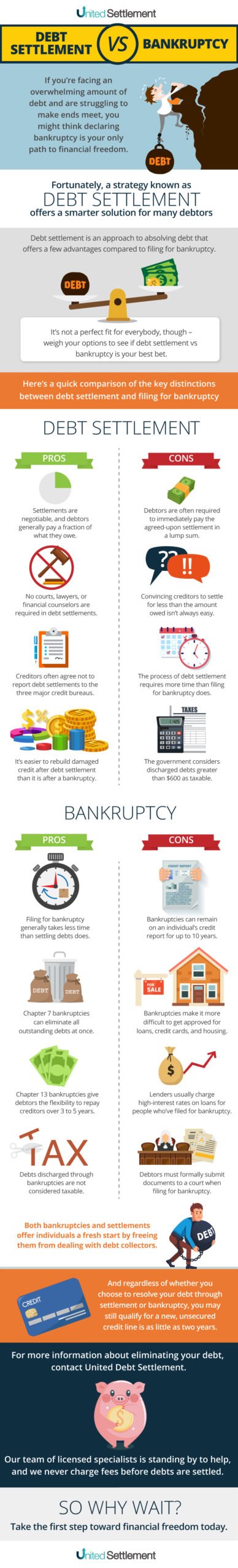

Debt Settlement vs Bankruptcy

The processes of debt settlement and filing for bankruptcy represent two viable alternatives for an individual buried under insurmountable debt.

While choosing between one or the other may be akin to the feeling of being caught between a rock and a hard place, there are positives to be accrued in either approach. In this article, we will describe both processes while comparing and contrasting the virtues and drawbacks of each

Related to: Debt Settlement and Bankruptcy

The Basics of Debt Settlement

Debt settlement takes place when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower amount is agreed to by the creditor or collection agency and is fully documented in writing. Ideally, this lower negotiated amount is paid off in one lump sum, but it can also be paid off over time.

Even though it may seem surprising that banks would settle for less than what is owed, the statistical certainty that not all borrowers will actually pay back is built into a bank’s carefully formulated lending model. Understanding this reality makes it easier for many debtors to pursue debt settlement.

The process of debt settlement focuses primarily on unsecured debt, such as credit cards. Additionally, creditors are more likely to settle once a debtor has already demonstrated an inability to pay.

Therefore, if you’ve already fallen behind on payments by four or five months, it could be the ideal time to begin negotiating with creditors for the best settlement, as the bank still controls your account but also knows that the clock is ticking closer to charge-off, the point at which it would likely never recover anything from the delinquent account again.

Consequences of Bankruptcy

Bankruptcy should not be entered into lightly without an understanding of its long-term consequences. A Chapter 7 bankruptcy will remain on a credit report for ten years from the filing date, and a Chapter 13 bankruptcy will remain on a credit report for seven years from the filing date.

Either can impede a borrower’s ability to obtain new lines of credit, and potential landlords and employers may frown upon this aspect of a financial history. It is likely that a bankruptcy discharge will lower a FICO credit score toward the low 500s.

However, with careful planning and responsible financial behavior, particularly in the first two years following a bankruptcy discharge, it is possible to rebuild a FICO credit score to healthy levels following bankruptcy.

Debt Settlement vs Bankruptcy

Should I Pursue Debt Settlement or Bankruptcy?

The choice between debt settlement and bankruptcy will depend upon your aggregate debt level, the nature of your debt (unsecured vs. secured), your income, and additional considerations such as potential tax consequences and credit score impact.

For instance, even if your total debt level is high, if most or all of the debt is unsecured, debt settlement may be your best option. However, if you are carrying onerous secured debt (such as a home mortgage or auto loan) as well, pursuing bankruptcy could be the better option.

Regarding discretionary income, if you are able to put aside a certain fixed amount each month for an eventual settlement payment, then you can consider debt settlement. However, if you’re finding it unrealistic to accumulate any savings after accounting for basic necessities each month, then pursuing bankruptcy may be better. Do note that you will still need to meet certain income conditions to qualify for filing either Chapter 7 or Chapter 13.

Next, if you’re looking to reduce your debt burden related to certain private student loans (a form of unsecured debt), then debt settlement could work in your favor, as it is difficult to discharge private student loans through bankruptcy. Finally, regarding tax consequences, debt settlement savings in excess of $600 are considered a federally taxable event. However, this is not the case with bankruptcy, as discharged debts are usually not considered taxable income.

If you find yourself saddled with too much debt, regardless of how difficult things may feel today, there is a pathway out toward financial wellness. Regardless of whether you choose to pursue debt settlement or bankruptcy, you can effectively position yourself to secure a new unsecured credit line within two years of completing either. Contact us here at United Debt Settlement to discuss your various options as they relate to your specific financial situation.

Debt Settlement vs. Bankruptcy FAQs:

Is it better to file bankruptcy or settle debt?

The choice between debt settlement and bankruptcy will depend upon total debt level, the nature of the debt (unsecured vs. secured), income levels, and additional considerations such as potential tax consequences and credit score impact. Even if total debt level is high, if most or all of the debt is unsecured, debt settlement can be the better option. If you are carrying high levels of secured debt (such as a home mortgage or auto loan), pursuing bankruptcy could be the answer. However, bankruptcy should not be entered into lightly without an understanding of its long-term consequences. A Chapter 7 bankruptcy will remain on a credit report for ten years from the filing date, and a Chapter 13 bankruptcy will remain on a credit report for seven years. Either do significant damage to a FICO credit score and can impede the ability to obtain new lines of credit, and potential landlords and employers often frown upon this aspect of a financial history.

How many times can you file bankruptcy?

There is no specified limit to the number of times that someone may seek Chapter 7 or Chapter 13 bankruptcy protection. However, there are restrictions that govern the frequency with which someone may file, and these restrictions depend upon the previous type of bankruptcy filed and the filing date. For individuals who have previously filed Chapter 7, they must wait another eight years to again file Chapter 7, or wait four years to file Chapter 13. For individuals who have previously filed Chapter 13, they must wait another two years to again file Chapter 13, or wait six years to file Chapter 7.

How long does it take to file bankruptcy?

A Chapter 7 bankruptcy typically takes up to six months to complete, with a bankruptcy discharge granted within four months of filing in most cases. A Chapter 13 bankruptcy is different in that it typically involves a 3 to 5 year repayment plan.

How much should you be in debt before filing bankruptcy?

There is no minimum amount of debt required to file bankruptcy. The question of how much debt someone has is important in deciding whether to file bankruptcy, but this should be taken in context with additional considerations such as income level and whether it can ultimately prove affordable to pay back debts. Alternative forms of debt relief that include debt settlement, debt consolidation and debt management plans should be investigated prior to making any decision to file bankruptcy, given the long-term consequences of doing so.

Can you file bankruptcy twice?

Yes, an individual may file bankruptcy twice – in fact there is no specified limit to the number of bankruptcies that someone can file during a lifetime – although there are restrictions involving how much time must elapse between successive filings.