Save Money by Cutting these Expenses

Cutting These Expenses Can Save You Big Money

A 2017 CareerBuilder survey revealed some startling realities about the percentage of the labor force that lives paycheck to paycheck. Simply put, the majority of U.S. workers – 78% – live from paycheck to paycheck in some form or another!

Meantime, 71% of U.S. workers are in debt, and 56% of those workers who are in debt believe that they will always be in debt. Even for those earning $100,000 or more, 9% live paycheck to paycheck and 59% are in debt.

With so many Americans living on the margin each month, it makes sense that saving money and cutting back on unnecessary expenses should be as important as ever.

Even for the already cost conscious individual, there still could remain a number of opportunities to cut expenses that can result in saving big money when they add up in the aggregate. Let’s take a closer look.

Table Of Contents

Personal Finance

Under the heading of personal finance, we find expenses that include credit card interest, mutual fund investment costs, bank fees and life insurance. Let’s examine each of these in order. When it comes to credit card interest, approximately 43% of American cardholders subject themselves to this unnecessary expense by not paying their balance in full each month. With an average credit card balance exceeding $6,500 and an average APR approaching 18%, the average American credit card holder is paying almost $650 annually in credit card interest.

Meantime, mutual fund investment costs can be surprisingly substantial, as many funds charge 5% or more to the buyer – even though the marketplace for no-load mutual funds is robust. Investigate the various no-load mutual funds that are available and save up to $500 or more for every $10,000 invested.

Banks, meantime, are notorious for charging fees – there are overdraft fees, ATM fees, monthly maintenance fees, paper statement fees, inactivity fees – but virtually all of these are avoidable with careful planning and behavior modification.

Switching to an online bank without minimum balance requirements on checking and savings accounts can easily save $300 annually – and that’s before any possible ATM and overdraft fees. Turning to life insurance, although important for married couples, a young single person should spare themselves of the minimum $250 annual expense associated with term life insurance policy premiums.

ABC

Subscriptions

Let’s take a look at subscriptions next. Though not a traditional “subscription,” monthly cable television bills average around $100, in large part to various packages that often include premium subscription channels such as HBO and Showtime. Cutting the cord in favor of less expensive streaming services such as Netflix, Hulu and Amazon Prime can result in easily saving $500 or more per year.

Streaming services are most definitely a viable alternative, but it isn’t a good idea to go overboard here, either. Keep your streaming service subscriptions away from the premium versions and enjoy a wide variety of programming for less than $20 per month with the basic core offerings of Netflix and Hulu.

Meantime, with so much free content available online, unless you’re an older person with habits that die hard, many newspaper and magazine subscriptions just aren’t very necessary anymore.

Dropping the monthly newspaper subscription can save over $150 each year, with additional savings resulting from putting a stop to printed magazine subscriptions that cost less in digital form online.

Even online and phone games come with a recurring monthly cost of between $5-10 that adds up over the course of the year. Unless you’re playing these games regularly, consider cutting this expense as well.

Memberships

Meantime, if you’re a satellite radio subscriber, recognize that you are probably paying close to $200 per year for the privilege of listening to your favorite music and programming while driving. With several free and low cost music streaming services available as alternatives, examine whether this is a service that you truly need – or if satellite radio represents an ongoing expense that you can cut from your life. And then there’s the issue of that gym membership that you may or may not be using.

Unless you’re going to the gym regularly, you can easily break free from a monthly charge that often eclipses $50 and would result in an annual savings of $600 or more. Even in the case of Planet Fitness, a basic monthly membership, when combined with the annual membership charge, will approach $150 per year. If you workout only intermittently, consider investing in reliable, inexpensive (or barely used) home exercise equipment.

Finally, although warehouse club memberships can make sense for families, they don’t necessarily make sense for a young single person who may not need to buy in bulk – as this often results in food wasted at home. Save an approximate $50 annual membership fee (and potentially a lot more in added food waste) by shopping for groceries the old-fashioned way – take advantage of weekly specials at your local grocery store.

Expensive Habits

When it comes to bad habits, cigarette smoking certainly makes the list. Not only is smoking notoriously unhealthy – but it is also expensive. The recurring purchase of cigarette packs that average over $6 nationwide (and in some states surpass $10) is terribly unhealthy to a budget, as well.

Even the smoker who buys one pack every other day is spending around $100 each and every month on cigarettes! Do the right thing for your health and wallet – kick the cigarette habit and save more than $1,000 over the next twelve months! Next comes the matter of regular lunches out. Lunch can be a fun activity that helps breaks up the workday – but take a close look at how much you’re spending here.

The $10 lunch is not uncommon, and if you’re spending $50 a week here, ouch! That comes to a $100-200 monthly savings that you can achieve by often packing your own lunch. We’re talking $1,000 to $2,000 a year here in savings – just by bringing lunch to work half of the time or more!

A similar savings can also be achieved by cutting back on ordering takeout – as the average American spends over $150 per month bringing home takeout. Carefully planning simple home-cooked meals prepared from grocery store purchased food can save another $1,000-$2,000 per year! Finally, no discussion of expensive habits would be complete without bringing up trips to the coffee shop.

Whether it’s Starbucks or something similar, and whether you’re getting higher-end concoctions or just simple cups of coffee, there’s no question that you can save money by cutting back on coffee expenses.

Brewing supermarket-bought coffee the old-fashioned way or through somewhat more expensive K-Cups will literally save you money on every single cup – as can grabbing a cup from a fast-food outlet where coffees are often priced closer to one dollar.

Therefore, examine how much money you are spending each month at coffee shops – as it could easily fall into the range of $40-$100. The annual savings that result from changing how you consume coffee can save you $400 or more this year.

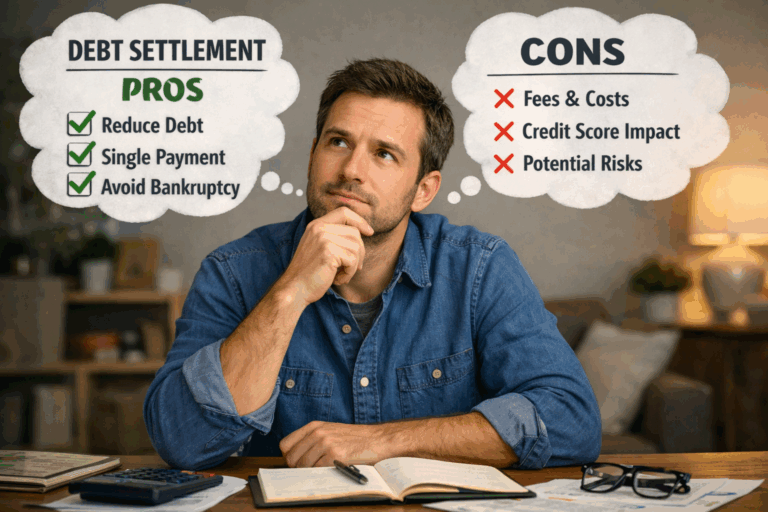

Are you in debt? we can help

About The Author: Steven Brachman

Steven Brachman is the lead content provider for UnitedSettlement.com. A graduate of the University of Michigan with a B.A. in Economics, Steven spent several years as a registered representative in the securities industry before moving on to equity research and trading. He is also an experienced test-prep professional and admissions consultant to aspiring graduate business school students. In his spare time, Steven enjoys writing, reading, travel, music and fantasy sports.

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs