Average Credit Card Debt

According to the U.S. Census Bureau and Federal Reserve, the average level of credit card debt for all U.S. households as of September 2017 sits at a relatively modest $5,700. However, the figure climbs significantly higher, to $16,048, when only balance-carrying American households are taken into account.

This wide disparity in credit card debt is more readily understood when considering the fact that almost 62% of all American households do not carry any credit card debt whatsoever. However, for the 38.1% of American households who do carry at least some measure of credit card debt, that level of credit card debt continues to gradually rise. In fact, aggregate revolving credit card debt in America now resides at over 1.022 trillion dollars.

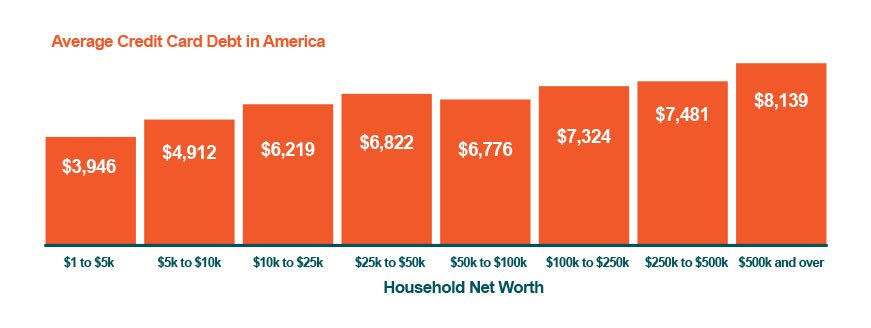

Credit Card Debt in the U.S. by Net Worth

When examining the average level of credit card debt in the U.S., there are several different ways to evaluate it. One method is to look through the lens of income levels, and when doing so, this reveals that those households with the absolute lowest net worth’s are carrying the highest amounts of credit card debt, averaging in at $10,307.

It should come as little surprise that American households with zero to negative net worth’s are forced to struggle to make ends meet and that the flexibility that comes with responsible utilization of a credit card can help make the process of monthly budgeting more manageable. The fact that the wealthiest households with net worth’s of $500,000 or more place second at an average credit card debt level of $8,139 only underscores the important budgeting flexibility that credit cards can provide to responsible lower net worth households.

ABC

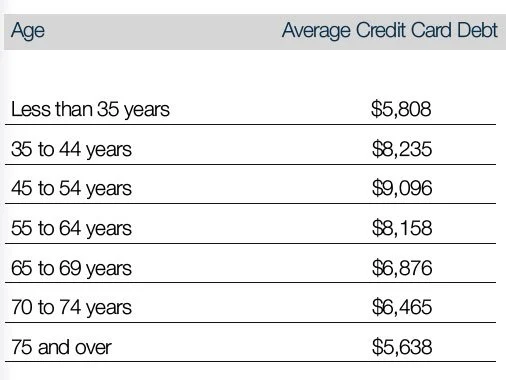

Average Credit Card Debt in America – Age Matters

The average level of credit card debt in America will vary across several other demographics – including region, state of residence, race, gender, and age. When examining average credit card debt by age, it quickly becomes apparent that those between the ages of 45 and 54 show the highest average debt, coming in at $9,096. This reflects that demographic’s stronger proportion of disposable income on a nationwide basis.

Interestingly, both the youngest (under 35) and oldest (over 75) demographics check in at the lowest levels of average credit card debt – $5,808 and $5,638, respectively. In the case of the younger set, this could reflect millennial’s’ preference toward debit card usage, while in the case of seniors, a relatively lower level of disposable income on a nationwide basis likely contributes to lower credit card usage and debt levels.

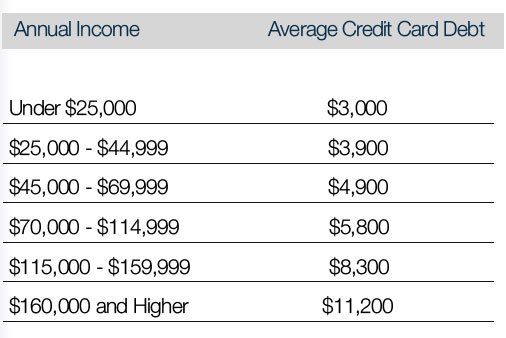

Average Credit Card Debt in America – Affected by Income Level

Unsurprisingly, those who earn more, typically spend more. Accordingly, average credit card debt levels do rise as incomes climb. However, as indicated by the numbers in the chart below, though this direct correlation is apparent, it is only when annual income levels exceed $115,000 that we see the amount of household credit card debt associated with such a household become significantly higher than the blended national average of $5,700.

Getting Your Credit Card Debt Under Control

Merely seeing what the national average credit card debt in America is, through various demographic variables, can be a good start in assessing whether you may have work to do toward trimming down your own levels of credit card debt. Remember, that credit cards are a useful tool when used responsibly as a means toward building a strong credit profile through a steady repayment history.

However, if you are concerned that the amount of credit card debt you currently have may be too high, it could be time to start doing something about that. Contact us here at United Settlement and we can discuss various credit card debt relief strategies that can get you on the road toward financial wellness.

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs