Average Cost of College

What Was the Average Cost of College in 2018

It is no secret that the costs associated with completing a college education have become prohibitively expensive. In fact, most college tuition rates over the past twenty years have more than doubled – and in some instances – tripled!

Furthermore, tuition increases have grown at a rate more than triple the inflation rate in the overall economy over that period. While it is natural to think in terms of tuition and academic fees comprising the bulk of college-related expenses, it is also absolutely necessary to include substantial additional costs related to housing, meals, transportation, books, computers, and personal expenses.

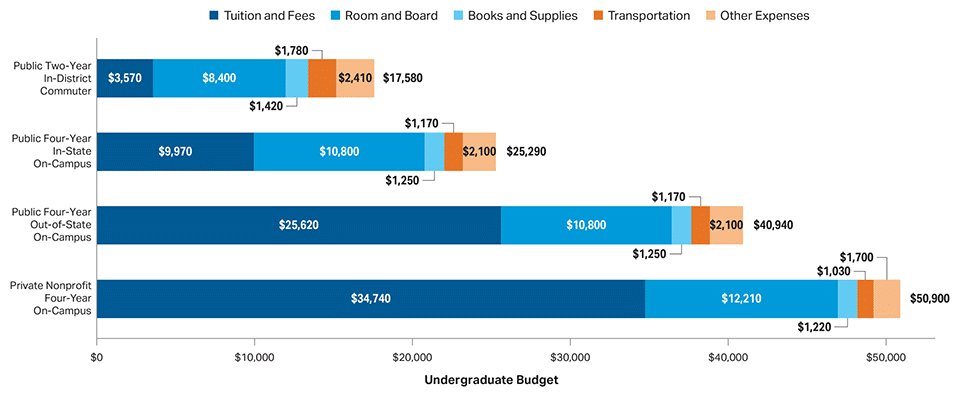

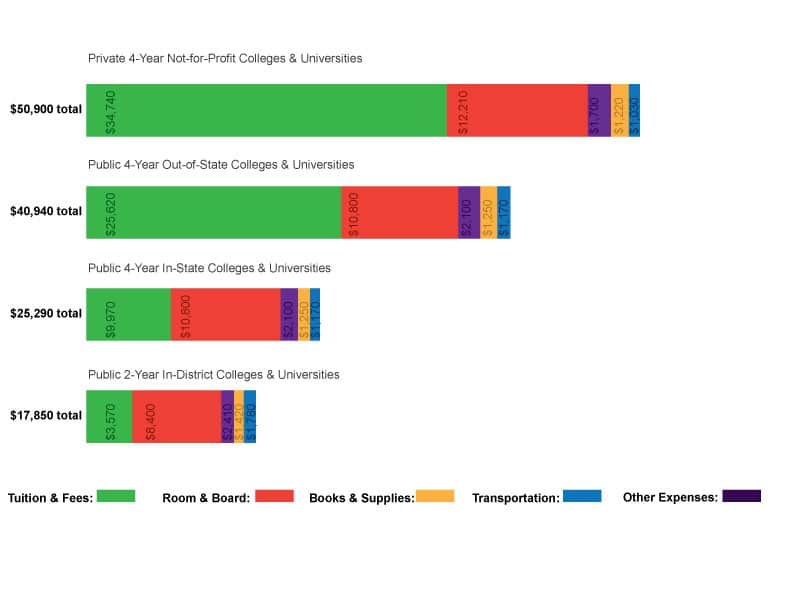

The College Board, in its most recent release of Trends in Higher Education breaks out these costs in statistical and graphical form in Average Estimated Undergraduate Budgets for the 2017-2018 academic year. Unfortunately, whether a student attends a state school or private college, participates in a 4-year or a 2-year program, and whichever the major chosen, the term “sticker shock” easily applies. Let’s take a closer look.

Sticker Shock!

For starters, the College Board reports that for 2017-2018, the cost of attending a public college – or a “state-school” – as an in-state resident, living on campus, in a 4-year program, averages out to $25,290. For one year. Meantime, the same exact educational experience at that same state school for an out-of-state resident living on campus averages out to $40,940.

Now, if that weren’t high enough, the average total cost for one year of a 4-year program at a private college or University runs even higher – coming in at a whopping $50,900. The silver lining? For those students who opt for a 2-year program at a state school and commute from off-campus housing, the average cost is lowest – yet it still weighs in at $17,580 per year. This begs the question – why are these numbers so high?

ABC

Tuition and Fees

Tuition is the actual rate that a school charges for classes and instruction on a per-credit basis per semester during the academic year. Fees are additional expenses that colleges charge for access to libraries, athletic facilities, on-campus transportation and functioning student government. Schools generally combine tuition and fees into one figure that varies by school, with the general practice that more prestigious private colleges charge more.

However, for in-state residents, tuition at a public college or University is often a relative bargain, checking in at $9,970 annually, and therefore, state schools represent a viable alternative to private colleges and Universities for in-state residents. Tuition for out-of-state residents attending the same public college averages out substantially higher at $25,620, though still lower than the average tuition level of $34,740 charged by private schools.

Meantime, average tuition and fees for a public 2-year program does check in at a relatively modest $3,570 per year. For all programs, tuition and fees do vary somewhat according to major, with students pursuing science, engineering and pre-med programs generally facing higher costs.

Room and Board

Following Tuition and Fees, the cost of housing and meals accounts for the next most significant contributor to the total cost of college. Room and board costs will vary considerably according to the geographic location of the school, as well as whether a student lives in a dormitory or in some form of off-campus housing, and whether a student participates in a meal plan or cooks at home.

However, the College Board still places these costs in the general range of $10,800 per year for a 4-year state school and $12,210 per year for a 4-year private college. Even the cost of room and board at a public 2-year program checks in at $8,400 per year – more than double the actual cost of tuition and fees at such a program.

Books, Computers, Transportation and Personal Expenses

The average cost of books, computers, software and related accessories checks in between $1,220-1,250 per year at a typical 4-year program, public or private school. Surprisingly, these costs are somewhat higher at public 2-year programs, coming in at an average of $1,420 per year. Meantime, the College Board estimates Transportation and Personal expenses of $3,270 per year at public schools and $2,730 per year at private colleges.

These numbers, however, may not be entirely comprehensive, as they omit gasoline and maintenance costs associated with keeping a car, as well as any round-trip out-of-state airline travel to and from school. Additionally, personal expenses such as cell phone bills, internet, laundry, and clothing should be taken into account.

Grants and Scholarships Can Help

Clearly, the cost of a college education is not to be taken lightly. The good news is that grants and scholarships are available to help reduce some of the overall cost of college. For example, even though the average annual cost of a 4-year private college came in at $50,900, on average, $20,090 of this amount was defrayed by grants and scholarships.

Similarly, the $40,940 and $25,290 average annual costs to out-of-state and in-state residents, respectively, attending a 4-year public college were reduced by an average of $7,060 in grants and scholarships. Finally, the $17,580 average annual cost of a public 2-year program was reduced by an average of $5,010 in grants and scholarships.

Are you in debt? we can help

Get Debt Relief

Connect with licensed debt specialists dedicated to supporting your long-term financial well-being.

Ready To Get Started?

See if you qualify for debt relief. Get A Free Savings Estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Debt Help Near Me

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Explore other blogs