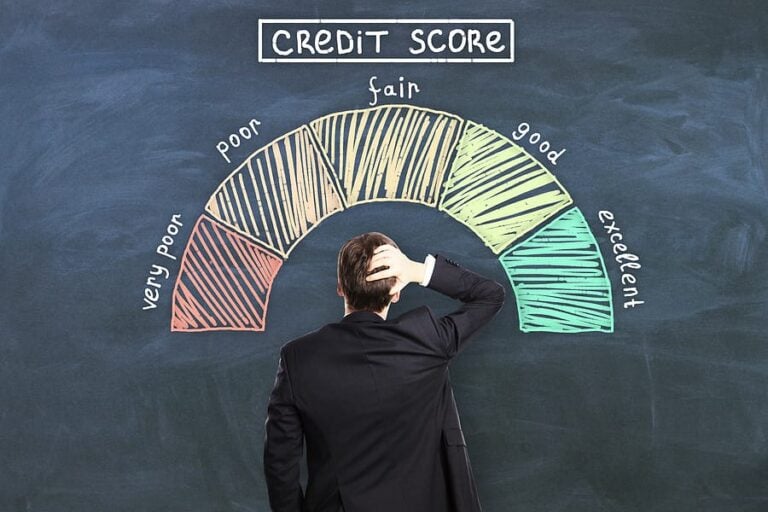

How hard is it to get a perfect credit score? According to statistics, it’s extremely difficult. Only about 1.6% of Americans have a credit score of 850.

The good news is that your score doesn’t have to be perfect to get credit from a lender. In fact, if you learn more about how to manipulate your credit score in a positive way and settle your debts, then your score will start climbing almost immediately!

There are things you can do to start making a financial difference in your life and secure credit when you need it most. The first step is learning more about what impacts your creditworthiness in the eyes of lenders. Are you ready to get started? Learn everything you need to know about the 4 c’s of credit below.

1. Credit History

When you’re seeking out a loan or applying for a credit card, the first thing the lender will want to do is take a peek into your credit history. The number one way that lenders will assess your creditworthiness is by checking your credit score. They’ll do so by requesting reports from Experian, TransUnion, and Equifax.

Your credit report gives your lender details about your credit history, and it also gives them a score based on how high of a risk you pose to lenders. In general, the lower your score is, the higher risk you pose to lenders. In other words, your lenders want to see a high score. It doesn’t have to be perfect, but it’s best to aim for a score that’s 650 or higher.

2. Capacity

Lenders will also want to know your capacity for handling more debt. Your credit history does play a role in your capacity, but so does your overall income amount. Often, lenders will want to know for sure that you have the income necessary to support more credit. They might also be interested to see how long you’ve been stable in your current place of employment.

3. Collateral

Sometimes, lenders will want to secure their loan if they fear that you could default on it in the future. The distinction between secured and unsecured loans is crucial for you to understand. That’s because unsecured loans are not backed by any type of asset, which limits your lender’s ability to collect from you if you can no longer make payments.

Secured loans, on the other hand, are backed up by a physical asset. This physical asset is what’s called ‘collateral,’ and it can seized if you can’t afford to make your payments anymore. If you’re willing to secure your loans with collateral, then your lenders are more likely to work with you despite a poor credit history.

4. Conditions

Finally, the lender will want to know what conditions you’re borrowing the money or credit for. Are you currently borrowing a sum of money to help with specific home improvements? Are you hoping to take out a loan to afford college? Are you looking to purchase a big-ticket item like a home or vehicle? The conditions under which you’re borrowing money matter, so expect your lender to ask.

So, What Are the 4 C’s of Credit and Why Are They Important?

The 4 c’s of credit are all important tools you should be using to take out a loan, get a better credit score, and secure a brighter financial future. You may be wondering – why are the 4 c’s of credit important? Without paying attention to the 4 c’s of credit, you may not have access to taking out a loan or credit. That means you could be barred from making any purchases that you can’t afford up front.

You’ll also be less likely to have a loan approved when you really need one. We all fall down sometimes, so we should all be aware of these 4 c’s of credit and how they can impact our ability to get a loan.

Debt Matters, Too

The 4 c’s of credit are crucial to understand if you hope to take out a loan or credit now or in the future. There is one more aspect that makes a huge difference, too: your current debt level. If you’re underwater on your loans or behind on your credit card payments, then you need to rehabilitate your financial situation as soon as possible. That’s because creditors and potential lenders will see your massive amount of debt, notice that you’re behind, and then feel inclined to not provide you with what you need.

Are you interested in learning how to manage your debt by qualifying for a debt relief program? If so, then we want to help. Leave your contact information on our online form now to hear back from one of our experts about your debt situation.

Gabriel Gorelik paves the way for customer service and operations at United Settlement. He is passionate about numbers and holds a strong belief in helping anyone with their debt. Before United Settlement, Gabriel received his BS in Finance & Economics from Brooklyn College. After graduation, Gabriel went on to build his first financial services company where he managed thousands of accounts for business and consumer clients. He understands the importance of client satisfaction, professionalism, and exceeding expectations.