Credit Reporting Agencies

The three major U.S. credit reporting agencies – Experian, Equifax and TransUnion – compile consumer financial data that is assembled into credit reports that are widely used by banks, credit card companies, mortgage lenders, auto lenders, and many others. The major credit bureaus are not affiliated with the U.S. government in any way, but rather – they function as separate, publicly-traded corporations that generate profit by providing a service to banks and individuals through the sale of internally generated credit reports.

They do, however, fall under the jurisdiction of the Fair Credit Reporting Act (FCRA), a form of regulation that dictates within what boundaries the credit bureaus must conduct operations. Let’s take a closer look at the role that the three major credit reporting agencies play within the U.S. consumer economy.

Massive Amounts of Consumer Data = Hundreds of Millions of Credit Reports

Experian, Equifax, and TransUnion each maintain a massive amount of consumer data that serves as a foundation for each bureau creating and updating credit reports on over 210 million American consumers. These credit reports serve an important function within the economy, as they represent the creditworthiness of a potential individual borrower to a lender, as indicated by the individual’s borrowing history, repayment history, and credit score.

Simply put, credit reports keep track of the success or failure over the short- and long-term of a particular individual’s ability to repay debt obligations in a timely manner and are central to a creditor’s ultimate decision of whether to lend, how much to lend, and at what interest rate and terms.

The data that the major credit reporting agencies rely upon in constructing credit reports typically originate from banks and credit card issuers, who report customer account activity directly to the major credit bureaus. However, banks and other creditors are not required to send information to any of the credit bureaus.

This is often the reason why differences can be spotted among credit reports for the same person that are issued by different credit bureaus. Additionally, credit bureaus generally do not share information – with the exception of fraud alerts – and one or two credit bureaus (but not all three) may sometimes purchase additional information related to public records that involve government tax liens and bankruptcies.

Credit Reports and Scores

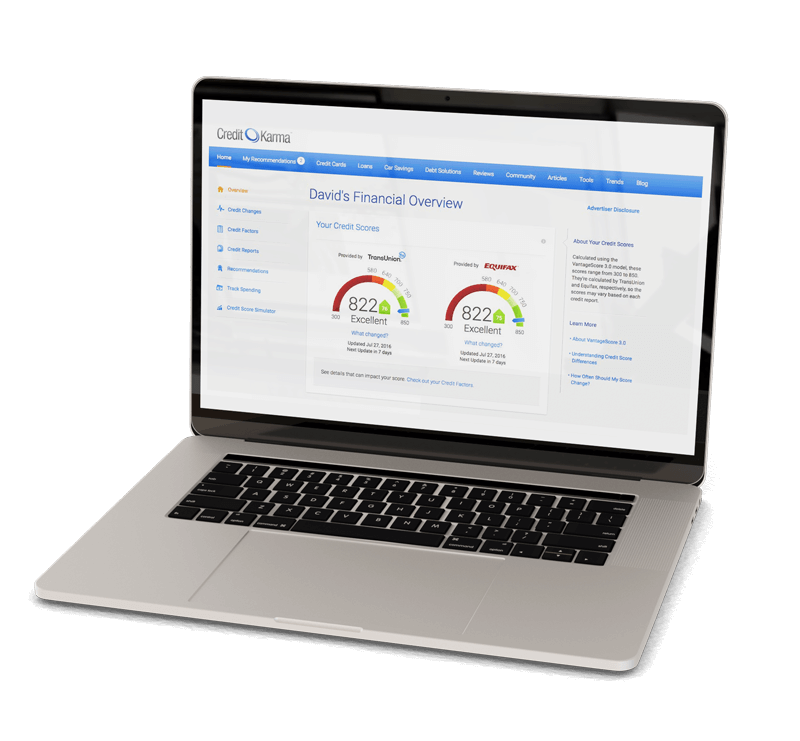

Aside from serving as a comprehensive review of an individual’s debt repayment history as it relates to credit cards, mortgages, auto loans, student loans and other debts, credit reports also include credit scores based on that repayment history. The most widely used credit score is the FICO score, created by the Fair Isaac Corporation, and it ranges from 300 to 850.

Another popular credit score, the Vantage Score, was created by the three major credit reporting agencies, and also ranges from 300 to 850. In either instance, scores above 700 are considered good, with 750 and higher considered excellent. Establishing a favorable credit history that speaks to responsible debt repayment places an individual in position to secure further debt at favorable terms from subsequent lenders. Conversely, a poor credit history and low credit score work against the individual when pursuing additional debt, and can also reflect poorly when potential landlords and employers view a credit report.

Who Looks at My Credit Report?

Whenever an individual applies for a credit card, mortgage, personal/installment loan, or auto loan, these are considered “voluntary” events, and a “hard pull” of a credit report results. Who’s looking? Banks, mortgage lenders, auto dealerships, and credit card companies are obvious answers. Hard pulls generally have a temporary adverse effect on a credit score, as they indicate an attempt to borrow and incur further debt.

In contrast, a “soft pull” of a credit report as performed as part of a background check, or by a utility company, insurance company, potential employer or potential landlord are considered “involuntary” and do not impact a credit score. However, because credit reports are requested by some less obvious suspects including potential employers and landlords as indicators of good or bad patterns of behavior, it behooves the individual even further to make timely payments and perform measures that ensure the accuracy of the information presented on credit reports.

Monitor Your Own Credit Reports

There are two ways to request free copies of credit reports issued by the three major credit reporting agencies. Visit https://www.annualcreditreport.com to request a free credit report from each of Experian, Equifax and TransUnion, every twelve months. It can be a good idea to stagger your free reports throughout the year, rather than requesting all three reports at the same time. You can also request free copies of your credit report by calling 877-322-8228. Again, it is a good idea to periodically review your credit report to ensure it remains an accurate reflection of your debt repayment history. If you do spot any inaccuracies, contact the appropriate credit bureau and file a dispute.

Are you in debt? we can help

Related to: Credit Reporting Agencies

Fraud Alerts

One instance in which the major credit reporting agencies share information is when fraud alerts take place. When a credit card holder suspects fraud or identity theft, one of the first steps to take is to contact Experian, Equifax or TransUnion and report the suspicious activity. A fraud alert will then be sent to all of your remaining creditors, as well as to the other credit bureaus. The credit bureaus will then investigate and confirm any fraudulent activity that will then get removed from all of your credit reports. Additionally, after reporting the fraud, you are entitled to one free credit report, and you should review that report closely to make certain that it excludes all fraudulent activity.

The Fair Credit Reporting Act (FCRA)

The FCRA is the primary Federal legislation governing activities pertaining to the reporting of consumer credit information. The FCRA outlines permissible purposes of obtaining consumer credit reports that the major credit reporting agencies must operate within. These include a creditor seeking a potential borrower’s credit profile in an application for credit, requests related to background checks, and those requests made by the consumer.

The FCRA also outlines disclosure and notification policies that must be followed by entities that seek a consumer’s credit report. The FCRA also standardizes what information should be included within a credit report and stipulates the duration that adverse items can remain on a consumer credit report at seven years, with the exception of bankruptcies, which can remain for ten years. Finally, under the FCRA, consumers maintain the right to know what is in their file, to dispute and correct information that is incomplete or inaccurate, and to remove any outdated information.