Have you ever heard the common phrase – you have to have money to make money? The reverse of this phrase is also true – it costs money to not have money. If you’re feeling confused about these statements, then there’s a good chance that you’ve never learned about compounding interest and how it can impact your wallet.

Regardless of your current financial situation, understanding compounding interest and how it works can be a game changer for you. So, how does compounding interest work? And, maybe more importantly, how can compounding interest change your financial situation?

Learn everything you need to know about compounding interest and how it works below.

What is Compound Interest?

Compound Interest is an important concept to understand. Over time, it can make the difference between generating wealth or merely treading water financially.

When you borrow or loan money, there’s often an interest rate attached to that money. For borrowers, that means you’ll be paying an interest ‘fee’ for borrowing the money. For savers, that means you’ll earn interest simply for keeping your money in a savings or investment account.

With simple interest, your fee or savings is calculated based on a percentage of the original (principal) amount of money.

So, how does compounding work? With compound interest, your earned interest or interest fees are added onto your principal balance, which results in even more fees or earned interest. In other words, either your savings or fees are ‘compounded’ and increased at different time intervals.

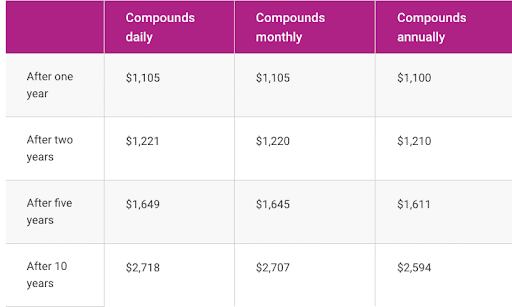

You might wonder — how often does interest compound? Interest can compound at an annual, monthly, daily, or even continuous rate. This time interval should be outlined in the contract you agree to when you either open your investment account or borrow money. As you’d expect, the shorter time in between intervals means the fees or interest payments will compound and increase more often.

What does it mean for money to compound annually, exactly? This means that once a year, all your unpaid interest will get added to your principal balance amount.

The Formula For Compound Interest

Let’s break down the formula for compound interest:

A = P(1+r/n)^nt

In this formula, A is the total amount you will end up with at the end of the time period. P is the principal, or the starting amount. R is your annual interest rate, while n is the rate in which your interest compounds each year. T is defined as the total number of years.

As an example, let’s say you put a principal amount of $10,000 into a savings account with an interest rate of 5% a year. If your interest compounds once a year, then the formula to calculate your overall amount after a year would look like this: $10,000(1+(.05/1)^(1 x 1) = $10,500. Let’s take a look at the various earning levels based on how often your interest compounds.

Following the formula above, we would see:

| Year 1: | (Daily) $10,513 | (Monthly) $10,512 | (Annually) $10,500 |

| Year 2: | (Daily) $11,052 | (Monthly) $11,050 | (Annually) $11,025 |

| Year 5: | (Daily) $12,840 | (Monthly) $12,834 | (Annually) $12,763 |

| Year 10: | (Daily) $16,487 | (Monthly) $16,470 | (Annually) $16,289 |

Let’s take a hypothetical example of $10,000 in a savings account that earns interest at 5% a year. (Not a real-world example as of December 2018) The simple interest income generated after one year would amount to $500.

However, in year two, compounding begins, as the first year of interest income brings the new account balance to $10,500, which is still earning 5% interest per year, and this results in interest income of $525 in the second year. The extra $25 in interest income that second year may not sound like much, but the principle of compound interest has now been activated, and with each passing year, the compounding increases. All of the interest income that was generated in previous years continues to earn 5%, and the cycle of wealth generation is in motion.

Advantages of Compound Interest

With compound interest, time is on your side. If at all possible, begin the process of depositing into a savings account at an early age and have a long-term view. Understand that compounding starts slowly, but that positive momentum becomes inevitable. Making money through the principle of compound interest can become a form of passive income that pays dividends throughout a lifetime.

Compounding interest is a huge advantage for consumers with savings or investment accounts. With a hefty initial investment, consumers can make huge returns with compounding interest. In fact, many of the wealthiest Americans use this type of compounding interest strategy to build a form of passive income. Here’s an overview of the advantages to expect:

Time is on your side

You make a passive income

Snowballing means you can earn dividends throughout your life without re-investing

Higher interest rates are on the way

Though a low interest rate environment has persisted in the United States since the days of the financial crisis, this hasn’t always been the case historically and likely won’t always be the case in the future. Banks advertise interest rates as APYs (annual percentage yields) that take into consideration the principle of compound interest and are therefore somewhat higher than the stated annual interest rate.

