Debt Advice

Debt can be a touchy subject for some. Though many people maintain a relatively manageable level of debt, many others do not. For those whom a high debt level has become a problem, denial and avoidance often set in. It is not uncommon for an individual with a high debt burden to allow it to gradually and insidiously worsen toward uncomfortable and stressful levels.

You’re Not Alone - 1 in 3 Adults Seek Debt Help

If you find yourself saddled by a high level of consumer debt, you’re certainly not alone. American consumers are participating in a debt binge, with aggregate levels of credit card debt hitting record levels and once again surpassing one trillion dollars, a figure scarcely seen since the days of the 2008 financial crisis. But if you think that sounds high, consider that total household debt (including mortgages and car loans) in the United States now approaches thirteen trillion dollars! To put that in perspective, China’s 2016 gross domestic product was $11.2 trillion. With stratospheric figures such as these, it comes as little surprise that most people are embarrassed to talk about their debt. However, ignoring the problem won’t make it go away. If you’ve got a debt problem, the time to start acting upon it is now. The good news is that there are several debt-relief paths you can take toward a solution. With proper planning, guidance and dedication, you can find a way out of debt.

ABC

Do You Have a Debt Problem?

If You Don’t, Stay There

If you’re lucky enough not to be toting around a bunch of debt, work hard to keep things that way. Putting aside a fixed percentage of your paycheck into a savings account on a regular basis is a great way to build an emergency fund and keep yourself out of trouble when unexpected events such as an illness or accident take place. You’ll reinforce sound spending habits while also enjoying the peace of mind and security that come with having a little money in the bank.

If You Do, Don't Pile It

The best way to ensure that you don’t build a pile of debt is to create a budget and stick to it. All a budget really implies is that you should have a clear and written account of your expenses as they relate to your regular monthly income. A budget is not designed to take the fun out of life. Rather, a budget can provide you with a sense of control over your money and keep you out of trouble. Simply having a clear handle on the level of your necessary expenses – housing, transportation, food, utilities, cell phone and so forth can go a long way toward establishing a solid financial foundation. If you have a credit card, try to keep it in reserve for emergencies or special situations, but not extravagances. On those occasions when you do run up a credit balance, pay your bill on time and for more than the minimum, and monitor your credit cards for interest rate movements. It’s never a bad idea to only buy things that you can purchase with cash out of your pocket, or directly with your debit card. Notice -that’s debit card – not credit card.

But Isn't it Ok to Take on Some Debt?

Some debts are worse than others. It may often be the case that debts associated with long-term purchases such as a house, college education or a car can make sense. For many of us, it simply wouldn’t be possible to buy a house without taking out a mortgage. Fair enough. Similarly, student loans can fall into the category of a necessary and useful loan. However, credit card debt often doesn’t fall into this same category. Many credit card expenditures can simply be avoided altogether, as these typically aren’t for necessities. When you find yourself ringing up credit card purchases for restaurant meals, entertainment, sporting events and other fun activities, it doesn’t necessarily mean you have a debt problem. But if you keep spending and making only minimum payments on your credit cards, then you’re certainly planting the seeds for an eventual debt problem.

How Do I Know if I Have a Debt Problem?

The level of debt that anyone takes on should be a direct function of that individual’s income and ability to pay. Ultimately, if you’re uncomfortable with your current debt level, that’s a symptom of a problem. But it’s not the only one. In fact, many people with excruciatingly high levels of unsecured debt aren’t actually as uncomfortable as they should be, because they’ve been engaging in an unhealthy amount of denial and avoidance for an awfully long time. So, in that sense, if you’re feeling a little bit uncomfortable, it’s a good thing. It implies that you’re mindful of your present situation and would probably be less likely to allow things to get out of hand from here.

There are some practical questions that you can ask yourself. First of all, are you able to pay all of your bills in a timely manner? After taking care of necessary household expenses such as rent, food, utilities and transportation, is the majority of your remaining disposable income being utilized to pay off credit card bills? Have you been paying only the minimums, because that’s all you can afford? Are you more likely to use a credit card instead of your debit card for groceries and other necessities? Are you consistently unable to deposit any money into a savings account at the end of the month?

Consider this: even if you haven’t been late on your credit card accounts and haven’t been receiving regular calls from collection agencies, if you’re answering yes to any of the above questions, you still very well may have a debt problem to address.

Where Do I Go from Here?

Best debt strategies to help get you out of debt

- Credit Counseling: If you think you may have a debt problem, the best place to start is with a credit counseling agency who can help you get your finances under control. In an initial 30-45 minute phone interview session, the counselor will ask questions relative to your income, expenses and debts, and can tailor solutions specific for your situation.

- Debt Management: Among the more common solutions considered is the Debt Management Plan (DMP), which involves streamlining multiple credit card payments into one simple monthly payment to the counseling agency. Included in the advantages of enrolling in a DMP are lower interest rates and a lower overall monthly payment. Read more about DMPs here.

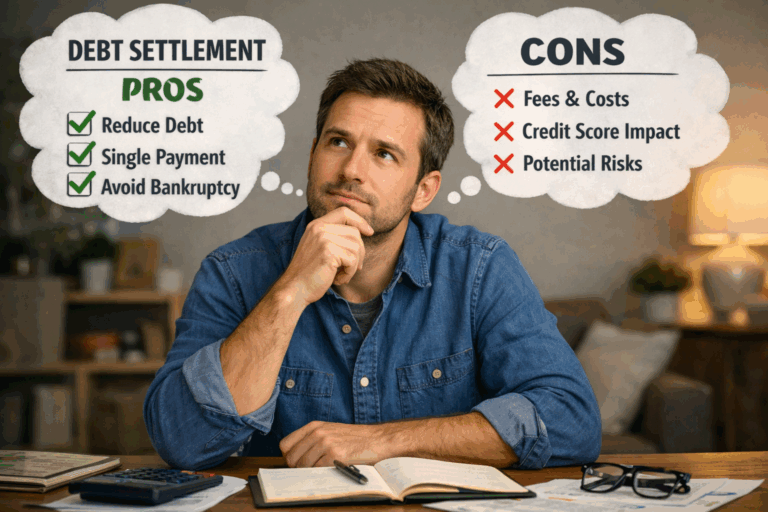

- Debt Settlement: If you’re already delinquent on some of your credit card accounts, Debt Settlement may be the best option for you, as it can result in creditors accepting lower balance payoffs. Read more about debt settlement here.

- Debt Consolidation: Another solution to your debt problem could involve a Debt Consolidation and debt consolidation loan, which is utilized to pay off all your creditors and typically results in an overall lower interest rate and monthly payment. You can read about debt consolidation and deb consolidation loans here.

- Bankruptcy: Even with its long-term stain on your credit report, may offer the best solution for your specific situation. Read more about bankruptcy here.

- Do Nothing: A final option is to do nothing and remain in denial and avoidance. This is unadvisable, as the best solution to any problem is to take steps to solve it. However, if you have little income, assets or prospects, and are willing to put up with the relentless pursuit of collectors, any court-ordered judgments issued against you could prove fruitless.

You Can Resolve Your Debt Problem

Regardless of whether you’re deeply in debt or not, take stock of your current financial situation. Develop and maintain a budget that provides you with a sense of financial control and a foundation for financial wellness. If you don’t have a debt problem now, just keep it that way. Don’t overspend, don’t fall in love with your credit cards, and when you do ring up charges, pay off your credit card debt quickly. However, make sure you’re being honest with yourself. If you do have the beginnings of a debt problem, or worse, then get the right kind of help.

Swallow your pride and remind yourself that working alongside skilled professionals who understand the territory and have escorted many others down the road to a debt-free lifestyle is in your long-term interest. Rather than being forced to pay off high-interest rate credit cards and other forms of onerous debt indefinitely, you’ll be on the right track toward resolving your debt problem for good. Now, isn’t that something to feel hopeful about? Learn how to get out of debt and how to deal with debt management.

Are you in debt? we can help

Get Debt Relief

Speak with licensed debt specialists dedicated to guiding you toward financial stability every step of the way.

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.

Explore other blogs