A whopping 84% of American adults owned a credit card in 2021. With so many Americans taking advantage of credit, it’s little surprise that the average credit card debt in America is exceedingly high.

When we look at average credit card debt in America by age, credit card debt increases significantly as Americans get older. Learn more about how your state’s credit card debt averages compare to others.

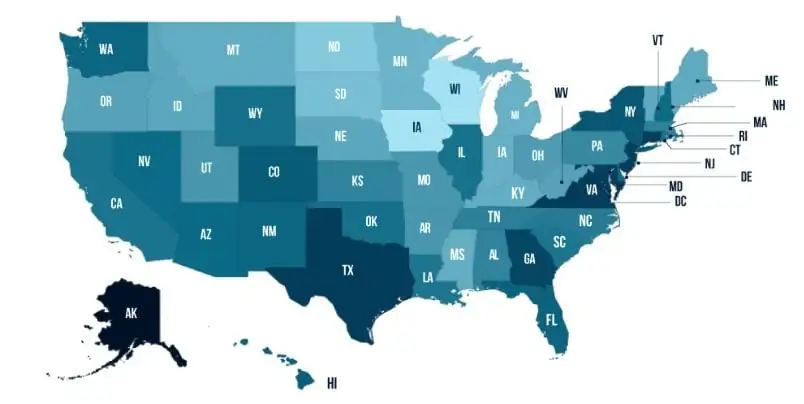

Average Credit Card Debt State-By-State

So, what is the average credit card debt in America state-by-state? Here is a breakdown:

| A | B | C | |

|---|---|---|---|

1 | State | Avg. Credit Card Balance | Mean Household Income |

2 | Alabama | $5,672 | $49,936 |

3 | Alaska | $8,026 | $68,734 |

4 | Arizona | $6,053 | $62,283 |

5 | Arkansas | $5,327 | $49,781 |

6 | California | $6,222 | $70,489 |

7 | Colorado | $6,416 | $73,034 |

8 | Connecticut | $7,082 | $72,812 |

9 | Delaware | $6,335 | $85,750 |

10 | District of Columbia | $7,077 | $85,750 |

11 | Florida | $6,460 | $54,644 |

12 | Georgia | $6,569 | $55,821 |

13 | Hawaii | $6,673 | $80,108 |

14 | Idaho | $5,213 | $58,728 |

15 | Illinois | $6,253 | $70,145 |

16 | Indiana | $5,254 | $59,892 |

17 | Iowa | $4,774 | $68,718 |

18 | Kansas | $5,769 | $63,938 |

19 | Kentucky | $5,140 | $54,555 |

20 | Louisiana | $5,811 | $49,973 |

21 | Maine | $5,442 | $58,663 |

22 | Maryland | $6,946 | $86,223 |

23 | Massachusetts | $6,213 | $86,345 |

24 | Michigan | $5,399 | $60,449 |

25 | Minnesota | $5,489 | $71,817 |

26 | Mississippi | $5,134 | $42,781 |

27 | Missouri | $5,601 | $61,726 |

28 | Montana | $5,482 | $57,679 |

29 | Nebraska | $5,423 | $67,575 |

30 | Nevada | $6,220 | $61,864 |

31 | New Hampshire | $6,235 | $81,346 |

32 | New Jersey | $7,084 | $74,176 |

33 | New Mexico | $5,851 | $48,283 |

34 | New York | $6,491 | $67,274 |

35 | North Carolina | $5,832 | $53,369 |

36 | North Dakota | $5,265 | $66,505 |

37 | Ohio | $5,560 | $61,633 |

38 | Oklahoma | $5,848 | $54,434 |

39 | Oregon | $5,498 | $69,165 |

40 | Pennsylvania | $5,840 | $64,524 |

41 | Rhode Island | $6,177 | $62,266 |

42 | South Carolina | $5,938 | $57,444 |

43 | South Dakota | $5,235 | $59,463 |

44 | Tennessee | $5,688 | $56,060 |

45 | Texas | $6,753 | $59,785 |

46 | Utah | $5,600 | $77,067 |

47 | Vermont | $5,466 | $70,066 |

48 | Virginia | $6,969 | $77,151 |

49 | Washington | $6,156 | $79,726 |

50 | West Virginia | $5,144 | $50,573 |

51 | Wisconsin | $4,961 | $62,629 |

52 | Wyoming | $5,782 | $62,539 |

Source: U.S. Bureau of the Census, Current Population Survey and Federal Reserve.

The average credit card debt USA residents carry exceeds an average of $6,000 per citizen. As a whole, this credit card debt is only one slice of the entire debt pie, too. Americans also often carry other debts in the form of car loans, mortgages, student loans, personal loans, and more!

What’s With the Midwest Having Less Debt Than the Rest of Us?

When looking at the average credit card debt per person in America, a trend emerges. Midwesterners tend to hold the least amount of credit card debt. Why is that? Experts believe it’s a mix of midwestern ideology and state policies. Midwestern states mostly have very strong economies but low costs of living. On a personal level, Midwesterners tend to be frugal and don’t like to stay in debt.

Credit Card Debt Vs. Household Income: What’s the Correlation?

When looking at average amount of credit card debt in America, it’s important to also consider each household’s average income.

While almost all American adults have a credit card, household income does play a role in how those credit cards get used. Statistics show that almost everyone with higher incomes (over $100,000) had credit cards. These individuals are the ones most likely to use credit cards simply for credit score purposes. They typically pay off their full balances each month.

Americans in the middle class are the most likely to have a credit card to finance big ticket purchases. They’re also the most likely category to carry a credit card balance from one month to the next. Among Americans with minimal incomes, they’re the most likely to not have a credit card at all. For those that do have credit cards, they’re the most likely category to carry a balance from month to month.

Minimum Payments and the Interest Trap

When asking what is the average credit card debt in America based on credit scores, we start to see a totally new picture. Household income plays a major role in how and why credit cards get used, but what’s more, it also plays a role in how likely those adults are to get trapped in an interest trap.

An interest trap happens when someone takes out a debt on a credit card and then can’t pay it off in full by the end of the month. When that balance carries over to a new month, you get charged interest payments. If you can only afford the minimum payments, then you might only be making payments on interest. In other words, you won’t be reducing the overall amount you owe unless you pay more than the minimum due.

Nationwide Credit Card Statistics

Nationwide, credit card debt is a major concern. To make matters worse, at least 42% of Americans have taken on even more credit card debt to help them get through the pandemic. Areas like Alaska, which already had high levels of credit card debt, are facing even more strain as product shortages and importation costs are skyrocketing. Considering the economic situation we’re in and the Fed’s recent increase in interest rates, it’s safe to say that nationwide credit card statistics will continue to look grimmer as the years go on.

Average Credit Card Debt in America: How Can We Move Forward?

Average credit card debt in America is growing at an unprecedented rate due to the pandemic, supply chain breakdowns, high unemployment rate, increasing prices, rising inflation, and the generally negative economic atmosphere we’re all enduring right now.

While things might seem dark right now, we’re a nation of survivors, and we can all move forward by finding ways to resolve our credit card debt. Here at United Debt Settlement, we offer several different debt relief solutions that might be beneficial for you. See if you qualify for debt relief through one of our programs today or give us a call at (888) 574-5454 to learn more about the solutions we offer.

Gabriel Gorelik paves the way for customer service and operations at United Settlement. He is passionate about numbers and holds a strong belief in helping anyone with their debt. Before United Settlement, Gabriel received his BS in Finance & Economics from Brooklyn College. After graduation, Gabriel went on to build his first financial services company where he managed thousands of accounts for business and consumer clients. He understands the importance of client satisfaction, professionalism, and exceeding expectations.