Compound Interest and Debt

Just as compounding interest can provide magical returns on savings and investment accounts, it can create disaster nightmare scenarios for debtors. If a borrower takes on more debt than they can pay off before the compounding period, then they’ll likely accumulate a massive balance once that interest rate hits. This will inevitably cause you to have a greater balance to pay off, but it won’t stop even more interest from compounding on the even bigger debt!

As you can imagine, this can lead to a devastating cycle where you can never reduce the debt you owe.

The only way out of this type of debt situation is to pay off big lump sums as soon as you can.

For those already burdened with high debt levels, it can make sense to pursue debt consolidation or a debt management plan to achieve a lower blended interest rate that will reduce the negative effects that result from compound interest expense on existing debt.

Other Things to Know About Compound Interest

Obviously, if you’re stuck in a debt trap cycle like the one described above, then you likely don’t have the money to pay off huge lump sums on your loan. If that’s the case, then understand that you have other options. It might make sense in your situation to consider debt consolidation or a debt management plan. If you’d like to learn more about these options, then consider reaching out to our debt experts.

If you’re ever asked to explain how compound interest works, then don’t fail to mention the importance of how often the compounding will happen. This massive factor makes a huge difference in how much you can earn or how much you’ll get charged.

The principle of compound interest is completely unaffected by the amount of money invested. When two different accounts start with $100 and $10,000, the percentages earned on either initial deposit are of identical proportion over time, assuming the two accounts are earning the same annual percentage yield. However, pay attention to the frequency of compounding – in other words, how often does the account compound? Savings accounts and CDs that calculate the compounding daily – as opposed to monthly or annually – will earn interest income faster – so look for this when opening an account. Unfortunately, in the case of credit cards, it isn’t too difficult to find those that do compound daily – they are very common. Understand that in either instance, daily compounding does not imply that the full interest rate is earned each day, but rather, 1/365 of what would be the annual simple interest earned (or charged) on the existing balance is added each day.

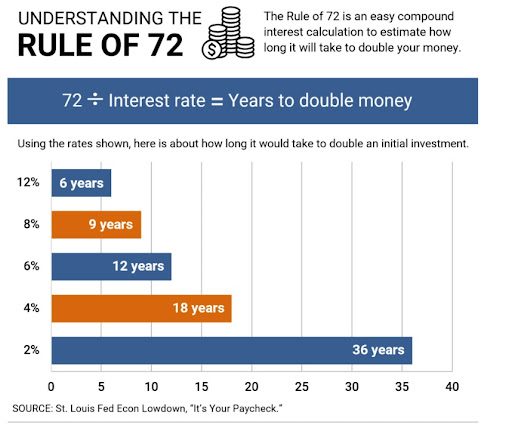

The Rule of 72

The rule of 72 is often used to calculate how many years it will take for money to double through compound interest. If you’re currently taking advantage of compounding interest in a savings account, then this rule can help you determine how long it will take for your money to double.

Simply divide 72 by your specific interest rate. For instance, if your interest rate is 5%, then you’ll want to calculate 72/5 = 14.4. So, it will take about 14 and a half years for your original principal balance to double.

For example, an interest rate of 9% will lead to a balance doubling in eight years, since 72 divided by 9 is eight. Similarly, an interest rate of 6% will double a balance in twelve years, since 72 divided by 6 is twelve. For other calculations designed to illustrate the power of compound interest, it can be useful to practice with an online compound interest calculator.

How Does Compound Interest Work?

So, how does compound interest work? In a nutshell, compounding interest builds upon your existing financial situation. If you’re saving or investing, then that money is propelled forward with a lot of growth. If you’re borrowing money, then the debt you owe is also growing exponentially.

The sad news is that compounding interest can be your worst enemy if you fall into a financially difficult situation and you’ve borrowed money. Getting out of debt can be complicated and complex, but we’re here to help. Contact us now to get in touch with our debt experts about your situation. Together, we’ll come up with a debt relief solution that works for you.

Gabriel Gorelik paves the way for customer service and operations at United Settlement. He is passionate about numbers and holds a strong belief in helping anyone with their debt. Before United Settlement, Gabriel received his BS in Finance & Economics from Brooklyn College. After graduation, Gabriel went on to build his first financial services company where he managed thousands of accounts for business and consumer clients. He understands the importance of client satisfaction, professionalism, and exceeding expectations.