Debt Settlement Blog & Insights

Stay informed with the latest updates and expert guidance on debt management.

Featured Blog

Is Debt Relief Worth It?

Debt can feel overwhelming when you’re doing everything right, but your balances remain high. For many, debt relief offers a path toward stability and financial control.Debt relief helps consumers reduce what they owe through structured repayment or settlement programs. These come in several forms, each with its own pros and cons. If you’re exploring options, here’s how to decide whether debt relief could be worth it for you.Different Types of Debt Relief ProgramsThere are several...

Read MoreIs Debt Relief Worth It?Debt Settlement Guide: What Is it & How Does It Work

Debt can feel overwhelming when balances rise faster than you can pay them down. Debt settlement is a structured way to reduce what you owe through negotiation. It’s a process built around realistic goals and clear communication, helping you take meaningful steps toward financial stability. This guide explains what debt settlement is, how debt settlement works and when it may be a helpful option for managing your unsecured debt.What Is Debt Settlement?Debt settlement is a financial...

Read MoreDebt Settlement Guide: What Is it & How Does It WorkExplore Our Blog & Articles

How to Prepare for a Recession

How to Negotiate a Settlement With Your Landlord

What is VA Debt Management Program

How does compound interest work

The Ukraine-Russia Conflict Impact on Americans’ Wallets

How to Prevent Eviction: 5 Steps on How to Not Get Evicted

6 Options on Private Student Loan Relief-Forgiveness

5 Benefits of Using Tax Return To Pay Off Debt

PPP Loan Round 3 and Tax Treatment

Here’s What You Need To Know About The New Eviction Ban

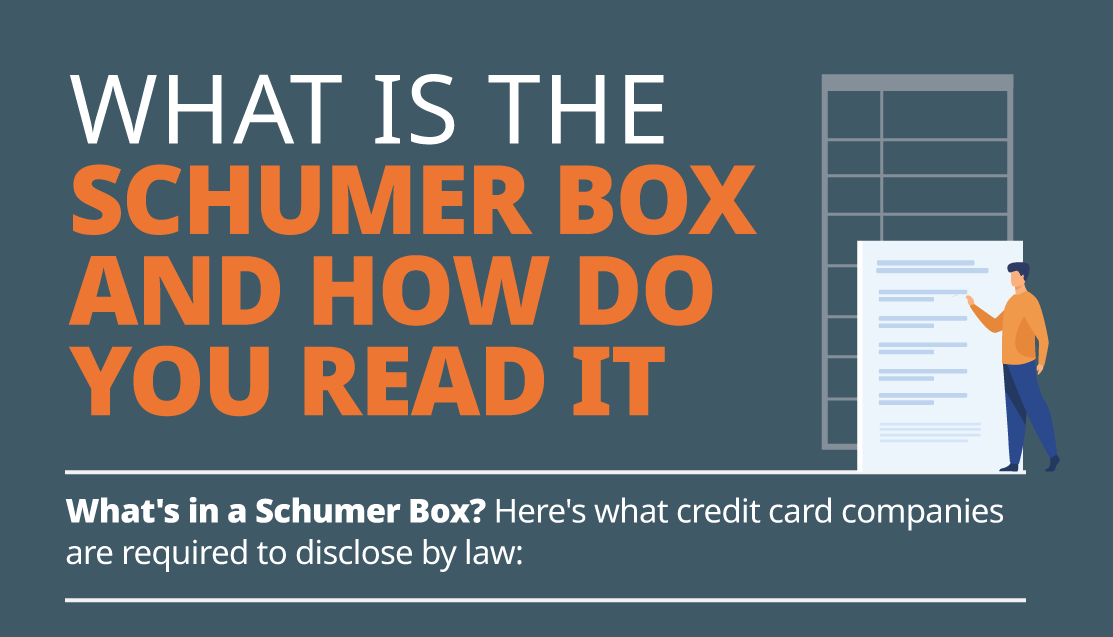

What Is The Schumer Box and How Do You Read It

Debt and Taxes: 3 Tips on Reducing Debt This Tax Season

How To Get Small Business Loans in 5 Steps

5 Things to Consider When Choosing 0% APR Credit Card

Explore Our Specialized Videos

Ready To Get Started?

See if you qualify for debt relief. Get a Free savings estimate to see how quickly you can be debt free.

Embrace financial freedom with our tailored solutions, expert guidance, and unwavering commitment to your success.

Experienced Professionals

Our experienced team has helped thousands of clients successfully eliminate debt and regain financial freedom.

Customized Solutions

We know every financial situation is different, so we design personalized debt relief plans to fit your specific needs and goals.

High Success Rate

Our proven debt relief strategies deliver real results. With a strong track record of success, we help clients achieve lasting financial stability.

Confidential Consultation

Your privacy is our priority. All debt relief consultations are 100% confidential and handled with the highest level of discretion.