Things You’re Wasting Money On

The expression, “A penny saved is a penny earned” is as true today as it was when originally penned in the mid-1700s by Benjamin Franklin in his annual Poor Richard’s Almanacks. This well known phrase implies that it is just as valuable to save money that one already has as it is to earn more.

It’s a simple enough saying – and one that many of us have ingrained in our memory since childhood. But, in order to preserve its meaning, maybe this oft-quoted American idiom should be severely updated for inflation – more like twenty dollars saved is twenty dollars earned – or “a hundred bucks saved is a hundred bucks earned.” Regardless, the point is clear – money held onto and not wasted is just as good as additional money earned.

But what of the negative habit of wasting money? We’re all guilty of it at different times in different ways – but just how commonplace is it? What are some of the things that people commonly waste money on? For many, this article could prove to be a real eye-opener and money saver! Let’s take a closer look.

Bank Fees

At the top of the list come bank fees. Not only do these not put any food on your table, they are incredibly unpalatable. Whether they take the form of ATM fees, monthly maintenance charges, overdraft fees – or anything else – the simple truth is that bank fees are to be avoided at any cost.

Look for a checking account at a consumer-friendly bank that does not seek to opportunistically levy fees in an attempt to pad corporate profits and appease shareholders.

If you have trouble keeping your accounts at minimum balance requirement levels, switch to a bank (offline or online) that doesn’t impose such restrictions. In the meantime, always keep track of your balance and scheduled automatic payment deductions that can inadvertently force maintenance and overdraft fees. And avoid using out-of-network ATMs that charge you for the privilege of accessing your own money!

ABC

Late Fees

Next up, let’s talk about late fees. Let’s face it – if paying a litany of monthly bills isn’t bad enough, stacking late fees on top of the pile only makes things worse. When it comes to late fees on credit cards, throwing away an extra $15-35 on top of any interest expense you’re already incurring from carrying a debt balance just doesn’t make any sense.

And that’s before any Penalty APR kicks in that can make your interest rate super ugly – and fast. Running late with a mortgage payment or rent can often involve a late fee that’s even larger – and it’s only a matter of time before the three major credit bureaus (Experian, Equifax and TransUnion) get wind of late payments and your credit score gets dinged.

If you’re rarely late on any bills, ask the creditor to waive the late fee and try to get the late payment designation removed from your credit report by contacting the appropriate credit bureau.

Even utility bills often stack on a late fee, and though your life isn’t likely to change if you accumulate library overdue charges, why start the habit of being late on any payments anywhere?

Credit Card Interest

This is a big one. With credit card interest rates frequently hovering at 14.9% or higher, and with the average for balance carrying households (41.2% of American households) checking in at $9,333 as of September 2019, it’s easy to see how a large percentage of American households could be wasting over $1,000 annually on credit card interest alone.

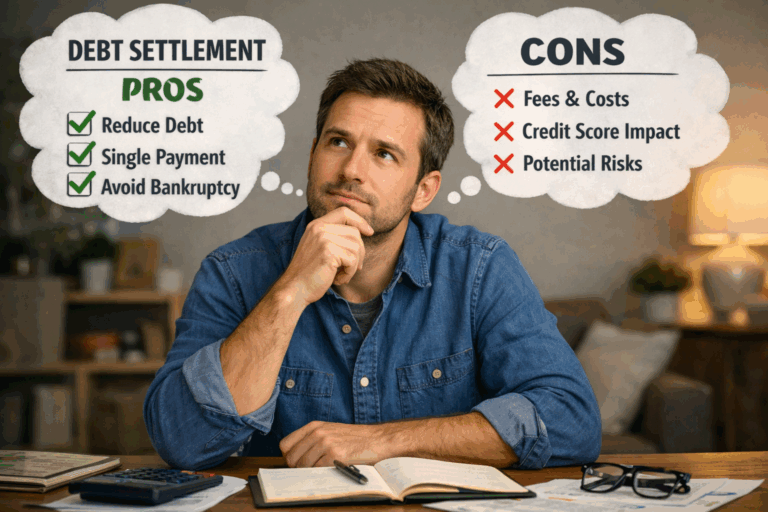

There are an abundance of resources on this website to consult in an effort to learn more about how to get out from under an onerous pile of credit card debt through debt settlement, a debt management plan or a debt consolidation loan, as well as approaches to paying off debt more rapidly and budgeting more effectively.

Before and after entering into any form of debt relief, it is important to have a properly constructed written monthly budget in place that can lead to financial well-being and peace of mind. Consult our experienced debt professionals here at United Settlement to discuss your specific financial situation and appropriate financial remedies that can get you out from under the insidious cycle of wasting money on credit card debt.

Poor Retirement Planning

Believe it or not, you could be leaving a lot of money on the table if you’re not taking full advantage of a 401K matching program that your employer could be offering.

Check with your employer’s human resources department to become fully aware of any retirement plan matching program, as approximately 25% of U.S. employees fail each year to fully invest in their employer’s matching program and wind up missing out on an average of $1,300 per year. Your future retired self will thank you.

Unclaimed Tax Deductions

Even though well over one trillion dollars of tax deductions were rightfully taken in 2018 by U.S. taxpayers, the fact remains that there are a multitude of deductions and credits that go unclaimed. For example, approximately 20% of taxpayers eligible for earned income tax credits fail to claim the credit on their 1040 when filing income taxes.

Making the wrong choice as to whether itemize or simply take the standard deduction when filing can also result in leaving money on the table. Although online tax programs can help taxpayers make the right decision while also highlighting additional eligible deductions, it is also often the case that engaging a tax professional can lead to greater savings – and less wasted money – that more than cover the cost.

Miscellaneous Food Items

Now this is a category with a number of villains. Starting with name-brand bottled water – there’s just little justification in paying up. Instead, invest in an in-home water filter pitcher and stop wasting money.

If you must buy bottled water, go with store brands only. Similarly, avoid name-brand groceries whenever possible – wasting money while contributing to a multi-national corporation’s advertising budget just isn’t necessary when similar generic store brands are readily available. Then there’s the matter of high-priced coffees.

Ditch the coffee shop habit for in-home K-cups or home brews for a fraction of the cost and watch your budget stretch. Next – watch that bulk grocery buying.

Though you think you may be saving by buying in bulk, if some of that food is going bad and ultimately winding up in the trash, then you are wasting money. What about convenience foods – things like pre-made salads, pre-cut vegetables and pre-sliced apples? How about just taking a knife out of the drawer and saving some money instead?

Restaurant Meals

No discussion of wasted money on food would be complete without mentioning restaurant visits. Dining out has become a way of life over the past fifteen years, but that doesn’t mean it should remain the overly expensive habit that it has become for so many. Instead, start enjoying the process of planning and preparing meals at home to enjoy with friends and family on a regular basis.

Keep dining out in reserve for when everyone needs a break from cooking or a little diversion from life’s routine. This can quickly turn into a noticeable money-saver. And let’s not forget mentioning ordering in delivery, which is just as expensive as dining out sometimes – only with the added expense of delivery thrown in.

Another money waster. And while we’re on the subject – let’s not forget lunch at work – spending a quick ten dollars on most days instead of packing a solid lunch from home quickly adds up to an extra hundred dollars or more that you’re wasting every month.

Other Miscellaneous Expenses

Finally, let’s take a look at other ways that you may be commonly wasting money. Remember – the point of this article isn’t to make you feel bad, but to awaken you to possibilities to save money that you are otherwise wasting. Let’s start with lottery tickets.

The odds are super long that you’re going to win the megabucks – and when you play every week, you’re throwing money down the tubes – only making your dream of financial independence that much further away. And when it comes to scratch-offs, you should know that the odds are built-in against you from the day those cards are printed. Bad idea.

What about that cable TV bill? Forget it already – cut the cord and get a subscription service or two to Netflix, Hulu and/or Amazon Prime. You won’t miss much – if anything – especially that overpriced cable bill of yours. How about that membership to the gym you don’t go to? Obvious enough – and even if you do exercise regularly, you may want to consider investing in quality in-home equipment that will save you money over the long-term.

When it comes to wasting money, these are all valid examples – and they’re not the only ones. I’m sure you may be able to think of some more on your own. So remember, as a final refrain – “a hundred bucks saved is a hundred bucks earned.”

About The Author: Steven Brachman

Steven Brachman is the lead content provider for UnitedSettlement.com. A graduate of the University of Michigan with a B.A. in Economics, Steven spent several years as a registered representative in the securities industry before moving on to equity research and trading. He is also an experienced test-prep professional and admissions consultant to aspiring graduate business school students. In his spare time, Steven enjoys writing, reading, travel, music and fantasy sports.

Debt Relief Reviews

Are you in debt? we can help

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs