How to Get Out of Debt

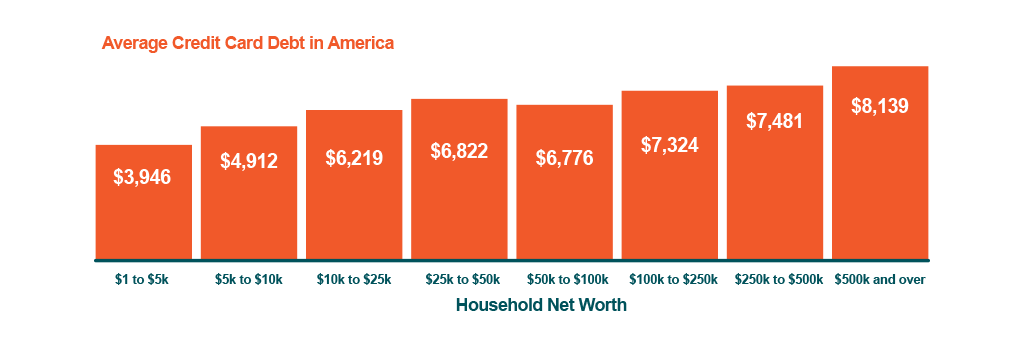

For many Americans, carrying high levels of debt has become a way of life and figuring out how to get out of debt has been put on the backburner. The American consumer remains on an unprecedented debt binge, as aggregate levels of revolving credit card debt now exceed one trillion dollars, with 38% of American households carrying some form of credit card debt (source).

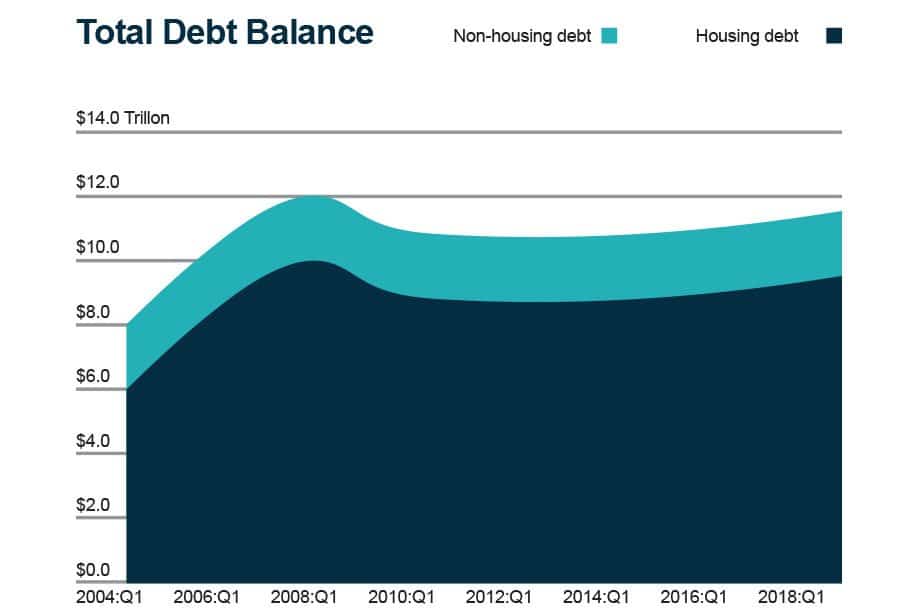

Meanwhile, total household debt (including mortgages and car loans) now stands at 13.15 trillion dollars. And let’s not forget that total student loan debt in the United States now checks in at a cool $1.45 trillion. Whether it be through credit cards, home mortgages, auto loans, student loans, personal/installment loans – or some combination thereof – it’s clear that for many, a component of the American Dream, unfortunately, is the debt nightmare.

Total Debt Balance

In fact, a recent study from early 2017 indicates that approximately 73% of American consumers don’t know how to get out of debt and actually die in it! If you’ve got a debt problem, don’t take it with you to the grave (source). There is no better time to figure out how to get out of debt than the present. With proper planning, guidance and dedication, you can find your way out of debt.

