Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower negotiated amount is agreed to by the creditor or collection agency and must be fully documented in writing. The settlement is often paid off in one lump sum, although it can also be paid off over time.

Although creditors are not legally obligated to accept debt settlement offers, negotiating and paying lower amounts to settle debts is more common than many people realize. For individuals who want to negotiate their own debt settlement agreements, contacting creditors with a carefully crafted debt settlement proposal letter is an absolute must. Fortunately, the debt settlement experts at United Settlement can help you write an effective debt settlement proposal letter.

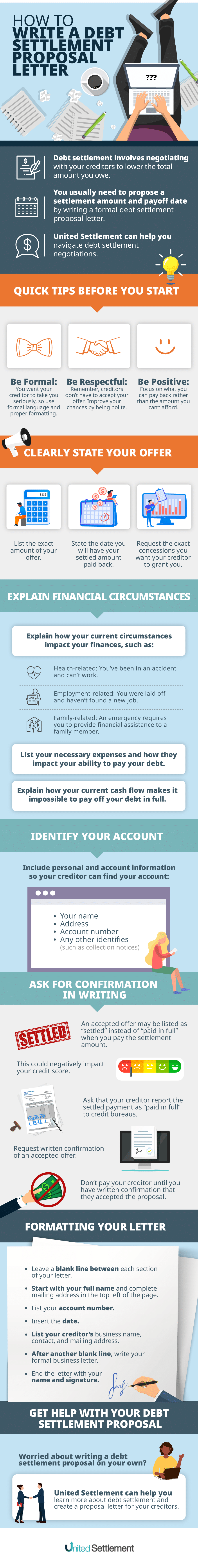

How To Write a Debt Settlement Proposal Letter

A successful debt settlement negotiation can save you thousands of dollars while relieving the burden of debt and its accompanying process of ongoing monthly repayments. With a lot riding on effective negotiation, you will want to do everything within your power to get things off on the right foot and to generate positive momentum for yourself in the direction of a money-saving and aggravation relieving settlement.

When you offer to pay a creditor, make sure to be clear about how much you’re offering, when you’ll offer to pay it, and what you want in return. You should also explain your current situation (employment-related, health-related, family-related) and how it affects your ability to pay the debt. Clearly state your intentions to pay a suggested amount and include all of your contact information so the creditor can easily get in touch with you. Include your full name as stated on the account, your full address, account number, and any other identifying reference numbers (including those related to collection attempts) that are associated with your account.

If the creditor agrees to your offer for debt settlement, make sure that the agreement is in writing before sending any money. A written agreement will help prove that the agreement was reached if there are any disputes later on. It is also important to understand that when you negotiate a debt settlement, you are agreeing to pay less than the full amount of the debt. The settled account will be reported as such on your credit report – as “settled,” rather than “paid in full.” However, you can still request that your account be reported as “paid in full” on your credit report. Accounts marked as “settled” will remain on a credit report for seven years, and often have a negative impact on a credit score and profile.

What should a debt settlement letter include?

A debt settlement letter should include the date, your name and contact information, the creditor’s name and contact information, the total amount of the debt, and a breakdown of the proposed settlement. The letter should state that you are offering to settle the debt for a specific amount, and that you will pay the creditor that amount within a certain number of days. It should also include a statement acknowledging that you understand that by accepting this offer, the creditor is releasing you from any further liability on the debt. Finally, it should include a signature line for you to sign and date.

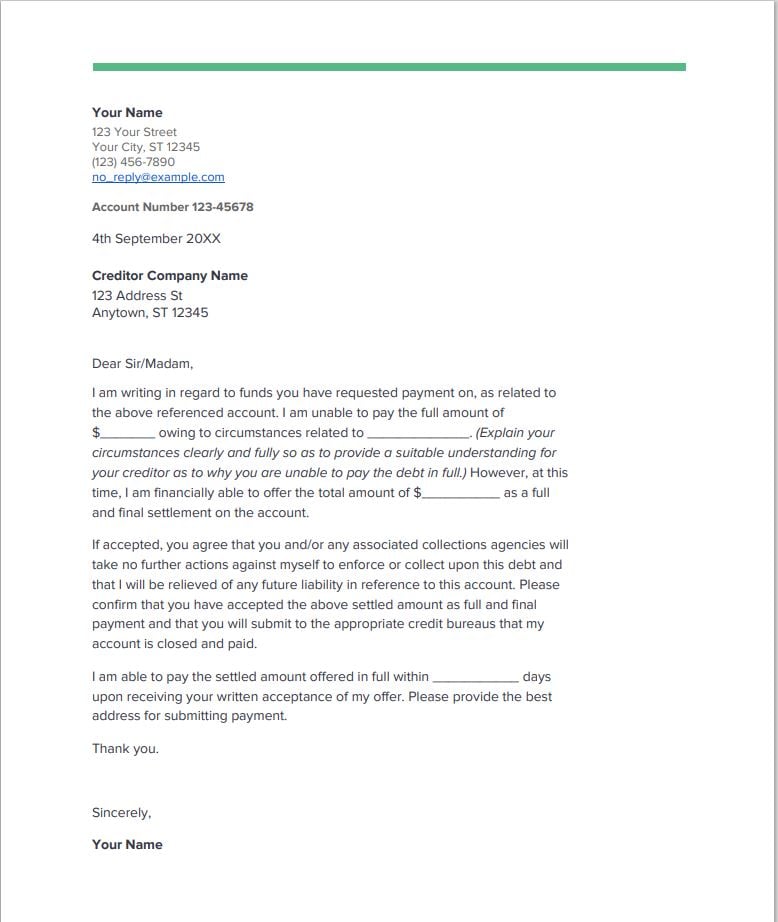

Sample Debt Settlement Proposal Letter

Your debt settlement proposal letter should be formatted as a formal business letter, with your name and complete mailing address in the top left corner of the page, followed by a blank line, your account number, another blank line, and the date listed beneath it.

After another blank line comes the full name and address of the creditor organization. After another blank line, you can begin the actual text of the debt settlement proposal letter.

Please see below a sample Debt Settlement Proposal Letter.

To learn more about debt settlement or to schedule a free consultation, please contact us online or call us today at 888-574-5454.

Yes, a settlement agreement needs to be in writing. You should not say anything to debt collectors that you would not want to say in front of a judge. This includes admitting to owing money or agreeing to make payments. Do not say anything that could be construed as threatening, obscene, or harassing. A settlement proposal is an offer made to a plaintiff by the defendant in order to resolve a legal dispute without going to trial. The proposal will typically include an offer of money or other compensation in exchange for the plaintiff’s agreement to drop the case. A valid settlement agreement is an agreement between two or more parties that resolves a dispute. The agreement must be in writing and must be signed by all of the parties. It must also be notarized, if it includes a promise to pay money.

Steven Brachman is the lead content provider for UnitedSettlement.com. A graduate of the University of Michigan with a B.A. in Economics, Steven spent several years as a registered representative in the securities industry before moving on to equity research and trading. He is also an experienced test-prep professional and admissions consultant to aspiring graduate business school students. In his spare time, Steven enjoys writing, reading, travel, music and fantasy sports.