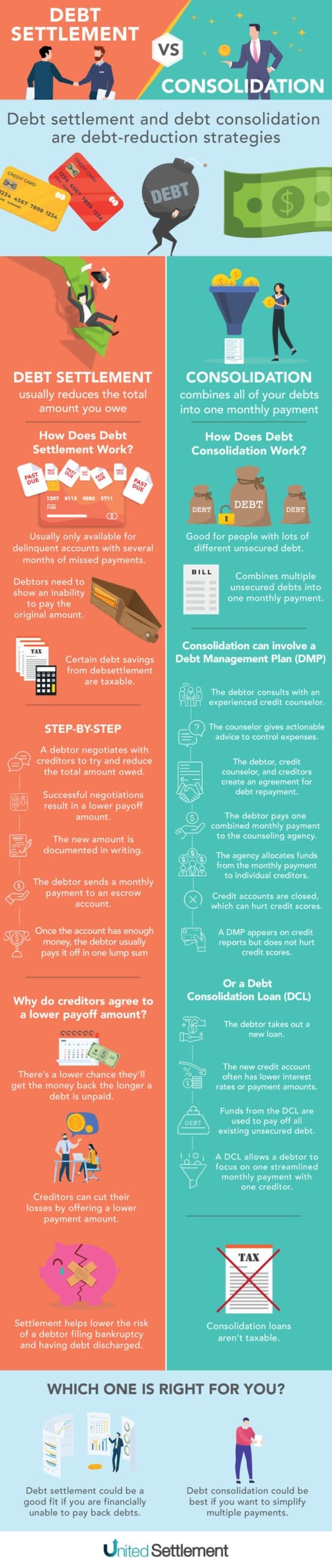

Debt Settlement vs Consolidation

Debt settlement and debt consolidation are debt-reduction strategies

Table Of Contents

Share this Image On Your Site

- Debt settlement and debt consolidation are debt-reduction strategies.

- They have different functions:

- Debt settlement usually reduces the total amount you owe.

- Consolidation combines all of your debts into one monthly payment.

How Does Debt Settlement Work?

- Usually only available for delinquent accounts with several months of missed payments.

- Debtors need to show an inability to pay the original amount.

- Certain debt savings from debt settlement are taxable.

- Step-by-step:

- A debtor negotiates with creditors to try and reduce the total amount owed.

- Successful negotiations result in a lower payoff amount.

- The new amount is documented in writing.

- The debtor sends a monthly payment to an escrow account.

- Once the account has enough money, the debtor usually pays it off in one lump sum.

- Why do creditors agree to a lower payoff amount?

- There’s a lower chance they’ll get the money back the longer a debt is unpaid.

- Creditors can cut their losses by offering a lower payment amount.

- Settlement helps lower the risk of a debtor filing bankruptcy and having debt discharged.

How Does Debt Consolidation Work?

- Good for people with lots of different unsecured debt.

- Combines multiple unsecured debts into one monthly payment.

- Consolidation can involve a Debt Management Plan (DMP):

- The debtor consults with an experienced credit counselor.

- The counselor gives actionable advice to control expenses.

- The debtor, credit counselor, and creditors create an agreement for debt repayment.

- The debtor pays one combined monthly payment to the counseling agency.

- The agency allocates funds from the monthly payment to individual creditors.

- Credit accounts are closed, which can hurt credit scores.

- A DMP appears on credit reports but does not hurt credit scores.

- Or a Debt Consolidation Loan (DCL):

- The debtor takes out a new loan.

- The new credit account often has lower interest rates or payment amounts.

- Funds from the DCL are used to pay off all existing unsecured debt.

- A DCL allows a debtor to focus on one streamlined monthly payment with one creditor.

- Consolidation loans aren’t taxable.

Which One is Right for You?

- Debt settlement could be a good fit if you are financially unable to pay back debts.

- Debt consolidation could be best if you want to simplify multiple payments.

Are you in debt? we can help

Get Debt Relief

Connect with licensed debt specialists dedicated to supporting your long-term financial well-being.

Ready To Get Started?

See if you qualify for debt relief. Get A Free Savings Estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Explore other blogs