Start by Formulating a Budget

Regardless of how deeply buried in it you are, getting out of debt quickly starts by taking stock of your current financial situation. Develop and maintain a budget that provides you with a sense of financial control and a foundation for financial wellness. All a budget really implies is that you should get a clear and written account of your expenses as they relate to your regular monthly income. A clear budget will provide you with a sense of control over your money and get you started on the path toward living a debt-free lifestyle. Simply gaining a clear handle on the level of your necessary expenses – housing, transportation, food, utilities, etc. will go a long way toward establishing a fresh financial foundation.

Spend Less, Earn More

Common sense dictates that you must be willing to alter the spending habits that led you into debt in the first place. When it comes to spending less, cut out restaurant meals in favor of eating at home, brew your own coffee at home, look for bargains at consignment shops and thrift stores, find an alternative to that overpriced monthly cable bill, and cut out expensive sporting events and entertainment.

One simple rule that works – if you can’t afford something with the cash in your pocket or your debit card – don’t buy it! Think in terms of using credit cards only for emergencies. If changing your spending habits sounds like a difficult proposition, consider seeking help from an accredited credit counseling agency that can educate you while putting you on the right track to getting out of debt fast.

You may or may not have given much thought to taking on a second, part-time job that offers flexible evening and weekend hours. The fact is that restaurants, retailers and other service businesses (including driving for Uber or Lyft) are viable candidates for earning extra income. You may also want to consider looking for items around the house that you don’t really use and offering them for sale on Craig’s List, the Facebook Marketplace, or on eBay.

Examine Your Credit Reports and Monthly Statements

Request your credit reports from the three national credit reporting bureaus  . Check for any inaccuracies that could be lowering your credit score (and preventing you from the benefit of lower interest rates) and dispute them with the appropriate agency if necessary. For all existing credit card accounts, get clear on your balances, interest rates and minimum monthly payments.

. Check for any inaccuracies that could be lowering your credit score (and preventing you from the benefit of lower interest rates) and dispute them with the appropriate agency if necessary. For all existing credit card accounts, get clear on your balances, interest rates and minimum monthly payments.

Prioritize your debts by their interest rates (from highest to lowest), and find room in your monthly budget to allocate additional funds toward the card with the highest interest rate. Don’t be afraid of directly contacting your creditors – particularly those to whom you have been making timely payments for a number of years – and ask to have your interest rate reduced.

Be Patient

Figuring out how to get out from under a significant amount of debt requires commitment, sacrifice and thoughtful planning. Be realistic about the time frame involved and be willing to commit to a 3- to 5-year course of action to get out of debt. Always pay your creditors on time and pay as much of your balances as your monthly budget will allow.

Additionally, as you achieve the victories of paying off various credit card accounts in full, be sure not to close any of them, as closing an existing account will have a negative effect on your credit score. If you still find yourself burdened by an onerous amount of revolving credit card debt after your best efforts, then the best option may very well involve you working alongside a skilled credit counselor from a reputable credit counseling agency who can help you tailor an appropriate solution toward getting out of debt.

Get Help If You Need It

The best place to begin sorting out your debt is with a credit counseling agency who can help you get your debt under control. In an initial 30-45 minute phone interview session, the counselor will ask questions relative to your income, expenses and debts, and can tailor solutions specific for your situation to help with debt relief. Among the more common solutions available is the Debt Management Plan (DMP), which involves streamlining multiple credit card payments into one simple monthly payment to the counseling agency.

Included in the advantages of enrolling in a DMP are lower interest rates and a lower overall monthly payment. However, if you’re already delinquent on some credit card accounts, Debt Settlement may be the best debt relief option for you, as it can result in creditors accepting lower balance payoffs. Or, if you have a variety of different creditors beyond unsecured credit card debt, it may be best to pursue a Debt Consolidation Loan, which is used to pay off all of your creditors and typically results in a lower blended monthly interest rate and payment. Contact us here at United Settlement to discuss your available options and get yourself going in the right direction financially – and on the road toward getting out of debt.

Related to: How to get out of debt