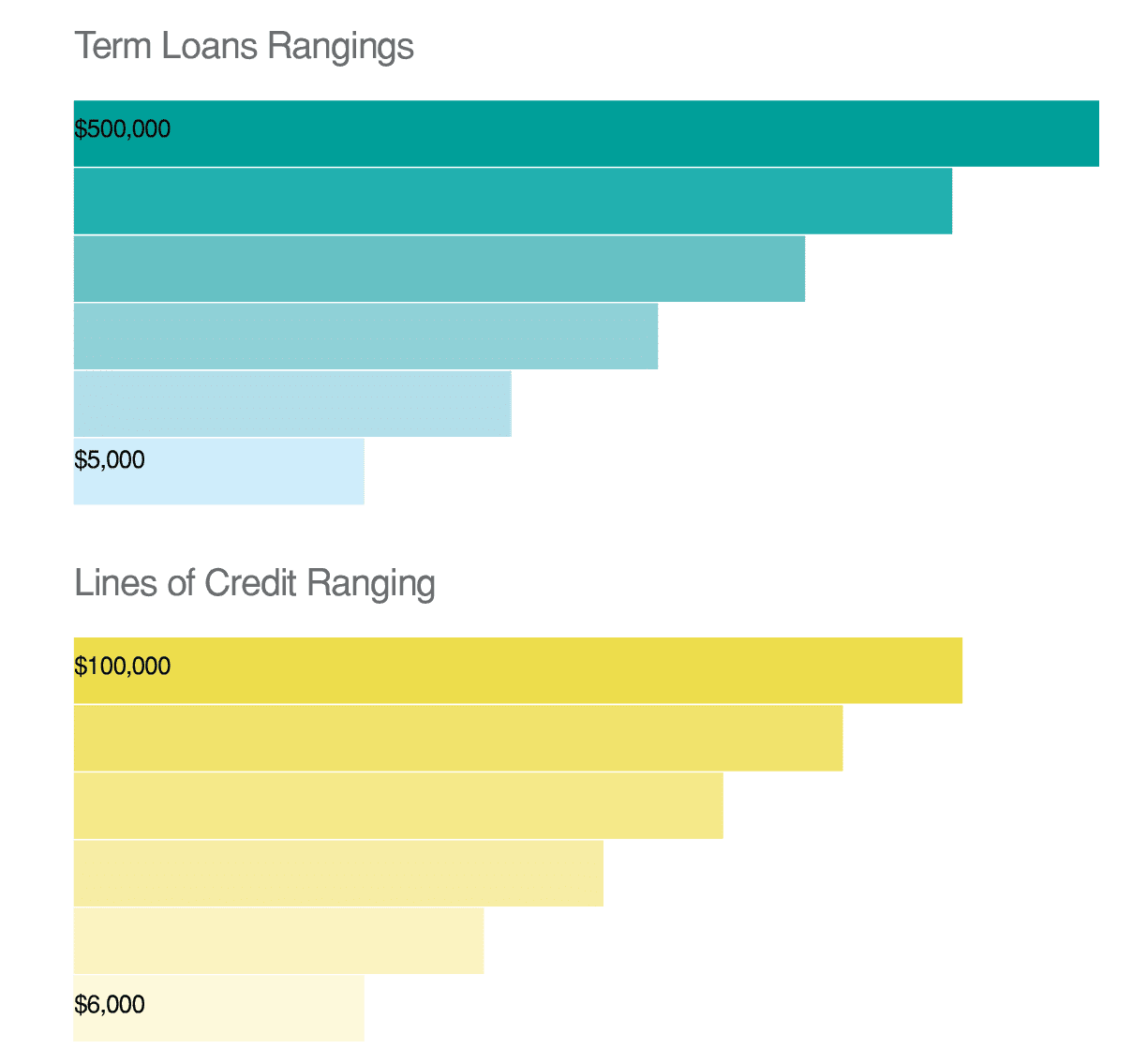

Through its website, On Deck allows small businesses to apply (24 hours a day – 7 days a week) for a term loan or line of credit. On Deck, using its proprietary technology, often makes a funding decision immediately and transfers funds as quickly as the same day. On Deck offers term loans ranging from $5,000 to $500,000, with maturities of three to thirty-six months, as well as lines of credit ranging from $6,000 to $100,000 that are generally repayable within six months of the most recent draw.

Qualified customers may carry both a term loan and line of credit simultaneously. On Deck also reports back to several business credit bureaus, a process that helps small businesses build their business credit profiles. Because On Deck requires no in-person meetings and collects comprehensive information electronically online, it has enhanced the convenience and efficiency of the small business loan application process.

The Small Business Loan Market and On Deck Customer Statistics

The size of the small business loan market is vast. According to the FDIC, as of June 30, 2017, there were 24.7 million small business loans with originations of under $250,000, amounting to a total of $207 billion in small business loans outstanding. In 2017, the top five states in which On Deck or its issuing bank partner originated loans were California, Florida, Texas, New York and Illinois, representing approximately 14%, 9%, 9%, 7% and 4% of the company’s total loan origination’s, respectively.

At the close of 2017, the median annual revenue of On Deck’s customers was approximately $631,000, with 90% of its customers generating between $161,000 and $3.8 million in annual revenue. Meantime, the median length of time its customers had been in business was eight years, with 90% having been in business between two and thirty years. During 2017, On Deck’s average term loan was approximately $57,000, while the average credit line extended to a customer was approximately $23,000.

On Deck Company Profile

Headquartered in New York City, with offices in Arlington VA, Denver CO, and Sydney, Australia, On Deck is a publicly traded company on the New York Stock Exchange, trading under the ticker symbol ONDK. In 2017, On Deck was featured in Crain’s New York Business as one of New York’s 50 Fastest Growing Companies.

On Deck’s most recent Net Promoter Score (an index ranging from -100 to 100 that measures customer loyalty) of 79 places it at the upper end of customer satisfaction, ranking considerably higher than the average Net Promoter Score of 35 for the financial services industry. This high customer satisfaction is also evidenced by a strong level of repeat borrowing by customers. In 2017, 2016, and 2015, 52%, 53% and 57%, respectively, of loan originations came from repeat term loan customers, who often take larger term loans than previously undertaken.

Small Business Debt Relief

If you are currently burdened by high levels of business debt, the process of pursuing debt settlement may make sense for you and your small business. Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor and is fully documented in writing. Though creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than many people realize.

United Settlement and On Deck

Clearly, On Deck is no small player in the small business loan marketplace. At United Settlement, we are proud to help those small businesses truly in hardship. We do not deal with businesses that are not already behind on payments and / or on the brink of closing shop. Our core values, integrity, and ethical approach helps us maintain strong working relationship with juggernauts such as On Deck.

Our experienced debt settlement professionals have successfully negotiated business debt settlements with On Deck for clients who truly were facing serious financial hardship and stress that have resulted in large saving the total balance owed. At United Settlement, our experienced business debt settlement specialists possess past relationships with On Deck and more small business lenders.

Our team has an expert level understanding small business landscape, we know when a business is facing hardship and can help get you to financial freedom. See if you qualify for small business debt relief.

Are you in debt? we can help

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs