Unsecured Vs Secured Loans

What’s The Difference?

There are two primary categories into which loans can be divided – unsecured loans and secured loans. In the case of unsecured loans – of which the most common types are credit card debt, student loans and personal loans – the amount borrowed is not backed by collateral that can potentially be seized in the event of non-payment by the debtor. In contrast, secured loans – the most common types being home mortgages and auto loans – are backed by collateral that can be seized (and sold) by the creditor in the event of non-payment by the borrower.

Because secured loans are backed by collateral, they are naturally more appealing to a creditor, who generally will loan larger amounts at lower interest rates and more favorable terms than are offered with an unsecured loan. Additionally, it’s important to know that even though a lender can repossess a home or car in the event of non-payment of a secured loan, the debtor may still owe money to the creditor in the event that proceeds raised through the sale of seized collateral are less than the balance remaining on the loan. Let’s take a closer look at the broad landscape of unsecured and secured loans.

The Most Common Unsecured Loan - Credit Cards

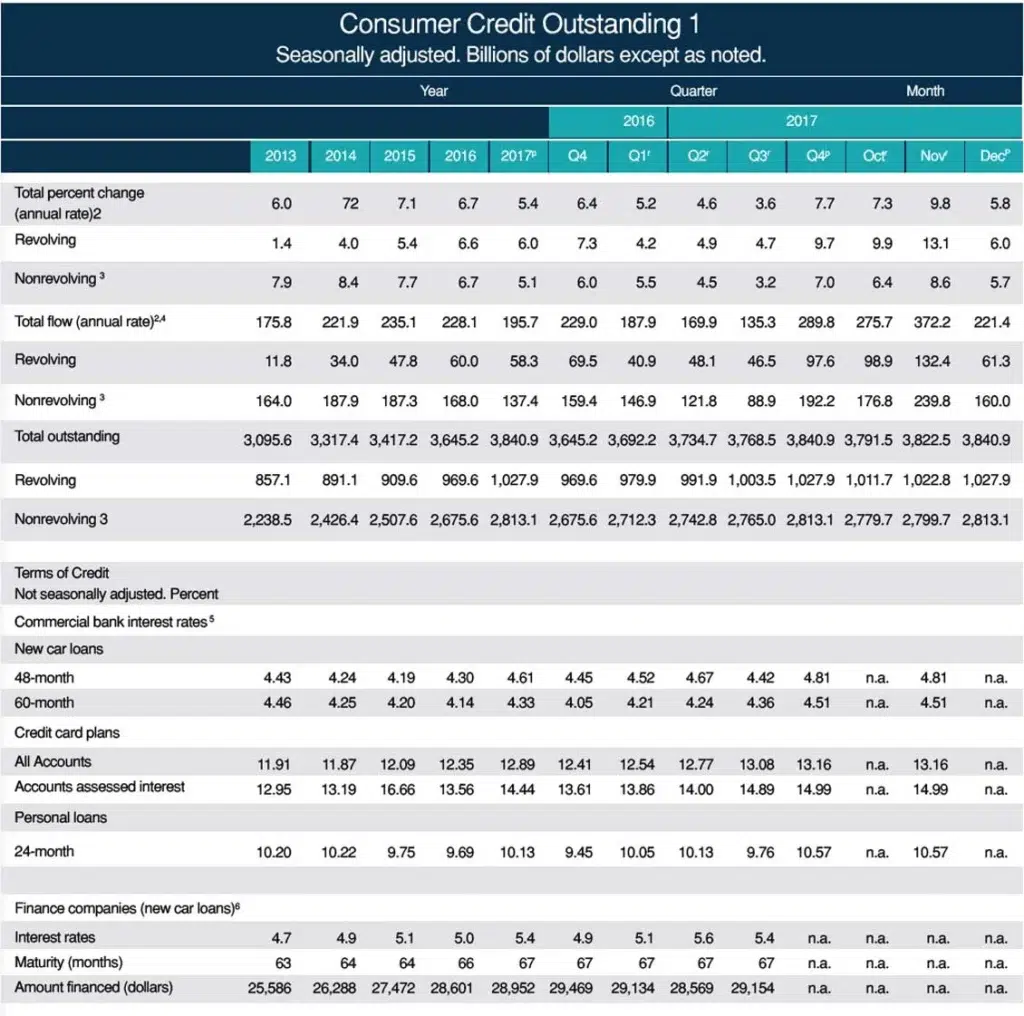

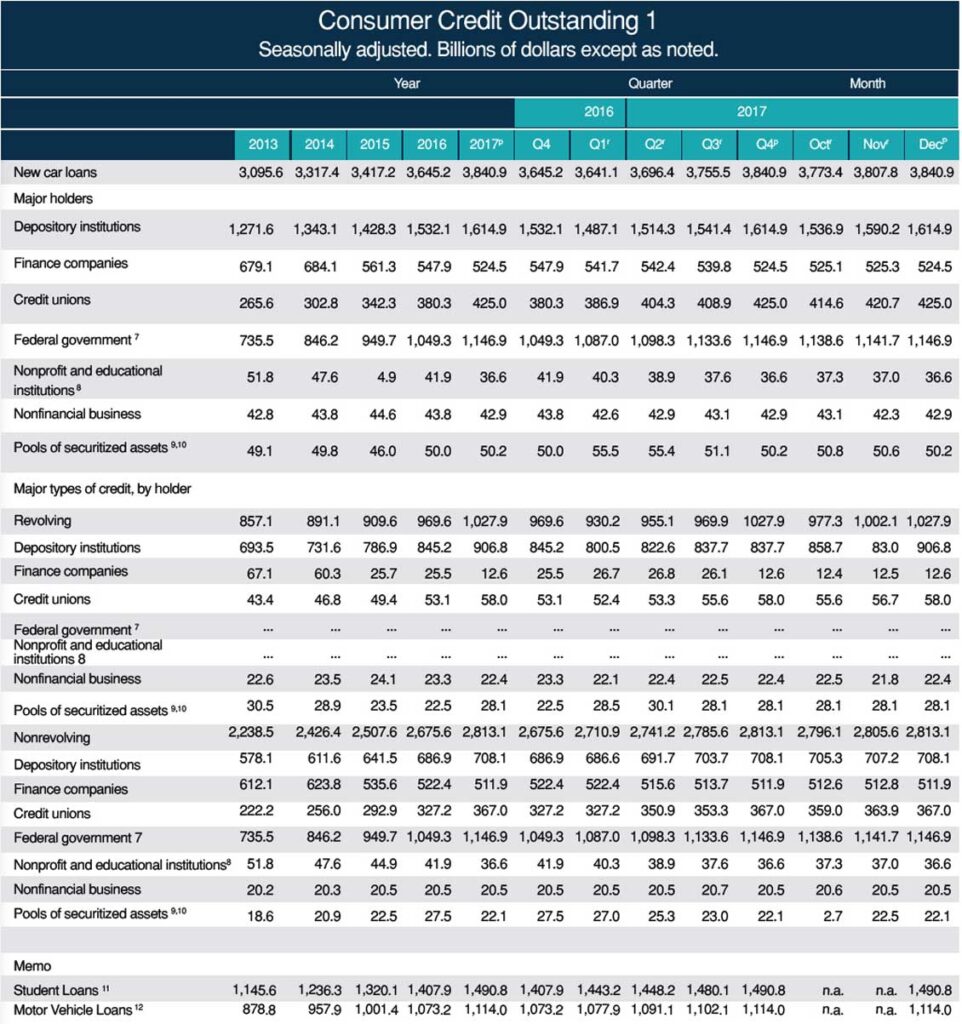

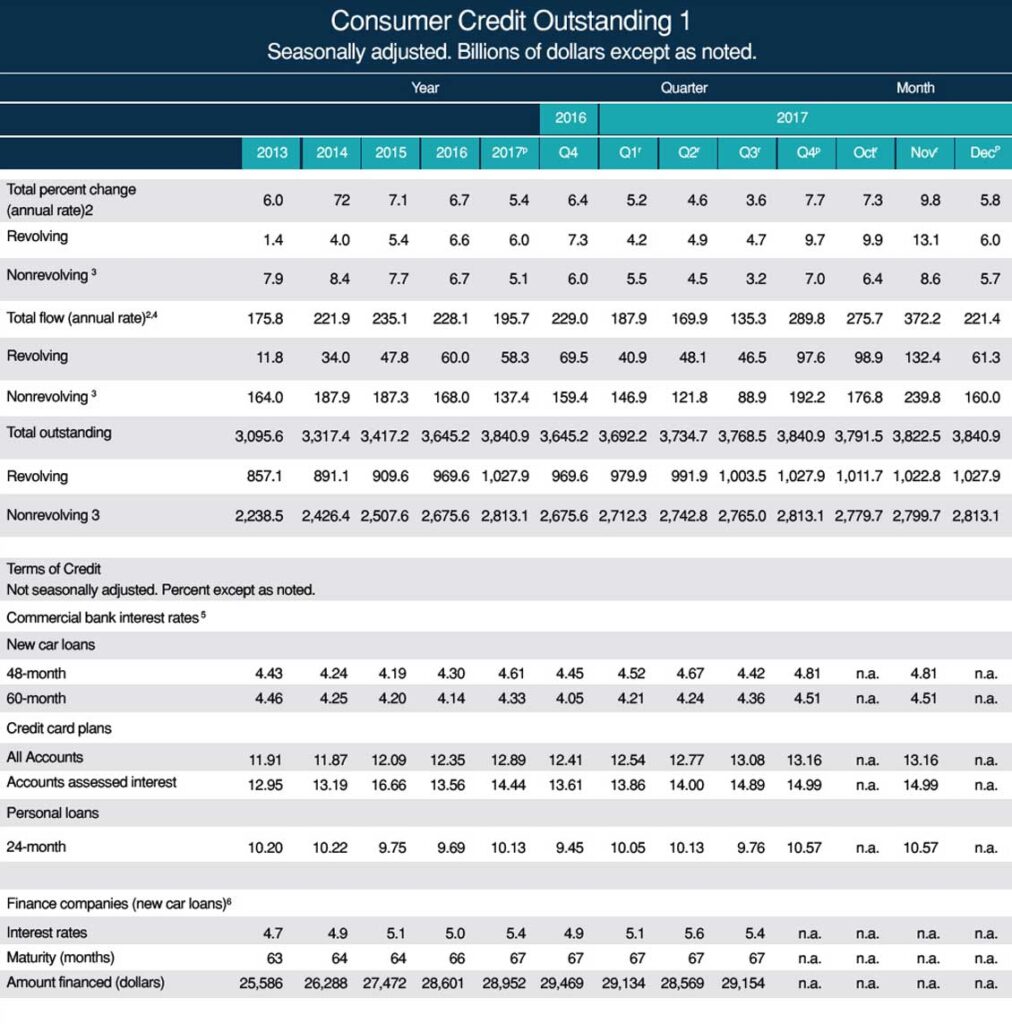

The most common type of unsecured loan is credit card debt, and it has become a way of life for a significant percentage of the American population. As of September 2017, 38% of American households carried some form of credit card debt, with balance-carrying households averaging a credit card debt level exceeding $16,000.

The relative ease of gaining approval for a credit card, along with the American consumer’s appetite for spending has driven aggregate credit card debt to stratospheric levels. Indeed, according to the Federal Reserve, at the end of 2018, total revolving debt in the United States stood just shy of 1.03 trillion dollars.

Student Loans

Begin by choosing a reputable counseling agency staffed with certified counselors who are trained in debt management. Be prepared to discuss specifics related to your income and expenses. In other words, know exactly how much money you have left over at the end of the month after accounting for basic necessities such as rent, food, transportation, utility bills, etc. You should also be able to discuss a clear picture of your unsecured debt situation. Therefore, you should know exactly how much you owe on all of your individual credit cards, their respective interest rates and minimum monthly payments, as well as any outstanding medical bills and other personal financial obligations. These debts will all be discussed in an interview with your credit counselor, who will refer to your credit report to verify that all of the information you provide is accurate.

A reputable credit counselor will make recommendations related to controlling your expenses and enhancing income while also offering free educational materials that can further get you on the right track financially. After evaluating your situation, the counselor can offer you a debt management plan that includes a reduction of interest rates and monthly payments on your unsecured debts – subject to the acceptance of your creditors. If you agree to enroll, the duration of the payment schedule will generally be between 36 and 60 months. Most counseling agencies charge a one-time enrollment fee and regular monthly fees of approximately $50 per month for services related to a DMP.

Personal Loans

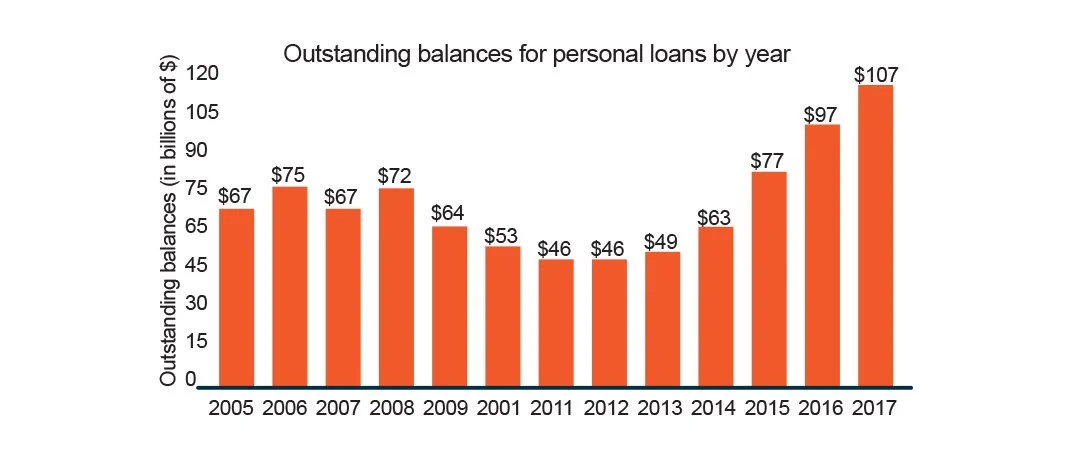

A third common type of unsecured loan is the personal loan – also known as the consumer loan or installment loan. Personal Loans can be used for any purpose that the borrower wishes, and they include a fixed installment payment schedule over a specified period of time. From an industry standpoint, following a period of double-digit annual percentage growth from mid-2013 through the present, the aggregate value of unsecured personal loan obligations at year-end 2017 stood at $107 billion.

This figure is notably lower than that of aggregate credit card debt, as the personal loan review process conducted by banks, credit unions and online lenders remains difficult for borrowers and often results in high interest rates and unappealing terms. However, if a borrower does possess a strong credit profile, high income level, and relatively low debt level, the flexibility that a personal loan provides can be worth the somewhat arduous application process.

Mortgages - The Big-Ticket Secured Loan

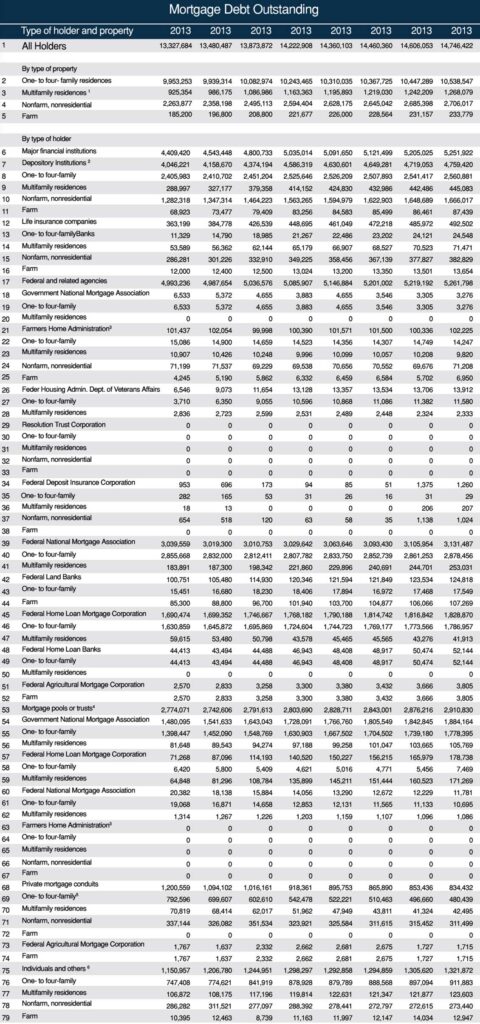

Mortgages are designed to meet the need of what will usually be the biggest-ticket item that an individual may make in a lifetime. Very few people possess the liquid cash reserves required to purchase a home without a need to borrow, and mortgages address that need. Mortgages can last for up to thirty years, and because of their long duration and the fact that they are secured by the underlying physical property, they often come with lower interest rates attached. However – make no mistake – mortgages are a secured loan.

This means that if a borrower becomes delinquent on making ongoing mortgage payments, the true owner of the property title or deed – the bank or finance company – can eventually seize possession of the property. As one might expect, mortgage lending is a huge business, with aggregate U.S. mortgage debt exceeding $14.7 trillion at the end of Q3 2017

Auto Loans

Auto loans are another form of secured debt, in this case tied to the car for which the loan was written. Auto loans typically last in duration from five to seven years and are issued by car dealerships, banks and credit unions.

A borrower’s credit score and profile will play a significant part in determining the interest rate charged, and it is the case that dealership loans – though often more convenient than auto loans secured with a bank – often come with higher interest rates attached. From an industry standpoint, auto loans are big business in the U.S., with an aggregate debt level of $1.11 trillion as of December 2017.

Home Equity Loans

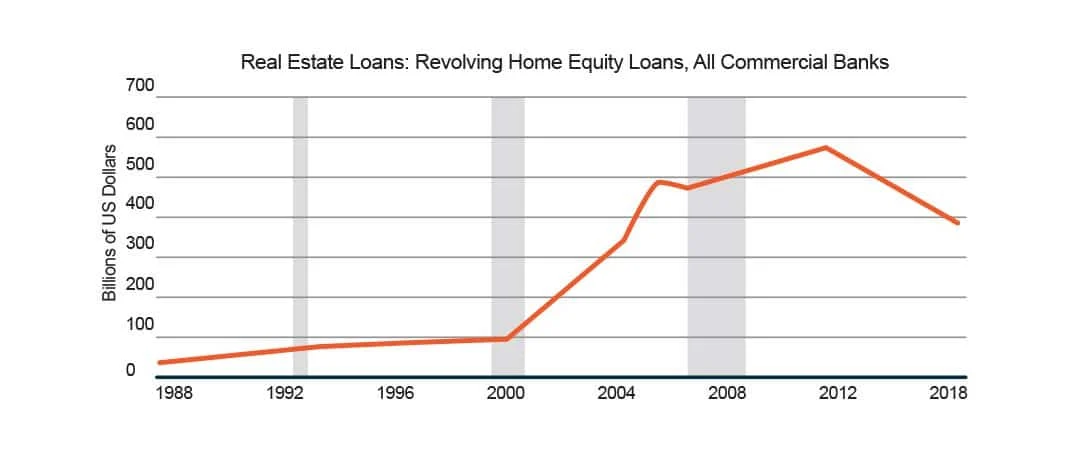

Home Equity Loans are secured loans available to those who have accumulated equity in their house – meaning they owe less on a mortgage than the actual value of the dwelling. Just as in the case of a mortgage, the underlying property is staked as collateral, and these secured loans frequently come with lower interest rates and more favorable terms as a result. According to the St. Louis Fed, the aggregate amount of home equity loans outstanding as of January 2018 exceeded 375 billion dollars.

The Big Picture

Remember, because unsecured loans are not backed by any collateral, creditors will make lending decisions primarily on a potential borrower’s ability to re-pay as illustrated by the borrower’s credit score and profile. Compared to secured loans, borrowers should anticipate higher interest rates at less favorable terms and lower borrowing limits with unsecured loans.

However, in the case of secured loans, it’s very important for a debtor to realize that the collateral that backs the loan is vulnerable to seizure and sale in the event of non-payment of the debt. It is this security of knowing that collateral can be seized by the lender that allows creditors to offer lower interest rates and more favorable terms with secured loans.

Credit Card Debt Relief Reviews

Get Debt Relief

Connect with licensed debt specialists dedicated to supporting your long-term financial well-being.

Ready To Get Started?

See if you qualify for debt relief. Get A Free Savings Estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our team comprises seasoned experts who have successfully navigated countless clients towards a debt-free life.

Customized Solutions

We understand that every financial situation is unique. That’s why we craft bespoke debt relief plans tailored to your specific needs.

High Success Rate

Our track record speaks for itself. Our effective strategies and dedicated approach ensure tangible results.

Confidential Consultation

Your privacy is paramount. Rest assured, our consultations are carried out with the utmost discretion and confidentiality.

Explore other blogs