Business Debt Relief Services

Running a business while managing growing debt can strain cash flow, operations and long-term stability. United Settlement provides business debt relief services designed to help business owners address unsecured business debt through structured, performance-based solutions. The focus remains on reducing balances, reorganizing obligations and helping businesses regain financial control without unnecessary disruption.

We work with small business owners, self-employed professionals, and entrepreneurs facing mounting financial pressure. Each business debt relief program is tailored to the specific debt types, creditor structures and financial circumstances involved.

Benefits of Business Debt Relief

Reduce Your Debt

Shrink your debt and grow your savings with United Debt Settlement. We’re your partners in chipping away at those towering credit card balances.

Avoid Bankruptcy

Steer clear of bankruptcy’s shadow with proactive debt management. Our experts craft escape routes that protect your credit and your peace of mind.

Financial Freedom

Step into a life free from debt. Our tailored strategies are your blueprint to a future where your finances are yours to enjoy, not owe.

How Does It Work?

Our Business Debt Relief Process

Our business debt relief plan follows a clear and transparent process focused on results and accountability:

- The process of debt relief for businesses begins with a confidential review of business debt, including balances, creditor types, payment history and current financial strain.

- United Settlement evaluates whether debt relief for businesses may be an appropriate option.

- A customized strategy is then developed to address outstanding obligations while supporting continued business operations.

- Once enrolled, the team works directly with creditors to pursue negotiated resolutions.

- Progress is tracked through a secure client portal, providing visibility into developments and next steps.

Fees are assessed only after successful debt settlements are achieved, consistent with a performance-based structure.

When to Get Business Debt Relief?

Business owners often explore small business debt relief when debt begins to interfere with daily operations or long-term planning. Common indicators include falling behind on payments, relying on credit to cover operating expenses or facing increased pressure from creditors.

Debt relief may also be considered when interest, fees, or short-term repayment structures limit cash flow and prevent reinvestment into the business. Addressing debt concerns early may expand available relief options and help reduce the impact of unresolved obligations on business operations.

Business Debt Consolidation Loans

Your business may qualify for a debt consolidation loan from a nonprofit organization such as: The small business association. This type of loan is generally low interest which is more affordable. The qualification for this type of loan is difficult and time consuming. If you do not qualify and/or do not have the time to apply using collateral can help you get a loan quicker. This could be a great option although is a major risk because you can lose assets.

Debt consolidation loans pay off original creditors and put all your obligations in one monthly payment. In addition debt consolidation loans save you money on the interest and in many terms roll out the payback to a longer period to significantly increase operating cash flow. The flip side to debt consolidation is it may take up to five years to pay in full. For the duration of the loan the lenders will accrue interests at above prime rates. The compounding interest limits the amount you can save with this form of business debt relief.

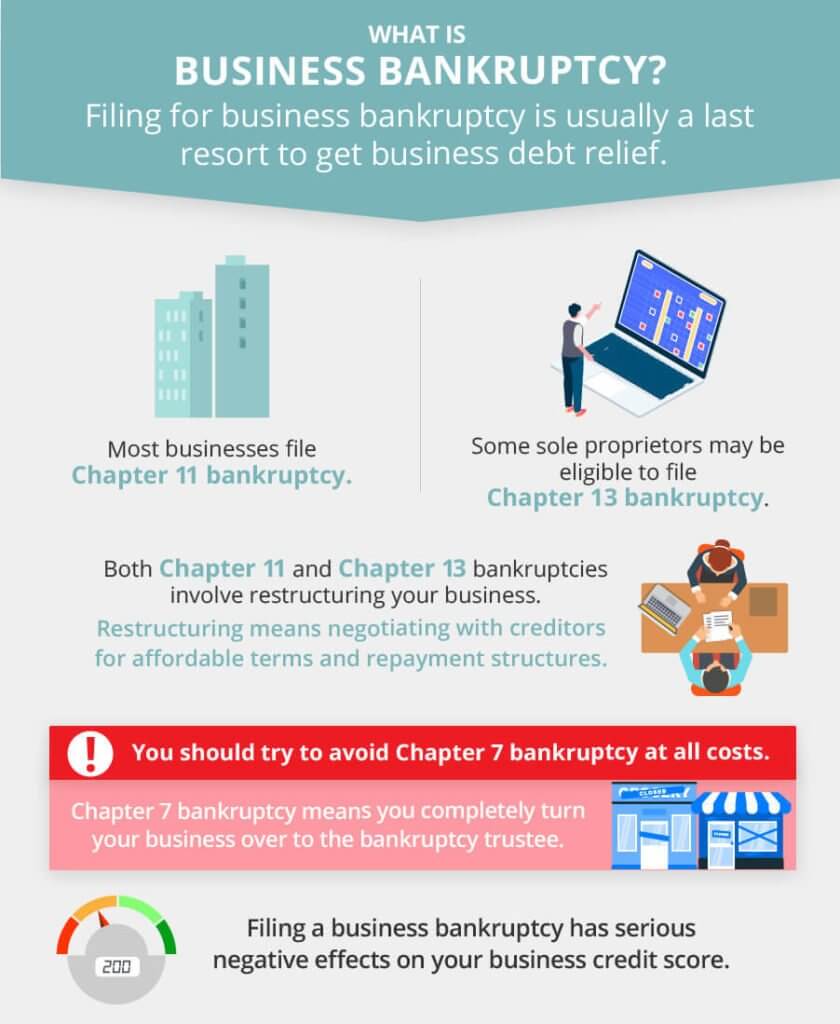

Business Bankruptcy

If you have already explored all alternative options and decided you have to go through with business bankruptcy, you’re not alone. Thousands of businesses are forced to declare bankruptcy annually. There are many reasons to continue the fight especially the cost and time of filing, although there is no shame in pulling the trigger in fact it could be the best decision for your business.

The flip side to filing for bankruptcy is the negative impact it has on your business credit score. Even if your restructuring is complete the file stays on your business credit report. This will hurt your business when you apply for new financing in the future.

A Realistic Alternative to Bankruptcy

Your business debt may qualify for relief through debt settlement. Eligible debts may include personal credit cards used for business expenses, unsecured business loans, merchant cash advances, and more. The debt settlement process has qualities of business restructuring but will likely have a greater impact on the savings amount. Every case is unique, although you may be eligible to reduce a significant portion of your business debt. If you qualify you can get out of debt in as soon as 24-48 months, reduce your payments, and have the least impact on your credit score.

As a business owner you have important decisions to make every day, with business debt relief you have many options such as: business debt consolidation, bankruptcy, debt management, debt settlement and more. Before choosing which is best for you, do your due-diligence as this decision will be present in the long game, think of this as a marathon, not a sprint.

Your Options for Business Debt Relief

There are several approaches to business debt relief, depending on the type and amount of debt as well as the business’s financial goals.

Negotiation and restructuring may help reduce balances on eligible unsecured business debts. In some cases, consolidating multiple obligations into a single payment structure may offer a more manageable solution. United Settlement also assists businesses facing merchant cash advance challenges by helping restructure restrictive repayment terms that may limit growth.

The role of United Settlement is to evaluate available options and recommend a business debt relief plan aligned with financial capacity and long-term viability.

How Will Debt Relief Help Your Business

Effective debt relief for businesses can provide meaningful financial breathing room. By reducing balances or restructuring repayment terms, companies may improve cash flow and stabilize monthly obligations. This can help redirect resources toward payroll, inventory or operational expenses.

Business debt relief services aim to reduce financial pressure while supporting ongoing operations. Results vary based on individual circumstances. United Settlement also offers personal debt relief services for business owners managing overlapping financial obligations.

Why United Settlement for Debt Relief

When comparing business debt relief companies, United Settlement stands apart through a focus on performance-based solutions and client advocacy. The team includes licensed professionals with experience negotiating business-related debt across multiple industries.

United Settlement offers transparent fee structures, personalized strategies and a no-settlement, no-fee guarantee. With experience helping thousands of clients address personal and business debt, the firm emphasizes clarity, accountability and realistic outcomes.

Education Center

Credit Cards And Your Credit

Business Debt Relief FAQ

Eligible business debts may include unsecured obligations such as credit lines, vendor balances, certain loans and merchant cash advances. Eligibility depends on creditor policies and financial circumstances.

Timelines for debt relief vary based on debt type, creditor response and program structure. Business debt relief programs often span several months rather than providing an immediate resolution.

In general, when one spouse incurs a business debt, the other spouse is not liable for that debt, unless there has been an instance of co-signing or guaranteeing the debt. Additionally, a spouse can be liable for the other spouse’s business debt when a business is jointly owned as a general partnership.

Whether an individual will be held personally liable for business debts depends upon the business structure and how it was formed. In general, a sole proprietor will be held liable for business debts, as will most partners within a general partnership. In contrast, the purpose of a corporate structure, such as an LLC, is to shield those with an ownership interest from personal liability.

Business debts typically do not affect personal credit, as they do not show up on personal credit reports. Business credit is generally separate from personal credit.

Limited Liability Corporations, or LLCs, are designed as separate legal entities from their owners, and as such, the financial doings of the LLC and the individual owner behind it are considered legally separate. This means that owners cannot be held personally liable for business debts, and that the business cannot be held liable for the owner’s personal debts. Therefore, an LLC’s business bank account cannot be garnished for any personal debt, except in rare instances when the LLC structure is abused – when personal funds have been commingled with business funds. In these instances, a court may “pierce the corporate veil” and deny the limited liability corporation protection that would have otherwise been in place, and the business bank account could be garnished for personal debt.

Business bad debt can be deducted on a Form 1040 in the miscellaneous expenses box.

A business with debt can be harder to sell, so the first possibility is for the owner to attempt to pay down the debt prior to facilitating a sale of the business. Absent that possibility, a debt pay-off contingency could be included in the sale of the business, and this requires proceeds from the sale to pay off debts related to the business that is changing hands. A third option is to have the buyer assume the debts, but if the selling business owner is the personal guarantor on these debt, the assignment cannot be transferred to the buyer. In these instances, a creditor may still pursue collection from the selling business owner if the new owner does not pay off the debts as promised and the creditor does not release the previous business owner as guarantor on the debt.

Debt forgiveness is not guaranteed. Some businesses may be able to lower balances through negotiation, while others may benefit from restructured repayment terms.

Business owners experiencing financial hardship with primarily unsecured debt may qualify for debt relief services. Each case is evaluated individually to determine whether the approach aligns with the business’s financial goals.

Fees for business debt relief services are performance-based and are assessed only after successful settlements are reached. Costs vary based on the scope and structure of services provided.

Master Your Finances:

Our Latest Insights & Articles

Top Videos Related to Business Debt Relief

Small Business Debt Relief

Business debt occurs when business owners struggle to meet debt obligations. Business debt relief reduces expenses and helps businesses survive.

Too Much Credit Card Debt

Issues start to surface when a borrower becomes overly casual with their credit lines, using credit cards for luxury purchases and other expenses that push them to live beyond their financial means.

Credit Card Interest Rates

Credit card interest rates are classified into three types: variable, fixed, and promotional. Proceed with the following actions to reduce your credit card interest rates effectively.